Cardano Revenue Falls to 3-Year Low amid Ethereum Surge: Is ADA Price at Risk

Cardano price closed May 2024 at $0.44 down 12% in the last 10 days, on-chain analysis examines the key bearish catalysts behind the ongoing ADA downtrend.

Cardano Price Slides Below Critical $0.45 Support Level

Since the Ethereum ETF approval, rival Layer-1 networks, including Solana (SOL), Bitcoin (BTC), and Cardano, have struggled for traction. In recent market events, retail investors have switched focus to Ethereum markets in efforts to supercharge their profits as the broader crypto markets slide into a consolidation phase.

This rare market dynamics has been evident in ADA’s recent price action.

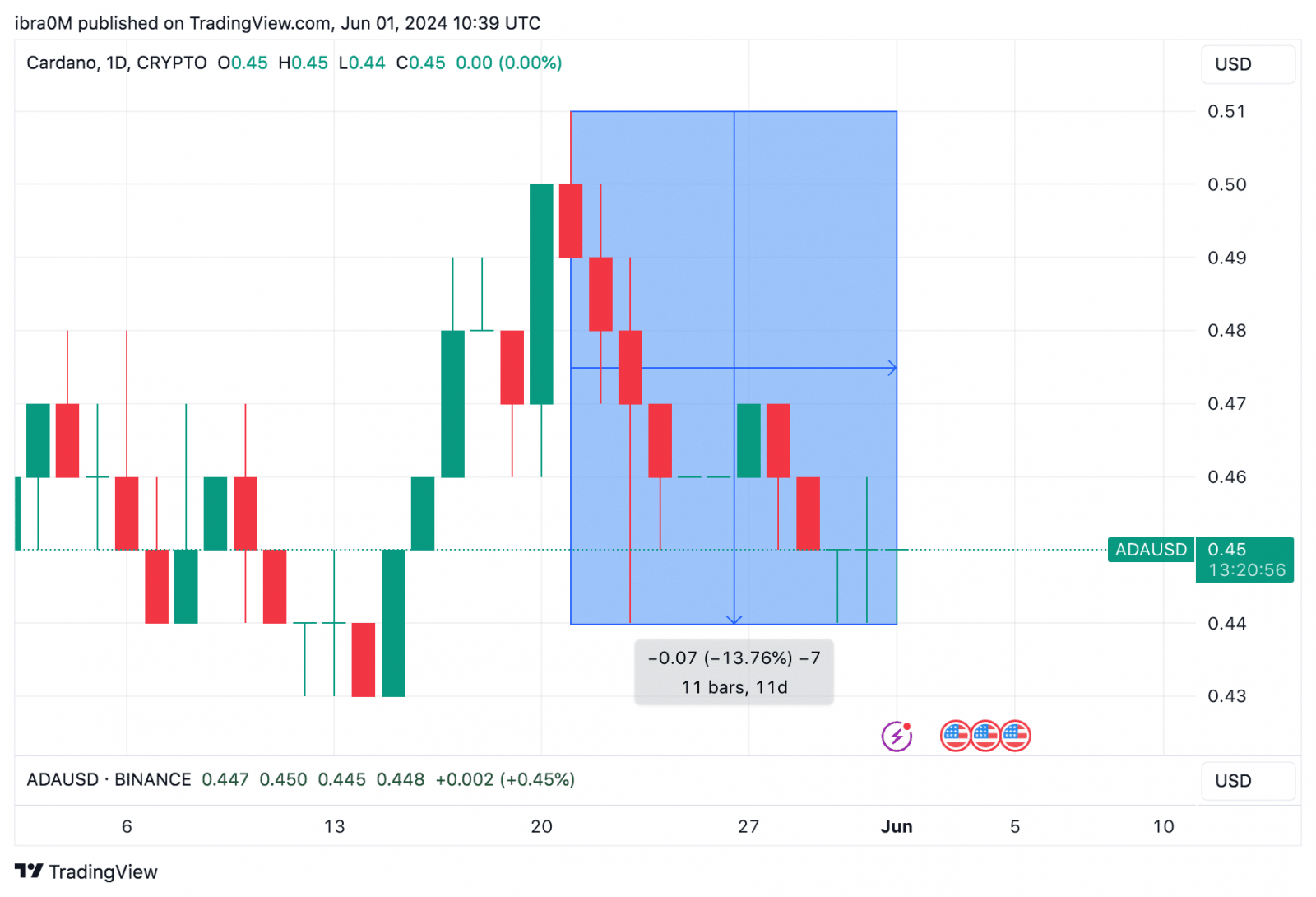

Cardano ADA Price Action | TradingView

Cardano price closed May 2024 at the $0.44 level, marking a 14% decline from the monthly peak of $0.51 recorded on May 21. The negative ADA price action over the last 10-days coincided with the bullish momentum surrounding ETH markets.

Cardano Network Revenue Falls to 3-Year Low

However, this shift in investor preferences has not been restricted to the speculative markets alone. On-chain data trends show that Cardano has attracted significantly lower traction across its native DeFi protocols this week, which has resulted in reduced network revenue.

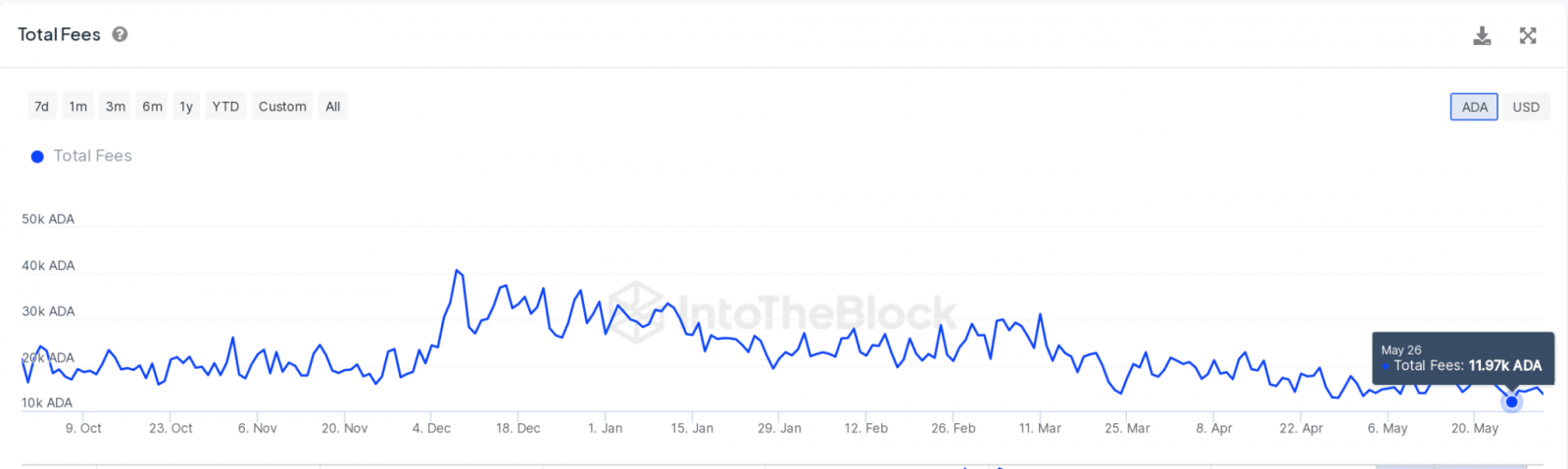

The IntoTheBlock chart below tracks the daily fees charged on transactions conducted on the Cardano blockchain network. This provides insights into network activity as well as the revenue accruing to network validators who stake their assets.

Cardano price vs ADA Transaction Fees

As depicted above, Cardano network pulled 11,970 ADA in total transaction fees on May 26, 63% lower that its 2024 peak of 32,480 ADA recorded in March. Notably, historical data shows that this is the lowest daily transaction fees recorded since 2021.

When a blockchain network records such a dramatic drop-off in transaction fees, it signals that the network is losing market share to competitors, leading to lower demand for its native products and services.

Moreover, as a Proof-of-Stake network, this decline in Cardano fees means less revenue accruing to network validators who stake their assets to validate transactors and secure the network.

Falling revenues could see Cardano stakers begin to withdraw their assets and shift focus to more profitable PoS protocols in the coming days. If this scenario plays out, it could further exacerbate the ADA price downtrend.

ADA Price Forecast: $0.40 Reverse in Motion?

Cardano price has twice fallen below the $0.45 support cluster in the last 48-hours. With transaction fees trending at 3-year lows, bears looks set to force a Cardano price downswing toward the $0.40 level in the days ahead.

However, IntoTheBlock’s GIOM data suggests the bears could hit a roadblock at the the $0.43 area in the near-term.

Cardano Price Forecast ADAUSD | IntoTheBlock

Looking at the chart above, 407,260 addresses had acquired 3.83 billion ADA at the maximum price of $0.43. If they hold their positions, ADA’s price could stage an instant rebound above $0.45.

However, with demand weakening as indicated by the falling transaction fees, bears appear to be in control, putting Cardano’s price at risk of an inevitable reversal towards $0.40.

Alternatively, if the markets swing bullish, the $0.46 level could be the next significant resistance level to watch.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Huobi

Huobi  Nano

Nano  Status

Status  Bitcoin Gold

Bitcoin Gold  Lisk

Lisk  Hive

Hive  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond