FET Made Double Bottom Formation: Is a Breakout Underway?

FET was on track to recovery and comfortably held gains above the 20-day EMA mark. Besides the recovery, it has made a double bottom formation, and a significant pullback was observed.

However, the lower lows formation and a declining trend were spotted, and sellers decisively secured the 200-day EMA mark zone. Until the FET price surpasses the cluster of $2, the token may continue to ride in a downtrend.

Notably, the Artificial Superintelligence Alliance token has demonstrated a follow-on recovery. Additionally, the buyers have begun accumulating and trying to cross the trendline barrier of $1.60 to sprint ahead.

FET at Press Time

At press time, the FET was trading at $1.52 with an intraday surge of 11.20%, reflecting buying momentum on the chart. It has a monthly return ratio of 2.30% and 40.20% yearly, reflecting short-term consolidation.

The pair of FET/BTC was at 0.0000230 BTC, and the market cap was $3.84 Billion. Analysts are neutral and suggest that the FET price may soon breach its trendline hurdle and reach the $2 mark.

FET Price Action and Indicators Overview

FET has shown a recovery and signals a short-term reversal. However, the bulls need to close above the $1.60 mark for a confirmed pullback.

Its RSI curve showed a positive divergence and reached the midline zone, conveying the bullish momentum on the chart.

$Fet

Finally Breaking Falling Wedge Expecting Massive Bullish Wave Towards $ In Coming Days#Crypto #Fet https://t.co/Lp5PpMdpZi pic.twitter.com/zjB8UYYrMF

— World Of Charts (@WorldOfCharts1) July 17, 2024

Moreover, the Money Flow Index (MFI) noted a rise and trended upward following the price reversal. That means the buying momentum might carry forward, and the token could eventually outpace the decline ahead.

Social Dominance and Active Addresses Data

Despite the price recovery, the online discussions of FET were still flat. Its social dominance curve floated below the midline region, directing the declining interest.

The relative strength curve showed a gigantic rise and approached the overbought trajectory. It implies that the buying pressure supported FET.

However, the active addresses data pointed to the rise, which means the new addresses are looking forward to the surge and eager to play a bounce.

Amidst the rise, a confirmed uptrend could be seen if the buyers successfully crossed the $2 mark.

Network Growth Showed a Dip

The investors’ primary concern is the decline of the network, whose value has swam to the lows of around 200. That led to a loss of interest in the new addresses this week.

Likewise, the velocity curve swims below the midline zone, highlighting the declining trading activity and a reduced frequency.

Is a Pullback Possible?

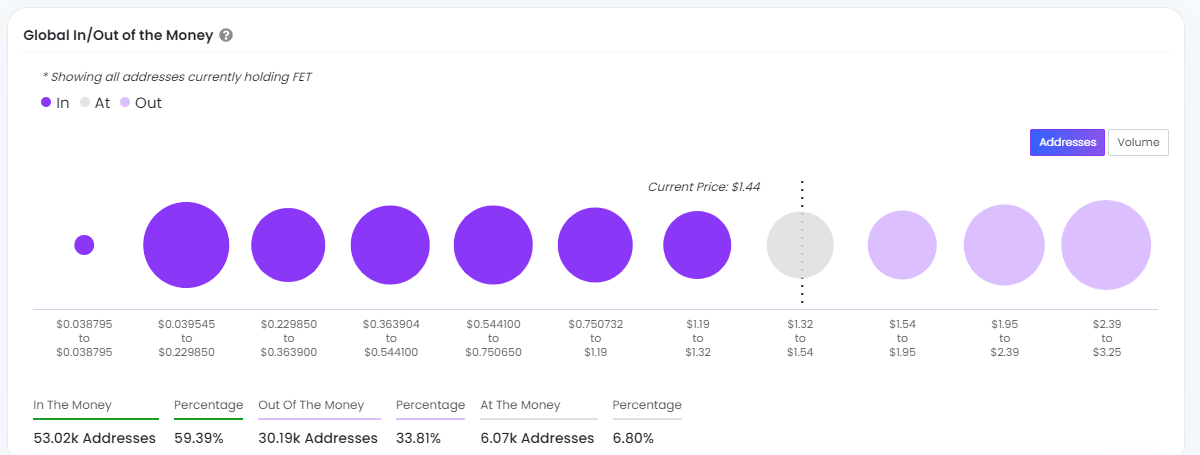

Per the Data From IntoTheBlock, 59.39% of FET addresses were profitable, while nearly 40% of its holders faced unrealized loss.

GIOM Indicator | Source: IntoTheBlock

These implications reflected somehow equal weighted data between bulls and bears and could lead to volatile moves ahead.

Any rejection near the $2 mark would impact the token’s strength, and a significant profit booking can also be anticipated.

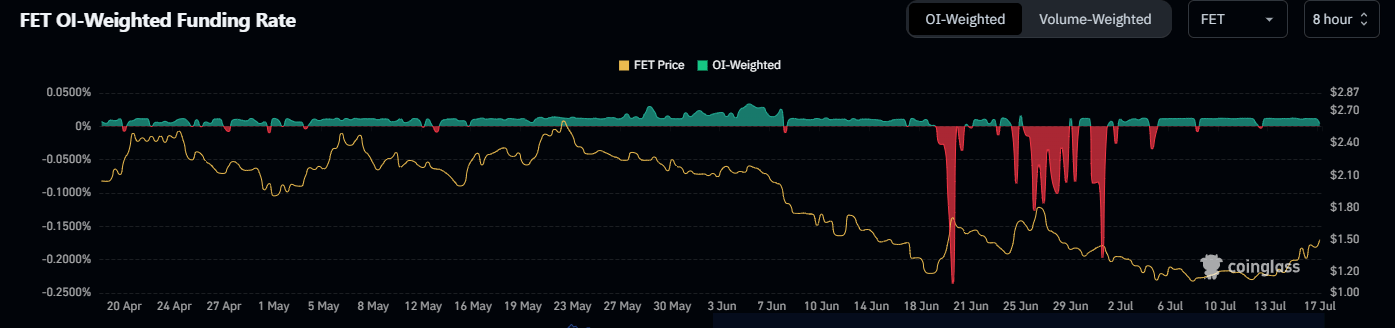

OI-Weighted Funding Rate

Besides the spot retail traders, the futures and options traders were eager to accumulate FET crypto.

FET OI-Weighted Funding Rate | Source: Coinglass

Data from CoinGlass cited that a constant positiveness in the funding rate this week highlighted buyer dominance.

Moreover, its open interest data rose over 10.66% to $44.81 Million, revealing fresh long additions in the past 24 hours.

The immediate support levels for the FET token are $1.20 and $1.10, whereas the key upside hurdle is around $1.80, followed by $2.

What to Expect Next?

The FET token price climbed above the 20-day EMA mark and approached the 50-day EMA mark. Meanwhile, the downward-sloping trendline barrier was on the brink of being crossed by the bulls. Once it breached, a directional move could be seen.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi