Identifying potential ETF wallet addresses as Coinbase leads weekly BTC trading with $11.4 billion volume

Coinbase Prime, the crypto platform explicitly designed for institutional investors, trusts, and high-net-worth individuals, has seen a dramatic increase in trading activity following the U.S. spot Bitcoin ETFs launch.

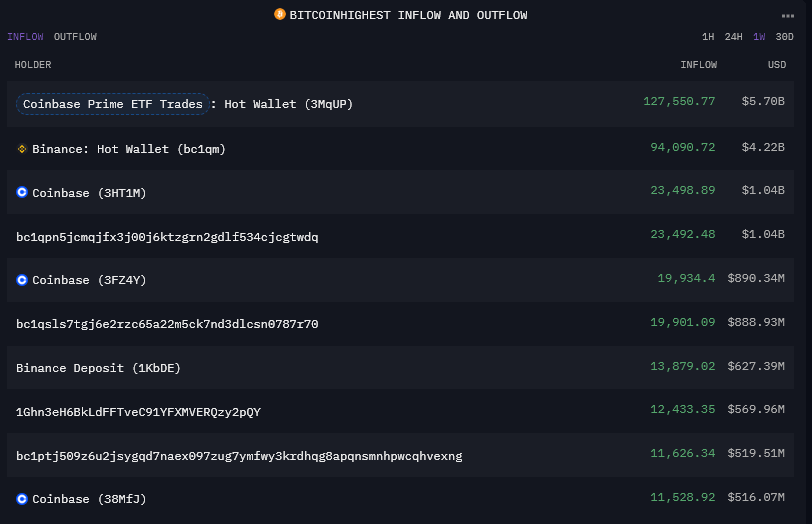

CryptoSlate analysis identified a hot wallet at Coinbase Prime that has surged to the top of the Bitcoin inflow chart over the past week. This wallet, used for trading activities within the platform, saw modest inflows and outflows in the hundreds of millions over the course of a month throughout 2023. However, over the past week, it has seen $5.7 billion in inflows and an equivalent amount of outflows. Historically, Binance’s hot wallet has dominated the flow leaderboard, and from the data analyzed, this appears to be the first time Coinbase Prime has surpassed Binance over 7 days.

Over the past 30 days, Binance still leads with around $14 billion in inflows and outflows, while Coinbase Prime flags slightly behind at around $12 billion. It is worth noting that other trading wallets are tagged as belonging to Coinbase Prime on Arkham Intelligence. However, this wallet appears to handle large transactions.

The surge in activity can be seen through the table below, which shows only transactions greater than $10 million. In the past 4 days alone, there were several deposits of over $400 million in a single transaction.

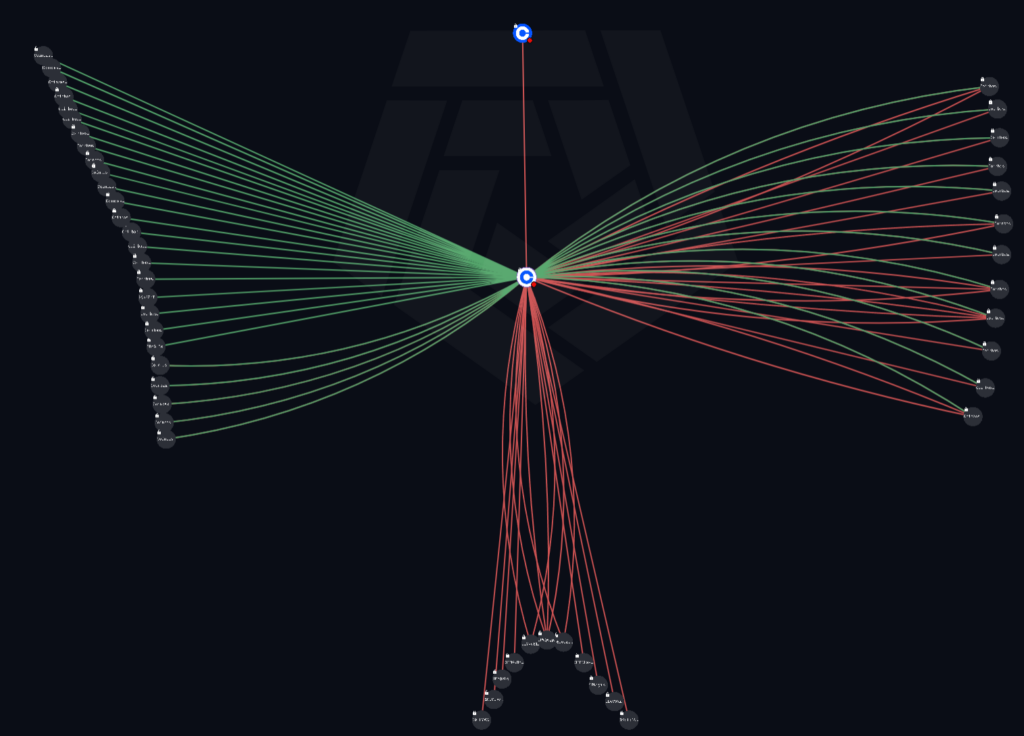

The below visualization shows the flow of transactions over $50 million for the Coinbase Prime hot wallet. The left cluster is tagged as Coinbase Prime deposit addresses, which all flow into the hot wallet. The cluster to the right contains wallets also tagged as Coinbase Prime deposit addresses but shows inflows and outflows. The wallets in the bottom cluster are untagged and show only outflows from the hot wallet. The top outlier is the Coinbase exchange, which shows a single $78 million outflow.

Speculatively, the left cluster may show deposit addresses for institutions, the right wallets may be the trading wallets, and the bottom wallets could be cold storage. At present, none of this is verifiable, but it would potentially align with the data stated in the ETF prospectuses regarding how Bitcoin trading works for the funds. Remember, the above only shows transactions greater than $50 million, or around 1,100 BTC.

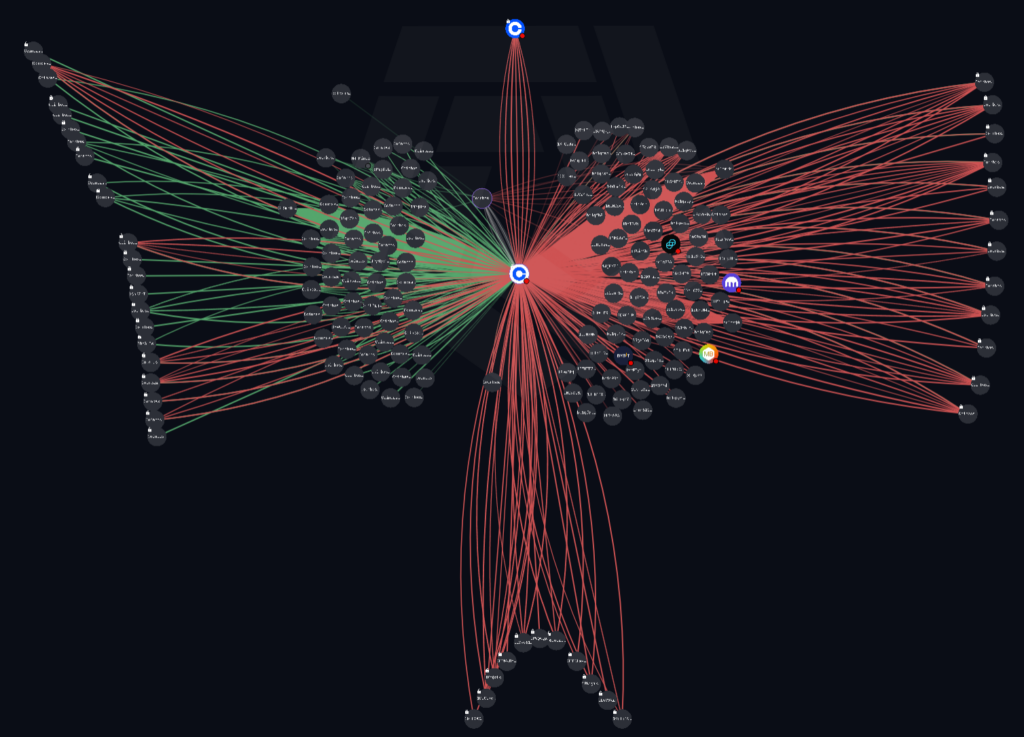

The below diagram includes transactions as low as $1,000 with all the above wallets locked into position. Notably, the bottom cluster still shows no inflows, while dozens of new wallets have entered the arena at these lower values.

Attempting to identify and analyze wallets related to ETF activity may give important insights into the Bitcoin market should trading volumes continue to follow the launch data. With CoinShares reporting around $17.5 billion in trading volume among crypto financial products last week, this activity will impact the spot Bitcoin price differently.

The price at which the ETFs value Bitcoin daily is calculated through the CF Benchmarks Index, BRR, which stands for the Bitcoin Reference Rate. This rate is calculated between 3 pm and 4 pm GMT on a daily basis by analyzing a range of transactions across several exchanges. The BRR is then used to calculate the net asset value for the funds and, thus, the value of the Bitcoin it holds. This rate and the fact that share creations and redemptions happen outside of standard trading hours add a new dynamic to Bitcoin trading that has not been a factor until now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond