Bitcoin Whales On the Move: What’s Behind Accumulation Tactics?

- Bitcoin whales accumulate amidst market volatility, signaling long-term confidence.

- Major investors’ 49,274.2% profit showcases Bitcoin’s historic profitability.

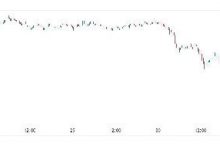

Bitcoin whales are making waves with significant accumulation moves. Today, two notable whales bought a staggering 791 BTC, equivalent to $49.8 million, seizing the opportunity at the market’s bottom. This strategic move comes amidst ongoing volatility and uncertainty in the digital asset space.

One such whale, identified by the wallet address 1LXdAT, has been steadily accumulating Bitcoin since March 19, amassing a total of 4,736 BTC valued at a whopping $309 million. With an average purchase price of $65,264.

Similarly, the wallet address bc1qr4 has diligently accumulated BTC since November 19, 2023, acquiring 791 BTC with an average price of $45,156, totaling $35.7 million. These calculated accumulation strategies underscore the confidence of seasoned investors in Bitcoin’s long-term potential.

2 whales bought 791 $BTC($49.8M) at the bottom today.

1LXdAT has accumulated a total of 4,736 $BTC($309M) at an average price of $65,264 since Mar 19.

bc1qr4 has accumulated a total of 791 $BTC ($35.7M) at an average price of $45,156 since Nov 19, 2023.

Address:… pic.twitter.com/7inMMDtPSk

— Lookonchain (@lookonchain) May 14, 2024

What are Early BTC Whales Upto?

In a separate development, a major Bitcoin investor from 2013 recently moved over 1,000 BTC. It reaped a remarkable profit of 49,274.2%. This significant transaction highlights the substantial gains made by early adopters of the pioneering cryptocurrency.

Just last week, data from Santiment revealed that large whales, holding between 1,000 and 10,000 BTC, collectively accumulated approximately $941 million worth of coins. This surge in accumulation coincided with its tight range between $61,000 and $64,000, signaling a renewed bullish sentiment among institutional investors.

As of the latest market update, Bitcoin is trading at $62,501, reflecting a 2.73% surge. With a trading volume of $27 billion, marking a 65% increase. Despite the recent gains, Bitcoin remains 15.31% away from its all-time high, indicating the potential for further upward movement.

Analysts say that these accumulation trends among whales and positive market indicators suggest confidence in Bitcoin’s resilience amidst market volatility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom