Fundamental Bitcoin (BTC) Resistance: Ahead of $70,000, Here’s What Keeps Solana (SOL) Down, Toncoin (TON) Massive Bull Run Beginning Again?

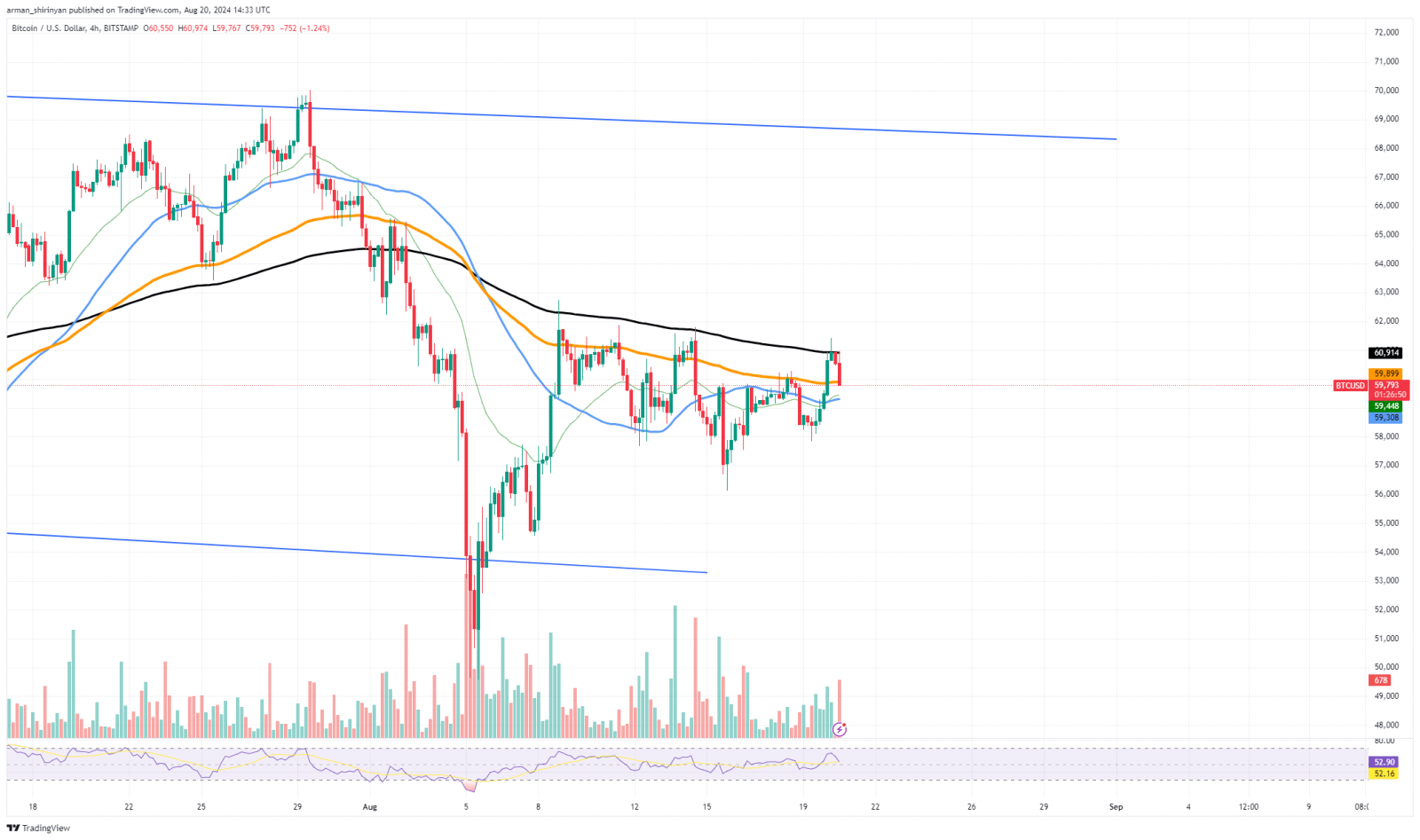

Bitcoin currently stands on the verge of breaking through the 50 EMA at about $61,000. A move toward $70,000 is likely to follow as the current resistance might not hold much longer. Bitcoin’s potential surge toward $70,000 could happen sooner than many anticipate. Successfully overcoming this resistance level could be pivotal in driving Bitcoin to new highs.

As Bitcoin remains close to this crucial level, traders and enthusiasts alike are watching closely. The bullish momentum needed for this breakthrough seems to be building up, and once it breaches this $61,000 mark, the path to $70,000 could be clear. Bitcoin’s resilience in the face of resistance shows the strength of the ongoing uptrend.

Anticipation is growing as market participants prepare for the possibility of Bitcoin hitting $70,000. The level of resistance above $61,000 is seen as the last major hurdle before Bitcoin could rally to this new milestone. Traders may expect that, once cleared, there will be little to no resistance on the way to $70,000. This potential breakout could be a significant moment for Bitcoin, reinforcing its position on the market and possibly setting the stage for further gains.

Bitcoin’s approach to $61,000 could lead to a rapid advance to $70,000, provided that this resistance level is successfully breached. The market’s outlook remains optimistic as Bitcoin is still consolidating instead of entering a correction.

Solana remains suppressed

A major selling signal for investors is the potential of the SEC considering Solana a stock. At any given time, this uncertainty could lead to a substantial price reversal. What is troubling is the possibility of a breakdown in the foreseeable future that might affect the cryptocurrency’s value.

This situation is creating bearish sentiment around Solana, which keeps its price from gaining upward momentum. The possibility of Solana being reclassified as a stock is not just speculation but a real threat that looms over the market.

A considerable price decline might follow if the SEC decides to act on this potential reclassification. Solana’s price has been struggling to maintain its position because of this ongoing uncertainty. Traders might be hesitant to invest in Solana until there is clarity from the SEC, which is contributing to the downward pressure on the price.

The SEC’s potential actions could trigger a sell-off among investors, who fear that Solana might be deemed a security. The market is on edge, waiting for any new developments that could impact Solana’s future. As long as this uncertainty persists, Solana’s price will likely remain under pressure, unable to break through its current resistance levels.

In summary, Solana is being kept down by the looming threat of SEC intervention, which is a significant concern for investors. This uncertainty is causing bearish sentiment.

Toncoin rally continuation?

A rally continuation in the next few days may be seen for Toncoin as the price successfully breaks through the key resistance level at the 50 EMA. The only technical threshold keeping it down at the current price level has essentially been surpassed. However, it is also unclear how things will unfold in the coming days.

Toncoin’s ability to overcome this resistance might be signaling the start of a new bullish phase. Traders might be watching closely as the asset begins to gain momentum. If this upward trend continues, we could witness a significant surge in Toncoin’s value.

A possible rally could follow this breakthrough, and traders are likely considering the potential for further gains. This key resistance level has been a major barrier, but now that it has been broken, the path ahead might be more favorable for Toncoin. As the market reacts to these movements, anticipation grows around the possibility of a massive bull run beginning once again.

While the immediate future remains uncertain, Toncoin’s recent performance indicates that a strong upward trend could be in the cards. Investors may need to keep a close eye on the market’s behavior over the next few days to see if this momentum continues.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Waves

Waves  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD