Ethereum Price Prediction: Is $ETH Recovery Heading to $3000 in February?

On Wednesday, the second-largest cryptocurrency Ethereum is trading in red amidst a generally volatile and uncertain market sentiment ahead of the FOMC Meeting. With an intraday loss of 1.5% the ETH price plunged to $2300 trying to sustain above the 50-day EMA slope. Despite the uncertain technical outlook for recovery, Ethereum’s fundamental developments continue to progress, notably with its eagerly awaited 2024 hard fork, Dencun.

The latest milestone for Ethereum is the successful launch of the Dencun upgrade on the Sepolia test network, marking a significant step forward. This leaves only one more testnet deployment before the introduction of the “proto-danksharding” feature.

Proto-danksharding is a pivotal enhancement aimed at reducing transaction costs on layer-2 blockchains and decreasing the expense of data availability. This will be achieved by introducing a new type of data storage known as “blobs.

Bear Trap Prepares ETH Price Rally Past $2700

- A recent breakdown below the support trendline indicates the correction trend is likely to prolong

- A healthy retracement in ETH price keeps the overall trend bullish

- The intraday trading volume in Ether is $10.2 Billion, indicating a 45% gain.

Ethereum Price Prediction| TradingView Chart

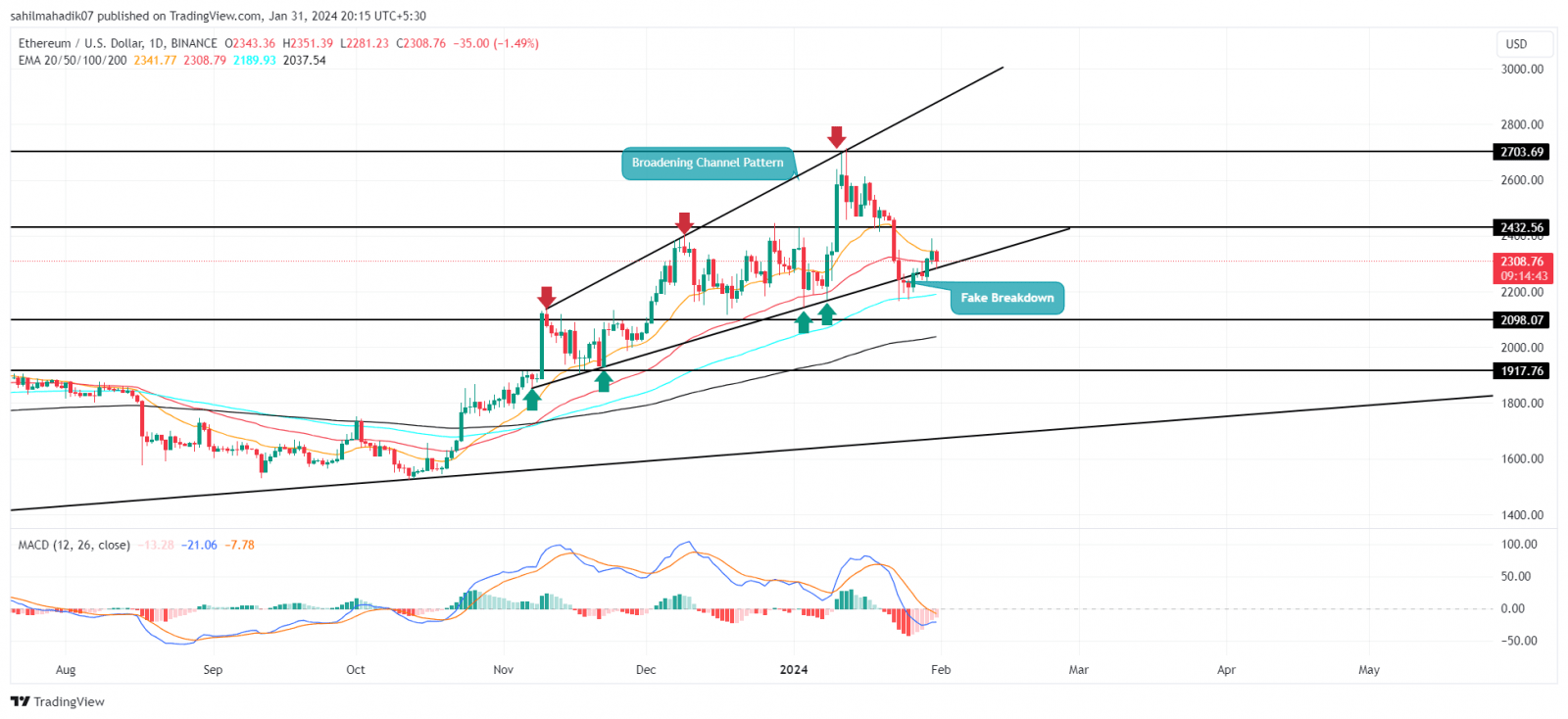

Amid the post-ETF correction in the crypto market, the Ethereum price dropped from $2714 to $2171, marking a 20% decrease. During this decline, the coin price broke through the support trendline of an expanding channel pattern, which had been supporting its recovery over the past three months.

Although this breakdown initially indicated a possible extended correction, the price found fresh buying interest around the $2200 level. This support led to a 6% increase in Ethereum’s price within a week, allowing it to reclaim the previously breached support level.

This failed breakdown could lead to an uptick in buying activity and foster a new recovery trend in the market.

📈 #Ethereum has returned to a $2,345 value for the first time since its fall began on January 22nd. The network is encouragingly rising in active addresses and network growth. Increased utility is a primary pillar to justify an increasing $ETH market cap. https://t.co/nyXkLceYDX pic.twitter.com/i9N9yaggB5

— Santiment (@santimentfeed) January 30, 2024

Moreover, as per recent highlights from crypto analytics firm Santiment Ethereum’s network is displaying significant growth and vitality in recent times. With a remarkable 101,000 new Ethereum addresses being created each day and a substantial 484,000 unique addresses actively engaging with the network daily, the Ethereum ecosystem is expanding at an impressive pace.

What’s particularly noteworthy is the speed of this growth, as daily network expansion is now 28% quicker than it was just three months ago.

If the aforementioned channel pattern is intact, the ETH price should lead a rally to retest the overhead trendline at $3000. The rising price may witness in-between resistances at $2430 and $2700.

- Exponential Moving Average (EMA): The price trading above 100-and-200-day EMA Indicates the long-term remains bullish.

- Moving Average Convergence Divergence: The MACD and signal line nearing a bullish crossover gives an early signal of this asset nearing recovery sentiment.

Related Articles:

- Bitcoin vs Ethereum: Numbers Explain Which Has Higher Growth Potential

- Ethereum ETF Approval Could Boost ETH to $4K: Standard Chartered

- Crypto Price Prediction For January 31: BTC, LINK, RNDR

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond