10X Research Reveals Reasons Why Ethereum (ETH) May Have Lost its Appeal

Ethereum (ETH) has witnessed a decline in demand over the past few months. Due to this slowdown in blockchain activity, the Ether burn rate has been reduced. This has increased the coin’s circulating supply and put downward pressure on its price.

In a new report, digital asset research firm 10X Research highlights what might be responsible for this.

Ethereum Begins to Lose Its Shine

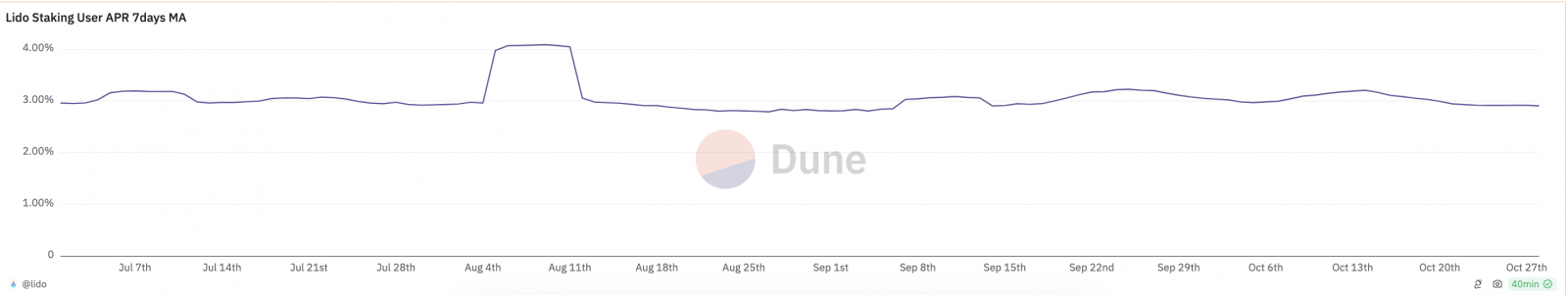

In its latest report, 10X Research highlighted falling staking yields on the Ethereum network as a major factor contributing to the decline in blockchain activity. For instance, the Annual Percentage Rate (APR) for users on Lido, Ethereum’s largest staking provider, has consistently dropped since August, now at 2.90%.

Read more: How to Invest in Ethereum ETFs?

Lido Staking APR. Source: Dune Analytics

The digital asset research firm highlighted that this trend stems from the rapid rise of low-cost meme tokens on chains like Solana. Consequently, many ETH holders now view staking primarily as a modest income source rather than a catalyst for broader ecosystem engagement.

Moreover, the existence of high-yield traditional finance options has also made staking ETH on the Ethereum network less appealing, further reducing the demand for the network.

“With TradFi interest rates (such as 2-year Treasury yields at 4.1%) significantly outpacing ETH staking yields at 2.9%, Ethereum holders face a slow bleed. The lack of demand for ETH drives down its collateral value in USD, Bitcoin, and other preferred benchmarks and diminishes overall appeal,” 10X Research explained.

10X Research noted that Ethereum saw a brief rise in activity following the September FOMC meeting, but momentum has since waned. If Donald Trump wins the upcoming election, high US Treasury yields could keep outpacing ETH staking yields, putting continued pressure on ETH prices.

“There is a risk that ETH fades into the background, as we have seen with other high flyers during the previous 2016/2017 and 2020/2021 cycles. Contrary to Bitcoin, Ethereum has not made a new high so far in this cycle; instead, it would need to rally by +87% to eclipse the 2021 high,” the research firm added.

ETH Price Prediction: The Nays May Have It

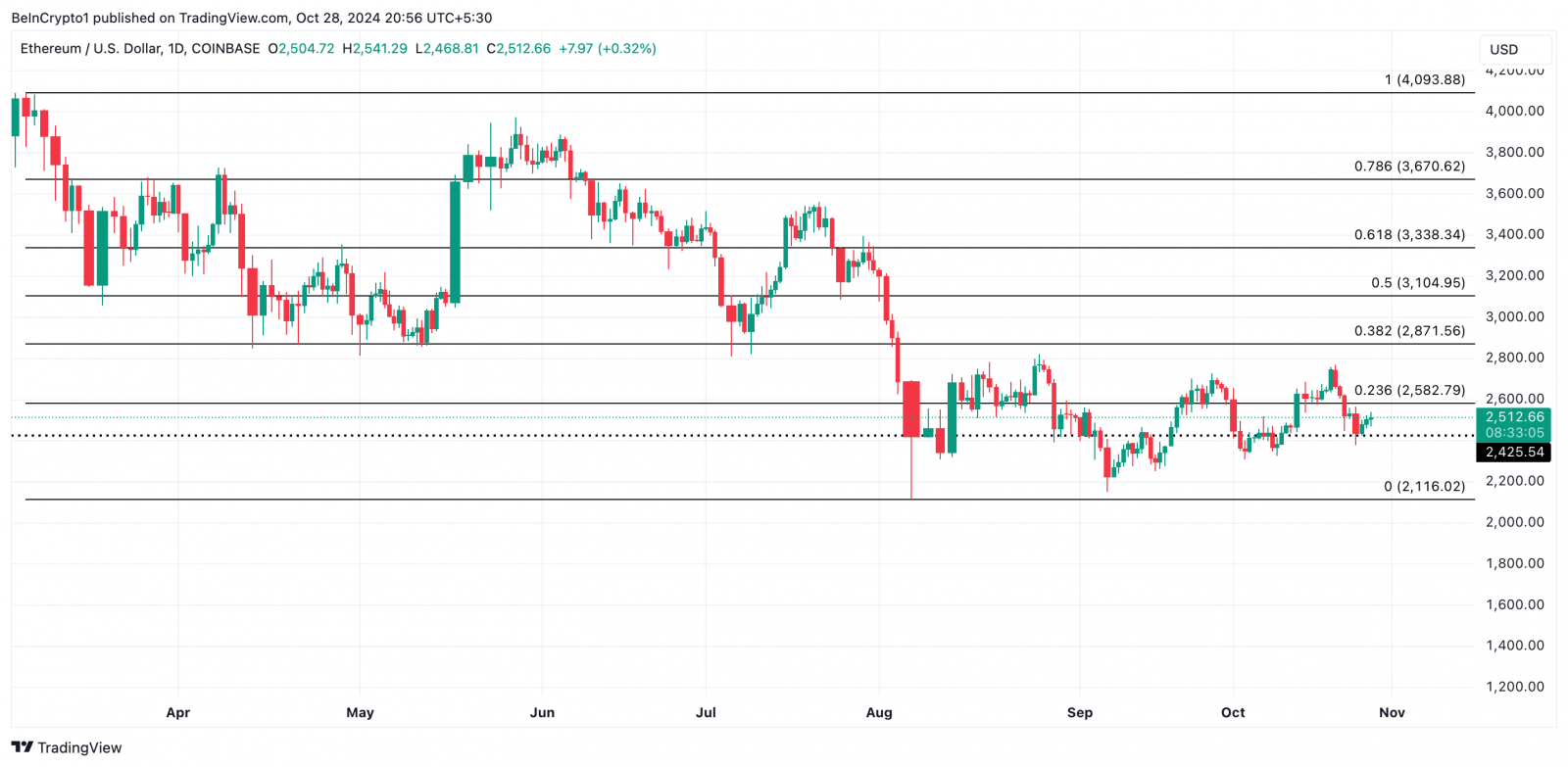

As of this writing, Ethereum is trading at $2,512, just shy of the resistance formed at $2582. BeInCrypto’s assessment of the ETH/USD one-day chart assessment confirms the bearish bias plaguing the leading altcoin.

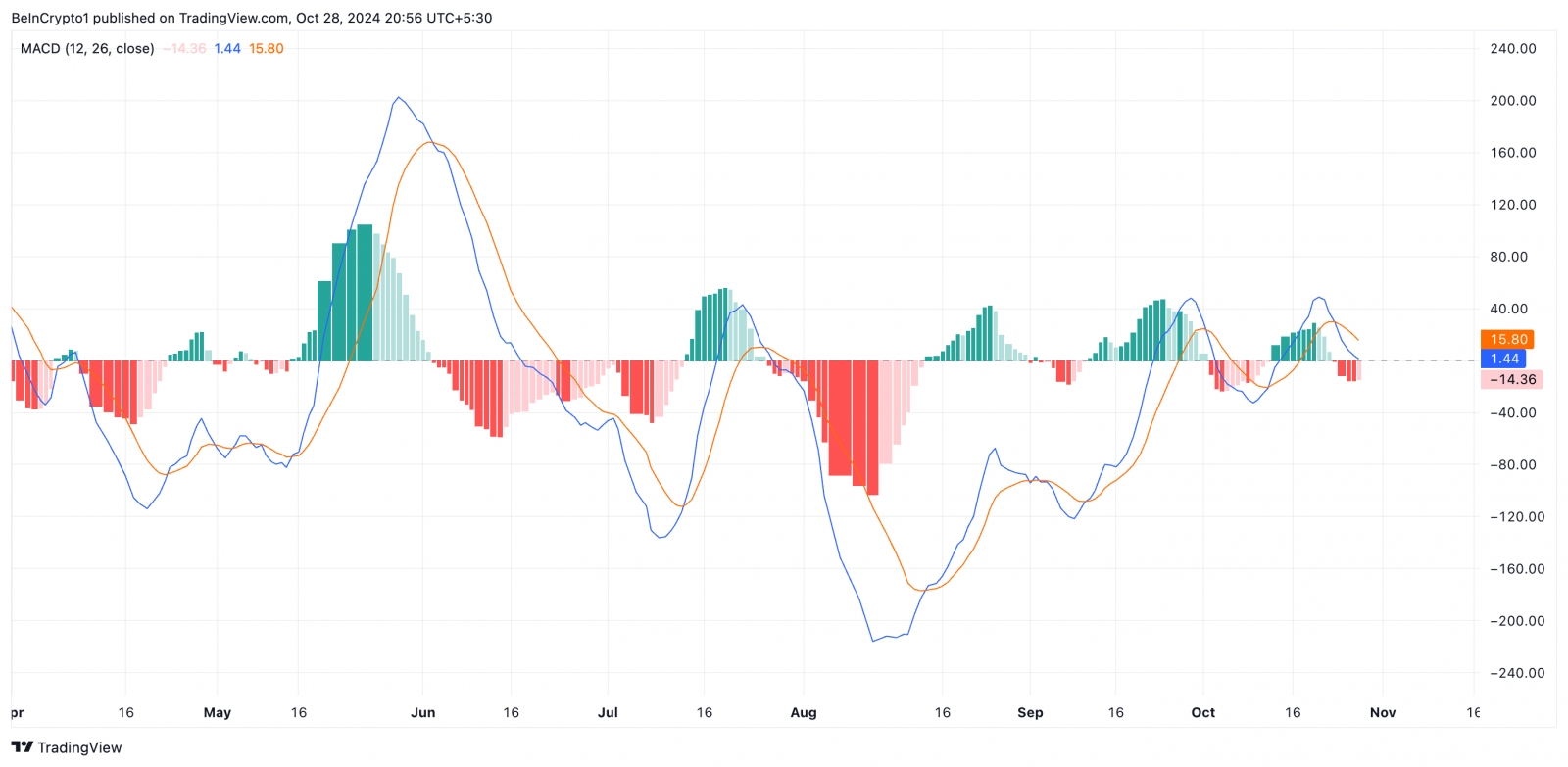

For example, readings from its moving average convergence/divergence (MACD) confirm the slowed demand for ETH. The coin’s MACD line (blue) is below the signal line (orange) and is poised to cross below the zero line.

ETH MACD. Source: TradingView

MACD measures an asset’s price trends and momentum and identifies its potential buy or sell signals. When set up this way, it indicates a bearish trend in the market, suggesting that overall momentum is negative and the asset is in a downtrend.

If this trend continues, Ethereum’s price will likely drop toward support at $2,425. If the bulls fail to defend this level, Ethereum could plummet further to $2,116.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

ETH Price Analysis. Source: TradingView

Conversely, a shift to positive market momentum could push Ethereum’s price above its resistance at $2,582, with a target of $2,871 — a high it last reached in August.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom