Ethereum’s supply rises by over 210,000 ETH amid Vitalik Buterin’s charity donation

- Ethereum ETFs post $10.8 million in net inflows.

- Ethereum’s annual inflation rate rose to 0.58% after its total supply increased by over 210,000 ETH in the past four months.

- Vitalik Buterin confirms 200 ETH sale was for a charity donation.

- Ethereum could rally toward its yearly high of $4,093 if it breaks above the ascending triangle’s resistance.

Ethereum (ETH) is down 0.7% on Thursday following three consecutive days of net inflows across ETH ETFs. Meanwhile, ETH’s annual inflation rate has continued trending upward amid signs of a potential bullish reversal.

Daily digest market movers: ETH ETF inflows, inflation rate, Vitalik Buterin’s donation

Ethereum ETFs recorded net inflows of $10.8 million on Wednesday, stretching their inflow streak to three days. BlackRock’s ETHA and Fidelity’s FETH saw inflows of $16.1 million and $6.6 million, respectively, while Grayscale’s ETHE posted outflows of $16.9 million.

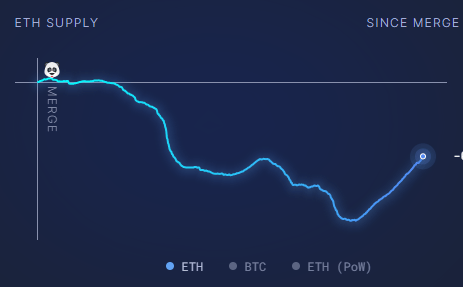

Ethereum’s annual inflation rate has increased to 0.58% after its net supply grew to 120.27 million ETH in the past 30 days, according to data from Ultrasound.money.

Since the Dencun upgrade in March, Ethereum’s supply has been in an uptrend, considering fewer transactions on the Main chain reduced ETH’s burn rate, which was meant to offset new issuance. This is evidenced in ETH’s supply change in the past 30 days. The network recorded 77,100 ETH issued against 19,300 ETH burned, increasing Ethereum’s total supply by 57,700 ETH.

ETH supply growth

Between April and August 2024, Ethereum’s total supply has grown by more than 210,000 ETH. A sustained uptrend in supply growth could negatively impact ETH’s price if demand declines or stays constant.

Ethereum co-founder Vitalik Buterin transferred 200 ETH worth about $532,000 to the Kraken exchange in the past 24 hours. While many earlier interpreted the transfer as profit-taking, Buterin later clarified that the 200 ETH was a donation to charity. Buterin received the funds from the sale of animal-themed meme coins he received in the past year.

Charity donation done, covering all animal coins from the past year or so!

That said, I appreciate it if coin holdings just get allocated to the charities directly

It’s 2024, we can start doing more sophisticated public goods fun-ding, eg. see https://t.co/8ZVhwkVwLy pic.twitter.com/RQ1ThdLCYL

— vitalik.eth (@VitalikButerin) August 15, 2024

ETH technical analysis: Ethereum could rally if ascending triangle continues

Ethereum is trading around $2,650 on Thursday, down 0.7% on the day. In the past 24 hours, ETH has seen over $32 million in liquidations, with long and short liquidations accounting for $24.51 million and $7.55 million, respectively.

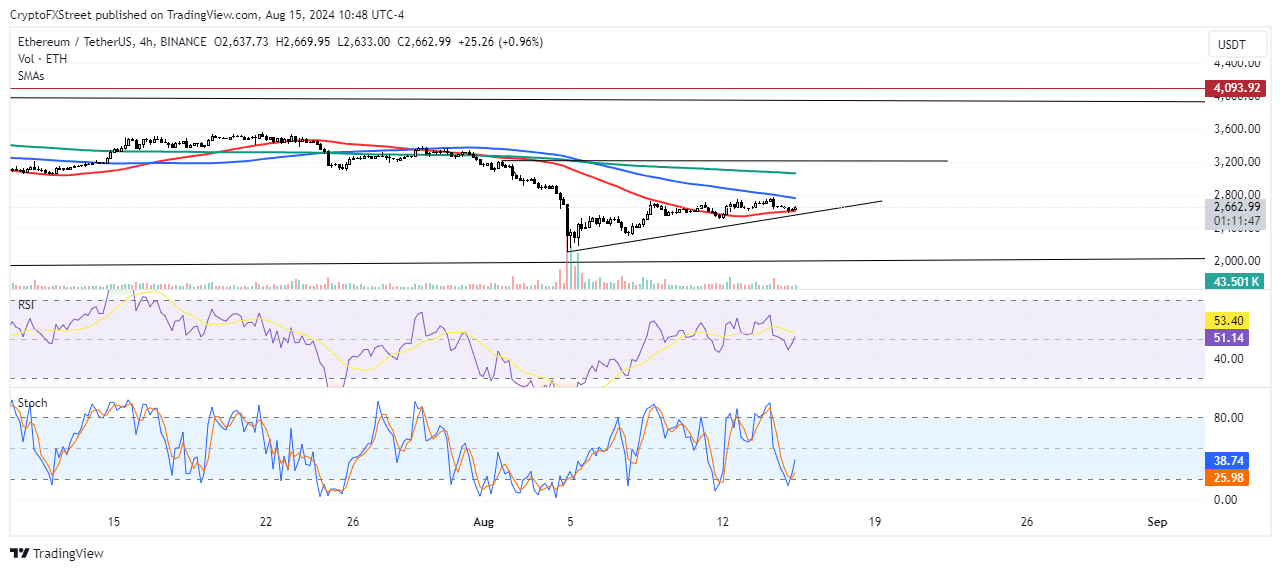

On the 4-hour chart, ETH appears to be following an ascending triangle since the market dip on August 5. This signals a potential reversal on the horizon.

ETH/USDT 4-hour chart

The 200-day Simple Moving Average (SMA) has served as a resistance since July 28, when the 50-day SMA moved below it in a Death Cross pattern.

If ETH continues posting higher lows and breaks above the upper resistance line around the psychological level of $3,200, it could rally toward its yearly resistance of $4,093.

This move is supported by the Relative Strength Index (RSI), which is attempting to move above its moving average. If the RSI successfully crosses above the moving average, ETH could see a brief rise in the coming days.

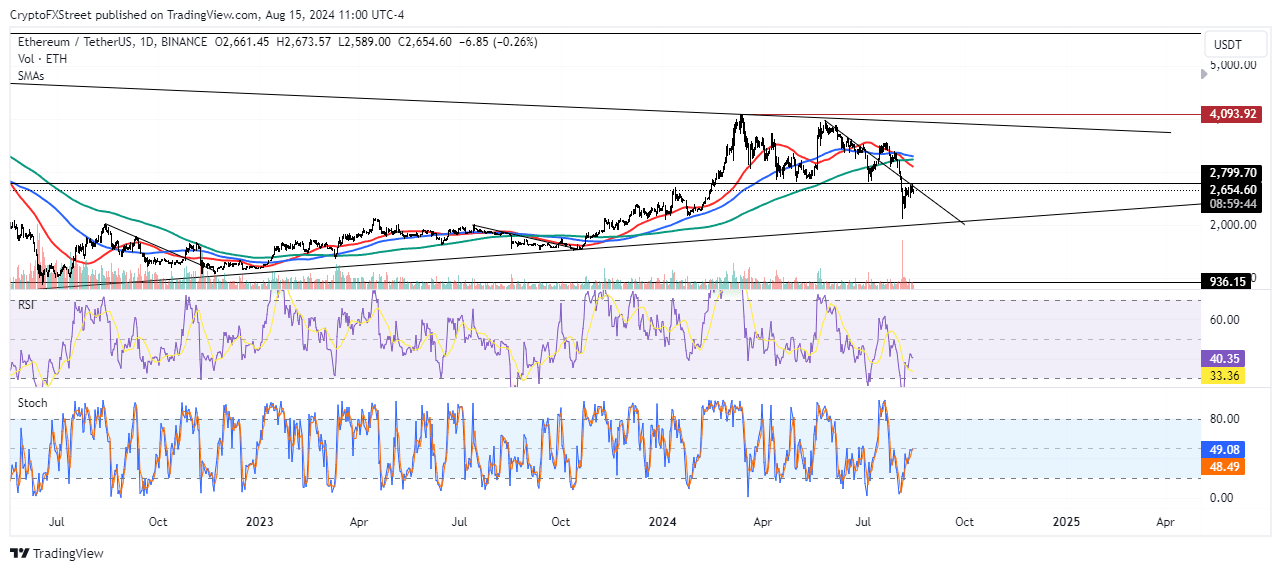

Meanwhile, on the daily chart, ETH faces a key trendline resistance that suggests its price could decline to the $2,000 to $2,200 range in the coming weeks. ETH has previously posted similar moves from August 2022 to November 2022 and July 2023 to August 2023.

ETH/USDT Daily chart

A daily candlestick close below the lower rising trendline could trigger a heavy correction for ETH.

Share: Cryptos feed

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Ethereum Classic

Ethereum Classic  Monero

Monero  Stellar

Stellar  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD