Bitcoin (BTC) Price Nears ATH: 5 Reasons It Could Surpass Gold’s Recent Record

- Bitcoin’s strategic withdrawals and growing institutional interest signal potential for surpassing gold’s record.

- Political factors and Fed expectations are key drivers behind Bitcoin’s current price momentum.

According to Coinglass data, strategic withdrawals from major platforms like Coinbase Pro and Bitfinex have led to the accumulation of over 23,000 BTC. Previously, CNF reported that Bitcoin accumulation mirrors 2019 levels, suggesting a $100K parabolic rally is imminent. This has also sparked speculation that certain altcoins are set to explode in price.

In brief, Bitcoin’s price surge is attributed to five key factors:

- Strategic Withdrawals: Over 23,000 BTC were strategically withdrawn from major exchanges like Coinbase Pro and Bitfinex, indicating strong confidence from long-term holders.

- Strong ETF Inflows: Significant investments from institutions like BlackRock and Fidelity have boosted Bitcoin ETFs, reflecting increased investor trust.

- Growing Institutional Interest: Companies like Goldman Sachs and Morgan Stanley are increasingly investing in Bitcoin ETFs, solidifying Bitcoin’s status as a credible asset.

- Political Influence: The U.S. elections are driving market optimism, with pro-crypto candidates contributing to Bitcoin’s positive outlook.

- Fed Rate Cut Expectations: Anticipation of a Federal Reserve rate cut is enhancing Bitcoin’s appeal as a hedge against inflation.

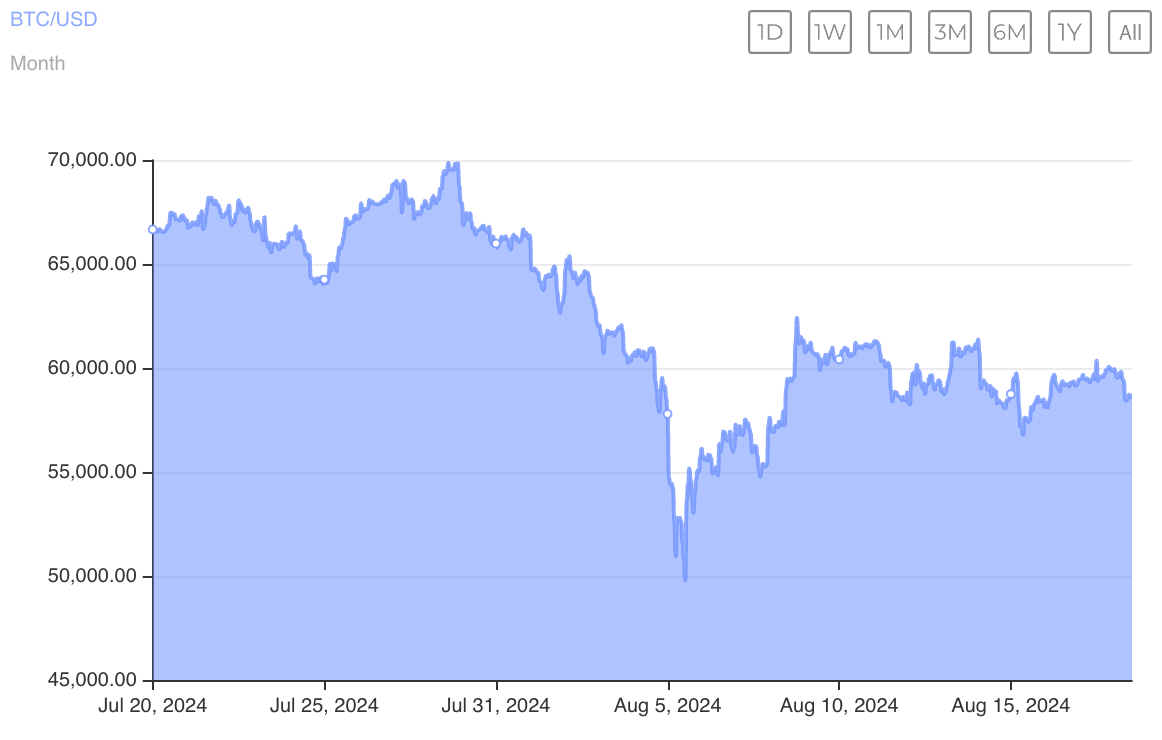

Mirroring previous events, Bitcoin surged past $61,000, fueled by $2.5 billion in stablecoin inflows. In our recent update, institutional investors, including Goldman Sachs, are boosting Bitcoin’s performance with increased activity in spot Bitcoin ETFs. As of now, BTC is trading at $58,723.47, down 1.62% in the past day but up 0.18% over the past week. See BTC Price chart below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom