Gold Crashes, Bitcoin Rockets, And Peter Schiff Is Not Happy About It

Gold prices fell sharply yesterday as investors reacted, as expected, to the latest U.S. inflation data, which came in below expectations.

Gold is traditionally seen as a safe-haven asset in volatile economic times and tends to rise when inflation rises. However, the latest CPI data has changed market sentiment, and many market participants now believe that the Federal Reserve may cut interest rates. This has made gold less attractive, leading to a sharp sell-off.

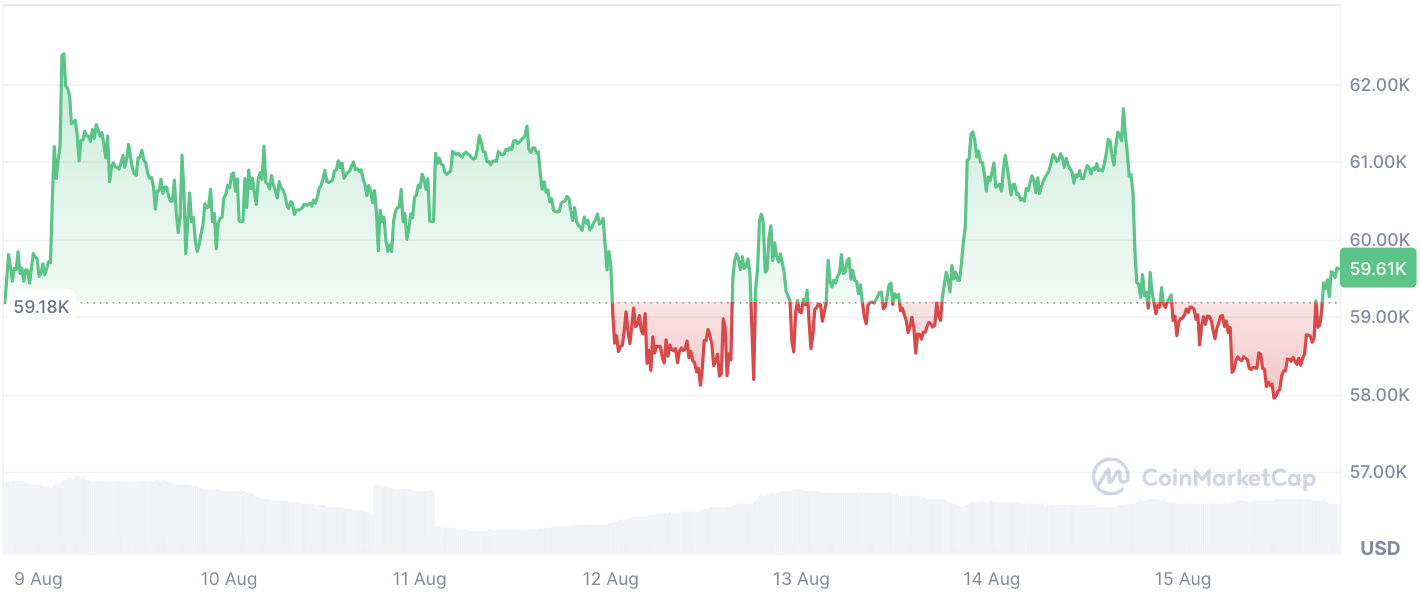

On the other hand, Bitcoin (BTC) and other riskier assets rose sharply in response to the same data. Cryptocurrency is generally seen as a more speculative investment and tends to do well during periods of economic optimism.

Anti-gold

Peter Schiff, prominent supporter of gold, said he was unhappy with the way the market reacted. He believes that investors have misread the inflation data, which as he says led to an unwarranted sell-off in the precious metal.

However, Schiff has always said that gold is a more stable store of value than Bitcoin, which he believes is just a “bubble.”

In addition, the crypto skeptic found reason to rejoice, stating that the rise of BTC against the backdrop of metal’s decline in current conditions proves once again that cryptocurrency is the anti-gold, not gold 2.0, as many claim.

Bitcoin is again proving to be digital anti-#gold. Investors incorrectly perceived today’s economic data as reflecting a stronger economy. Gold immediately sold off as expectations for a rate cut subsided. #Bitcoin rose with other risk assets that benefit from a stronger economy.

— Peter Schiff (@PeterSchiff) August 15, 2024

Gold or anti-gold, the cryptocurrency rally shows how the market feels right now, as investors turn their attention to assets that could benefit from potential interest rate cuts and an improving economic outlook.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Stellar

Stellar  Monero

Monero  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD