70% of Jasmy Holders ‘In the Money’—Will’ Bulls Take Over?

In the last 24 hours, Jasmy Coin has dipped 9.81% and is now trading at $0.03405. Despite the Federal Reserve’s 25-bps rate cut, the market has been tainted with unprecedented volatility. While the rate reduction was meant to spur growth, it has led to worries that inflation could rise, precipitating a 4.16% downslide in the total crypto market cap.

The fall of Bitcoin below $100k is testimony to the widespread uncertainty that extends across other tokens, such as Jasmy. The cryptocurrency, in particular, has been volatile for December, with its price ranging from $0.01924 to $0.05853. However, at the moment, the token is recovering, currently providing stability at $0.0340.

Market Alert: Bearish Supertrend Could Indicate Deeper Pullbacks

In December 2024, Jasmy has had a rather explosive month, with its price fluctuating between $0.02450 and $0.04850. The cryptocurrency is currently consolidating around the $0.03999 liquidity zone. As this critical level decides the token’s next direction, a turnaround could target $0.04850 resistance, and a breakdown may see it fall toward $0.02450.

The Supertrend indicator is now colored red, showing a continuation of the downtrend unless the cryptocurrency can recapture higher ground above $0.03999. Moreover, the CMF at -0.15 signifies a heavier selling pressure, and MACD attempts to turn bearish with negative divergence, testifying the market is now weak.

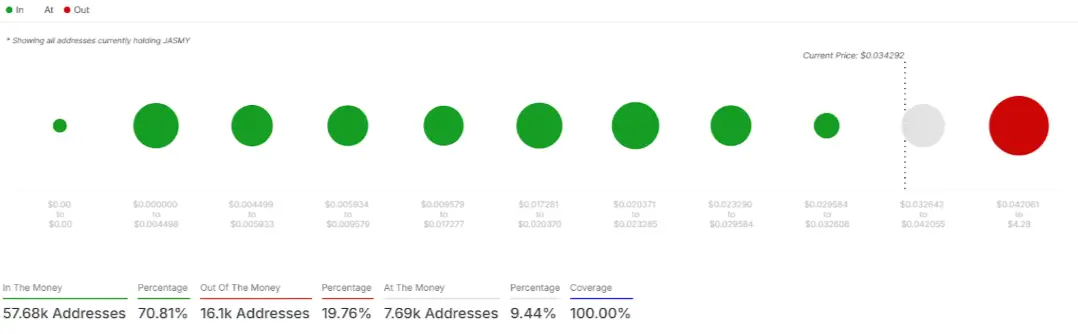

On-Chain Holder Distribution Metrics

According to Intotheblock data, 70.81%, or 57.68k addresses of Jasmy holders, are ‘In the Money,’ with their coins being bought for cheaper. Of that, 19.76%, or 16.1k addresses, which are ‘Out of the Money,’ are spent on tokens currently worth more than today’s value. Additionally, 9.44% of 7.69k addresses are ‘At the Money,’ which means purchases at the current price.

Analyzing the percentage of “In the Money” addresses reveals potential resistance near $0.042061 compared to the percentage of “Out of the Money” addresses. The distribution shows that the market dynamics are balanced, with clear supports and resistance zones defining how the trading plays out.

Jasmy Long/Short Ratio Reflects Mixed Sentiment in Market Trends

The long/short ratio from Coinglass shows a changing market sentiment over the past few weeks. Earlier in December, longs were in the lead until shorts began stealing the show around December 8th. Long positions were dragged higher, and the resulting oscillation trend was pushed again into renewed optimism on the 11th of December.

The ratio currently nears parity at 0.90, implying balance. Traders are cautious, as the short interest shows, but bullishness is possible as the long positions, however fewer than usual, begin to recover. In short, Jasmy Coin has entered a critical phase, and key support and resistance levels will guide where the cryptocurrency heads.

Also Read: Is Virtual’s Price Decline a Buying Opportunity?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom