Bitcoin declines as market awaits news from SEC about ongoing review of applications for spot ETFs

Bitcoin BTC -1.48% declined on Friday as the broader crypto market waited for news from the Securities and Exchange Commission about its ongoing review of more than a dozen applications for spot ETFs. The price of the world’s largest cryptocurrency by market capitalization declined 1.6% to $43,442 at 10:57 a.m. ET.

Despite a brief pullback earlier this week, ETC Group Head of Research André Dragosch said there is still substantial evidence supporting the possible approval of a spot bitcoin ETF in January.

“We have received even more evidence since the sell-off on Wednesday that suggests there is still no material change in investor expectation regarding an ETF approval in January,” he said, noting fresh filings from several applicants. “To the contrary, we have even received more evidence over the past days that point into that direction.”

On Thursday, Grayscale, Ark Investments, Valkyrie and VanEck filed new Form 8-As, signaling more progress toward potential approval. The SEC has yet to approve a spot bitcoin fund and hasn’t said when a decision could come.

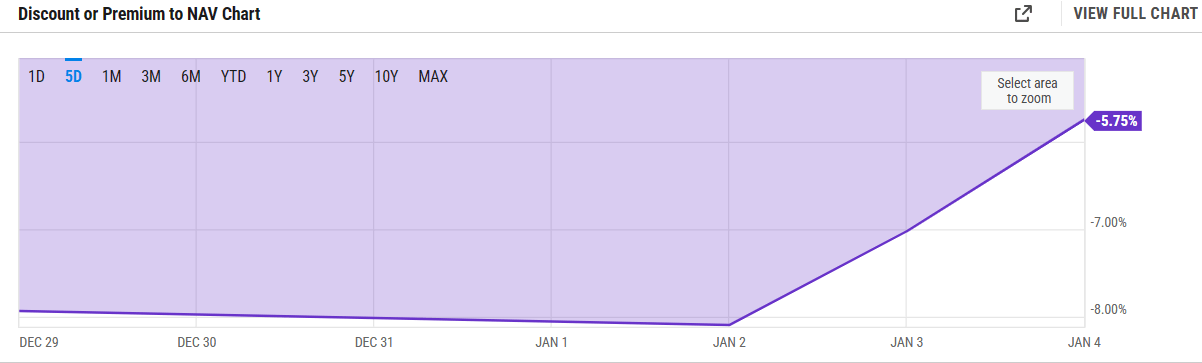

GBTC’s discount to NAV narrows

Dragosch highlighted that the Grayscale Bitcoin Trust discount to the net asset value has narrowed sharply in the past week. The narrowing of the metric, which measures the market price of each share compared to value of the bitcoin it represents, suggests investors believe Grayscale will be able to convert the fund into an ETF and remove restrictions that have kept the discount higher.

In the past week, the discount narrowed to -5.75% by market close on Thursday, the lowest level in weeks, according to YCharts data.

The Grayscale Bitcoin Trust discount narrows further. Image: YCharts.

The Grayscale Bitcoin Trust trades at a discount because the shares cannot currently be redeemed for the underlying asset, meaning the only option for shareholders who want out is to sell them to other prospective buyers. It historically traded at a premium until the crypto credit crunch in 2021.

According to Dragosch, the further narrowing of the Grayscale Bitcoin Trust “implies a probability of a spot bitcoin ETF approval of around 92%.”

The analyst pointed to other factors that support a continued positive outlook toward approval of a spot bitcoin ETF this month.

“This week, the SEC held meetings with the New York Stock Exchange, Nasdaq, and Cboe to finalize comments on spot bitcoin ETFs. Moreover, Fidelity filed a registration of securities for its spot bitcoin ETF with the SEC on Wednesday,” he added.

Cryptoasset sentiment remains elevated

According to Dragosch, ETC Group’s Cryptoasset Sentiment Index, CSI, still remains elevated despite Wednesday’s sell-off in the bitcoin market. The metric has risen over the past few weeks from a negative reading to a current measure of just below 1.

“Our in-house CSI has recently picked up again and currently signals a positive sentiment, as at the moment, 12 out of 15 indicators are above their short-term trend,” Dragosch said. “Compared to last week, we saw major reversals to the upside in BTC put-call volume ratio and BTC exchange inflows,” he added.

ETC Group’s crypto sentiment index remains high despite the recent sell-off in the bitcoin market. Image: ETC Group

Bitcoin market volatility increases

An analyst report earlier this week that suggested the SEC might not yet be ready to approve a spot fund has been challenged by market observers such as Bloomberg Intelligence analyst Eric Balchunas.

“We have heard nothing to indicate anything but approval but I want to give the guy benefit of doubt so I’m asking if he has any sources or if he just speculating,” the analyst said on X, adding he is “still expecting potential approval orders next week.”

Bittrex Global CEO Oliver Linch said in an email sent to The Block that a spot bitcoin ETF approval is already mostly priced into markets. He added that the “spike effect of an approval may not be as dramatic as some would like, but an approval coupled with the effect of the Bitcoin Halving could still add up cumulatively to a rampant 2024.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond