BTC Falls Below $60K but Hidden Sign Hints at a Possible Rally (Bitcoin Price Analysis)

Bitcoin’s price has yet to recover following the crash from $68K a couple of weeks ago.

The cryptocurrency has been consolidating in a tight range, leaving market participants wondering about its future direction.

BTC Price Technical Analysis

By TradingRage

The Daily Chart

The daily chart shows that the BTC price has failed to climb back above the 200-day moving average, located around the $63K mark, after dropping below it earlier. The market is now consolidating around the $60K level and is yet to reclaim this key area.

Either way, as long as the cryptocurrency is trading below the 200-day moving average, the probability of continuing the long-term bullish trend is considerably low.

The 4-Hour Chart

Looking at the 4-hour timeframe, Bitcoin’s recent rangebound movement becomes clearer. The price has been trapped between the $57K and $60K levels and has yet to break to either side. The RSI also hovers around the 50-point mark, showing indecisiveness in market momentum.

Therefore, to have a more accurate idea of what’s to come, investors should wait for the market to break to the upside or the downside, as the current range does not give away any significant clues.

Bitcoin Price On-Chain Analysis

By TradingRage

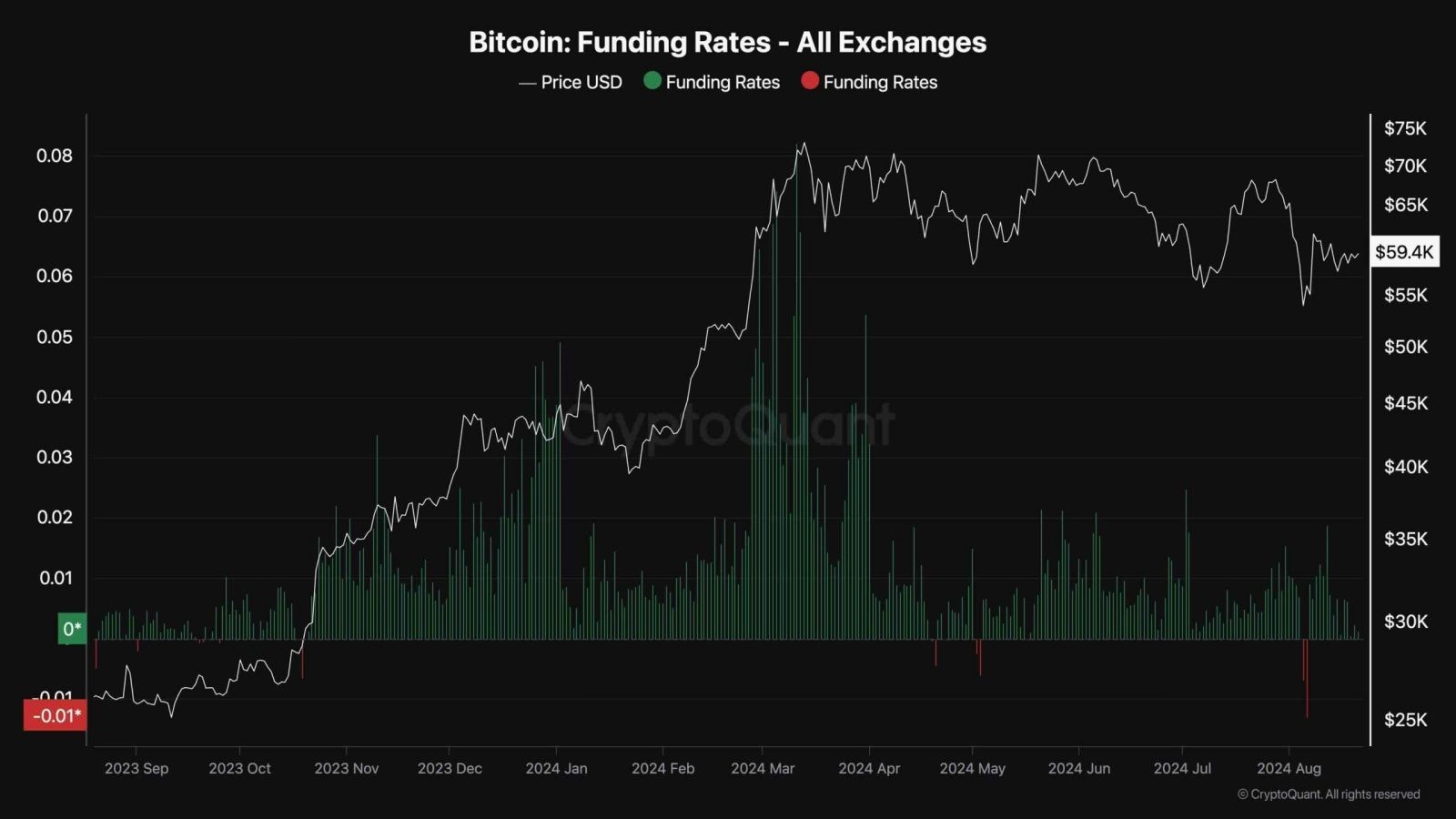

Bitcoin Funding Rates

BTC has been going through a lengthy consolidation period, and investors are wondering about its short-term direction. As we already discussed, the charts fail to provide significant hints. However, some optimistic signs can be witnessed in future market metrics.

This chart presents the Bitcoin funding rates metric, which measures whether the buyers or the sellers are executing their orders more aggressively. It is an important indicator in determining futures market sentiment. Positive values indicate bullish sentiment, while negative values support bearish sentiment.

As the chart demonstrates, the funding rates have declined to almost zero, as the recent price drops have led to a significant cool-down in the futures market.

Therefore, a sustainable rally could be on the verge of materializing, as this pattern has been seen before previous price surges. Yet, note that sufficient demand from the spot market must be present for this scenario to occur.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Waves

Waves  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD