FOMC Meeting: Bitcoin Price To Slump 30% After Fed Decision?

The Federal Open Market Committee (FOMC) meeting is due today and the crypto market is keenly eyeing every update that comes up. The Fed might introduce a rate cut or pause, both of which could be beneficial for the crypto space, according to multiple analysts. However, a renowned crypto analyst suggested that the FOMC meeting could bring extreme volatility to the market and the Bitcoin (BTC) Bitcoin (BTC) price could even lose 30% in value.

Will Bitcoin Plunge 30% After FOMC Meeting?

Sheldon The Sniper, a crypto analyst and YouTuber, noted that the FOMC meeting will lead to increased volatility in the digital currency market. In addition, the content creator stated that he could spot a “weakness” in the Bitcoin price chart, which could lead to a massive correction.

In a post on X, the crypto analyst hinted at a 20-30% pullback for Bitcoin in the coming days. Thereafter, Sheldon went live on YouTube and underscored the reasons behind the Bitcoin price correction. He analyzed the 4-hour price graph of Bitcoin and noted that if the hourly candle closes below $42,000, it could be an early sign of a major crash.

In addition, the YouTuber stated that massive Bitcoin liquidations can be spotted on the Heatmap, which could further push the crypto’s value down. Moreover, the volatility introduced via the FOMC meeting could play a catalyst in the scenario.

On the other hand, FlameseN, another technical analyst, cautioned Bitcoin leverage holders and asked them to stay alert when the Fed decision comes in. He noted that keeping a check on volatility is paramount to minimize losses. Furthermore, the analyst noted that Bitcoin is “currently holding the Mid-Range & 6h 200SMA.” Whilst, he warned against a potential retest if the value extends below this level.

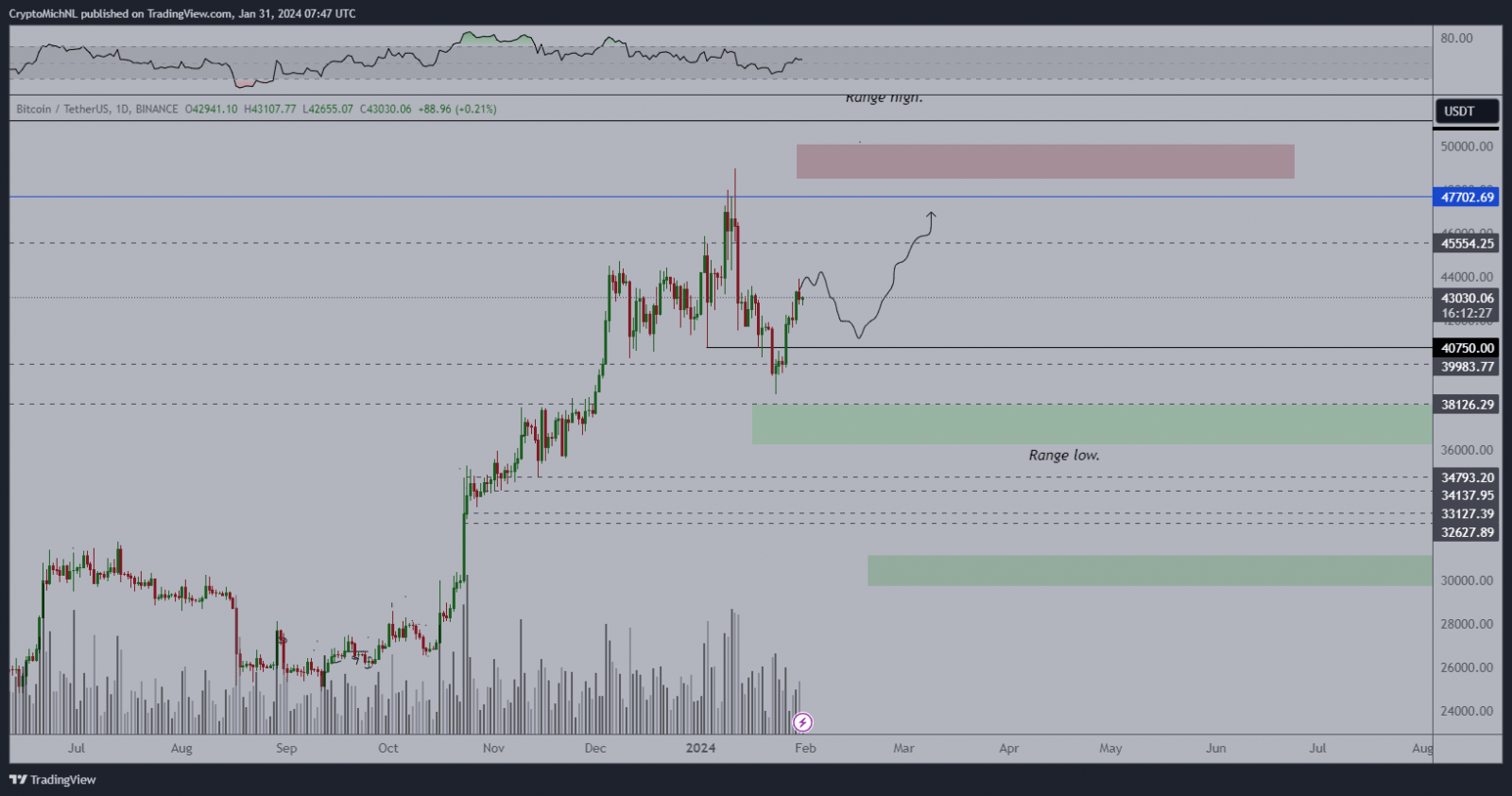

In addition, Michaël van de Poppe, a crypto insights provider, stated that he expects the Bitcoin price to range between $38,000 to $48,000 in the short term. Moreover, he predicted a potential pullback, aligning with other analysts’ opinions. Poppe took to X and wrote, “Probably a correction in the short-term after which a slight pre-halving rally to $48K seems likely.”

Also Read: Robert Kiyosaki Slams Jerome Powell & Janet Yellen Amid Bitcoin Advocacy

How Will Ethereum React To The Fed Decision?

In the aftermath of yesterday’s squeeze, Ethereum (ETH) faced a significant rejection around the $2,400 resistance after a substantial range deviation. Notably, a renowned crypto analyst Josh provided insights, expressing a bearish sentiment as long as prices remain below the critical $2400 level.

While the looming FOMC event is expected to induce slight volatility, Josh anticipates that another Fed rate pause may already be priced into the market. In line with the analyst’s prediction, the ETH price is already down 0.99% to $2,303.81 ahead of the FOMC meeting results.

Also Read: Bitcoin Price: How Will The FOMC Meeting Impact BTC?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond