Cardano Faces Pressure Near 50-day SMA On Daily Chart; What to Do?

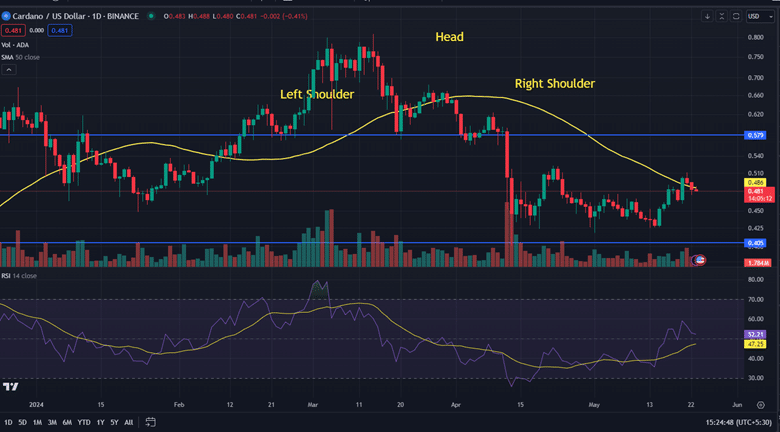

Cardano currently encounters resistance near the 50-day Simple Moving Average (SMA) on the daily chart, suggesting a potential decision point for traders.

Cardano (ADA) looked depressive on the daily chart for the third straight session on Wednesday. The bulls could not sustain the gains that gathered at the beginning of the week.

As it already trades in a short-term range of $0.42 to $0.52, the price behaves accordingly, facing pressure at the upper range. The bulls were unable to breach the mentioned level, indicating a lack of strength.

At the time of writing, ADA/USD changes hands at $0.48, up 0.21% for the day. The 24-hour volume dropped more than 24% to $374 million. An increase in the price with a drop in volume could suggest that the upswing is not sustainable.

Cardano 1D Chart

At present, the price displays a quiet movement with no clear directional bias. If ADA breaches above the 50-day SMA, the bulls could stretch their muscle towards $0.51, followed by the $0.56 high on February 13. This view is supported by the momentum oscillator, Relative Strength Index (RSI).

However, if the bearish sentiment kicks in amid a volatile market sentiment, then there is a probability of falling toward the lower levels. The immediate downside target could be found at the May 17 candle at $0.45.

The above-mentioned move will validate the movement of a range-bound market structure. Bears will further pull towards the key support zone of 0.42.

In a nutshell, Cardano (ADA) price trades at a crucial juncture, where there is a tug of war between bulls and bears. If the spot price convincingly trades below the 50-day SMA, then bears would have the upper hand.

Technical indicators

- 50-day SMA holds at 0.48. The price holds below the moving average as of press time.

- RSI (14) trades above 50, indicating a bullish bias.

Support and Resistance

Support 1: $0.46

Support 2: $0.42

Resistance 1: $0.50

Resistance 2: $0.52

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom