On-chain Data Confirms Whales Preparing for Altcoin Surge with Increased Buy Orders

Ki Young Ju, CEO of analytic platform CryptoQuant, believes that whales are setting up for a forthcoming altcoin surge.

In a recent disclosure on X, Ju pointed out that the limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant purchasing pressure from large-scale investors.

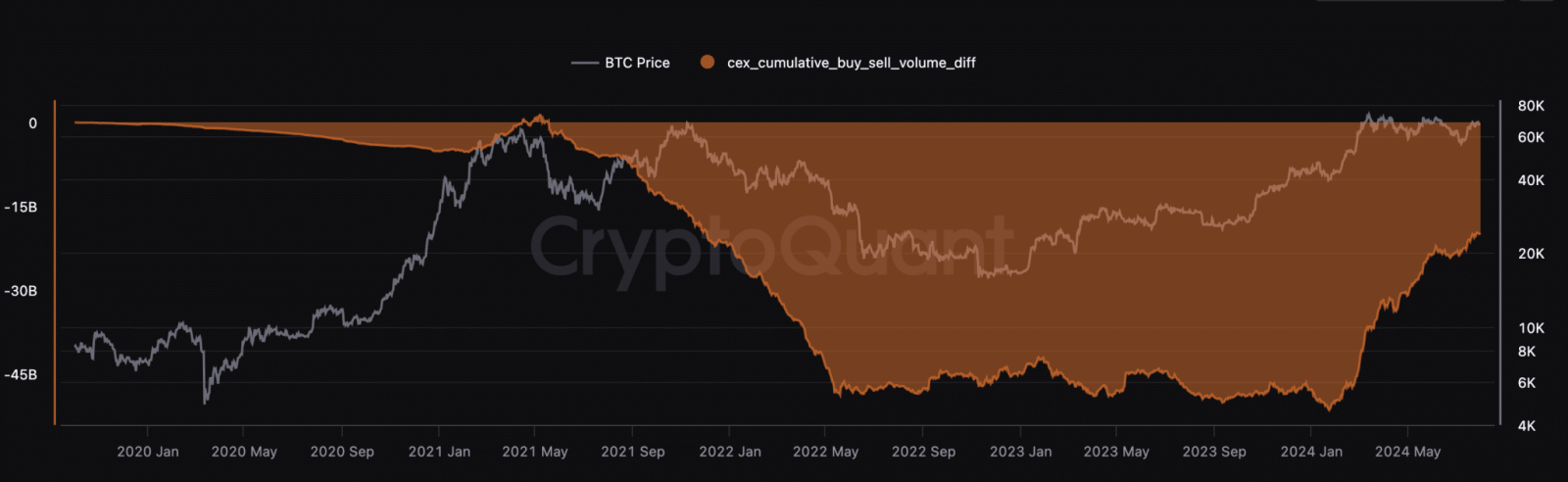

Ju’s chart identifies two major phases in the limit order volume for altcoins: the Limit Sell Phase and the Limit Buy Phase. The Limit Sell Phase saw a notable rise in cumulative sell orders back in 2022, demonstrating robust selling pressure from whales and other market players. This phase coincided with a period of altcoin price dump due to unfavorable market conditions.

Following this, the Limit Buy Phase began, marked by a significant increase in cumulative buy orders. This indicates a strategic accumulation period where whales establish substantial buy walls.

According to Ju, the rising buy volume suggests confidence in the future market conditions for altcoins. This buying pressure creates strong support levels, indicating that whales are preparing for a positive market shift.

Buy Pressure on Specific Altcoins

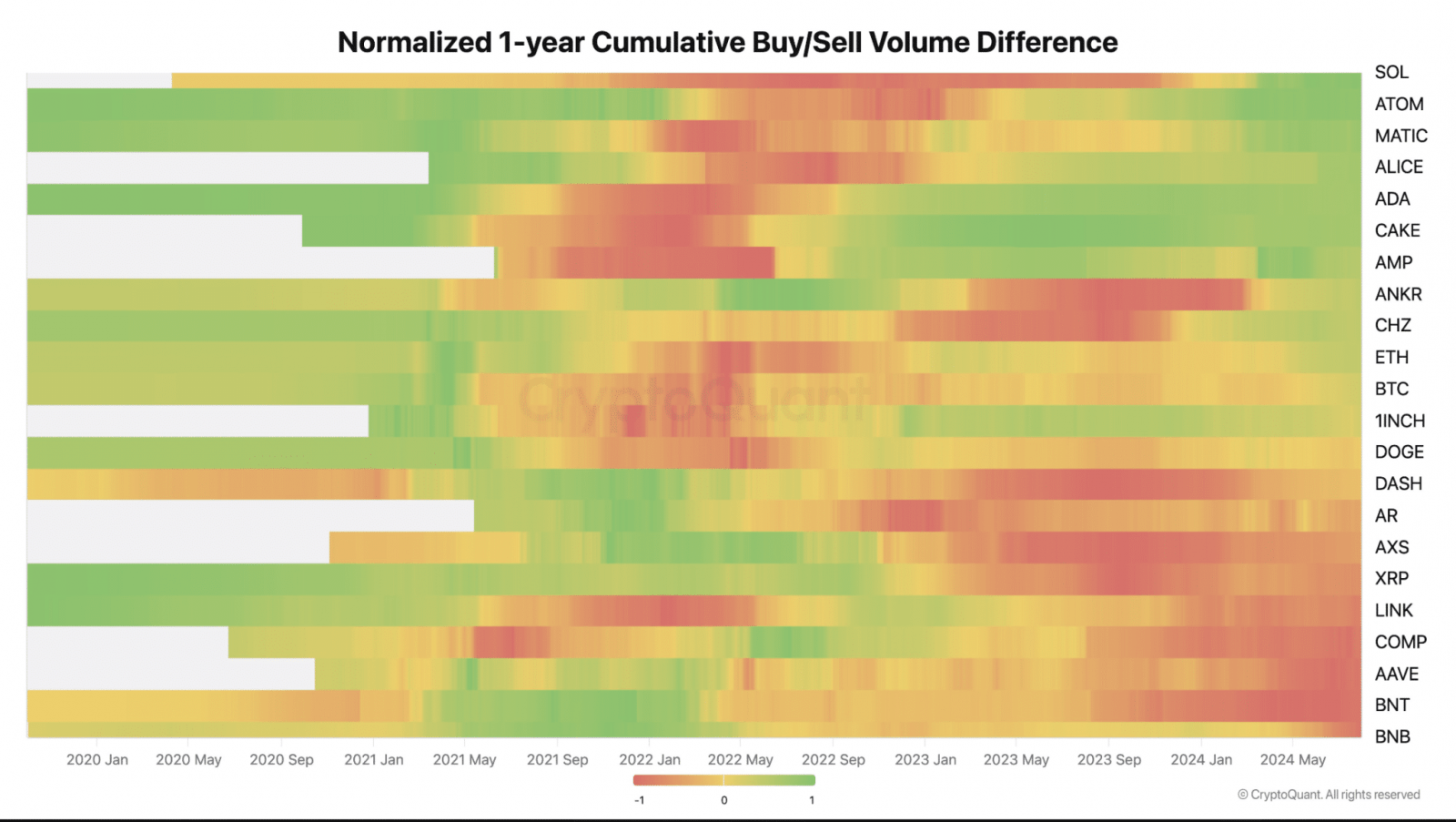

Ju also provided a heatmap of the normalized 1-year cumulative buy/sell volume difference for various altcoins, showing buying and selling pressure over time. Solana (SOL) exhibited alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) also displayed heightened buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) showed balanced buy and sell phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR also demonstrated a rise in buy activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and significant investors accumulate altcoins in anticipation of a rally.

Meanwhile, the coins experiencing selling pressure, as indicated by predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin Whales Are Also Buying

It is important to note that while whales accumulate altcoins, Bitcoin whales are also active. The Crypto Basic noted a surge in buyer activity on Binance, which aligns with an increase in the Taker Buy-Sell Ratio and whale movements. Analyst Ali Martinez highlighted fluctuations in the ratio from below 0.8 to above 1.7 between July 27 and July 31. Ratios above 1.0 indicate aggressive buying, often preceding price rises.

During July 27-28, the ratio stayed mostly above 1.0, corresponding with Bitcoin’s price rise from around $66.5K to above $67K. A spike to around 1.5 led to a sharp price increase to nearly $68.5K. However, on July 30-31, the ratio fell below 1.0 multiple times, correlating with a price drop back to around $66K, before a final spike to 1.7 indicated another slight price increase.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  Hive

Hive  DigiByte

DigiByte  Huobi

Huobi  Nano

Nano  Bitcoin Gold

Bitcoin Gold  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond