Ethereum Sell-off Coming? Whales Off-load $40 Million of ETH

Story Highlights

-

Whales have transferred a significant over 15,706 ETH worth $40.13 million in the last 24 hours.

-

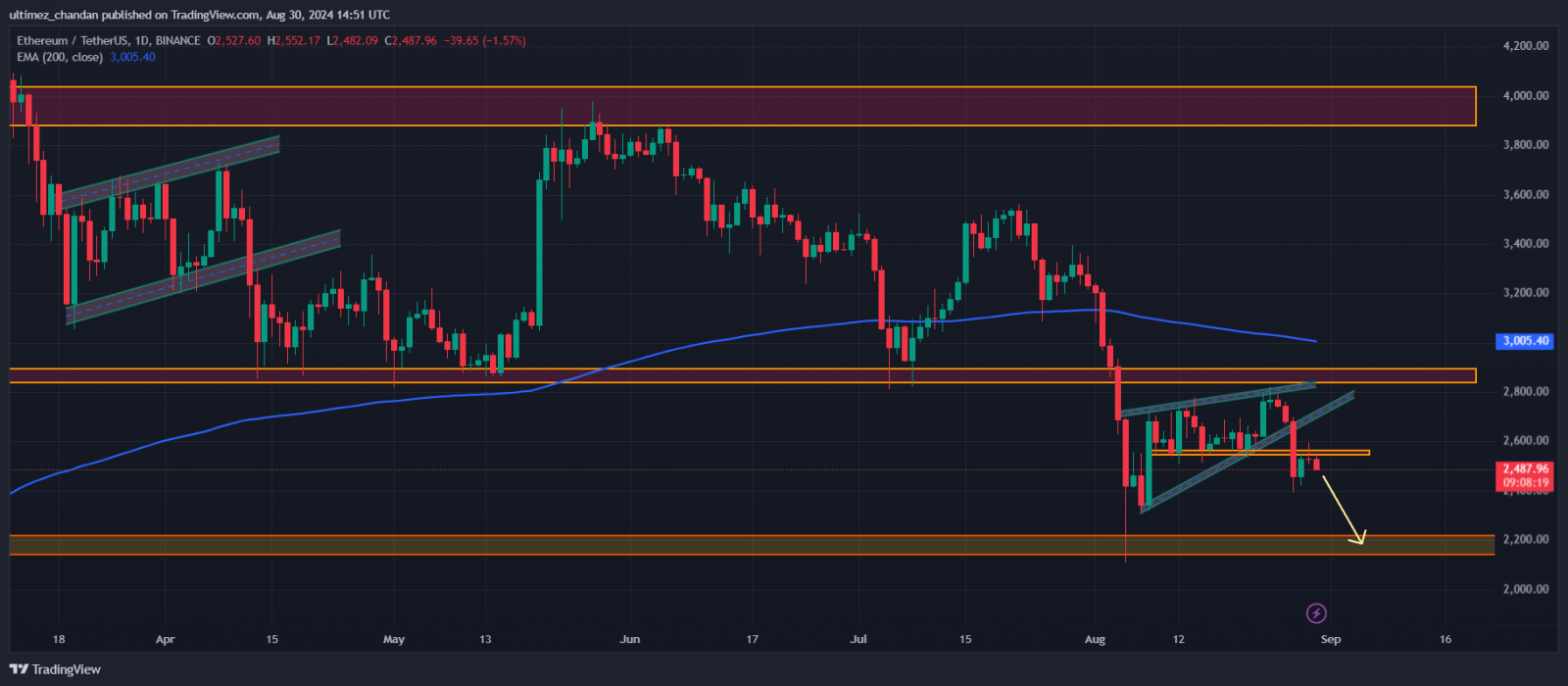

Following the breakout of the bearish pattern, there is a high chance ETH could decline by 12% to the $2,200 level.

-

If the ETH price falls to the 2,487 level, nearly $256 million worth of long positions will be liquidated.

Ethereum (ETH), the world’s second-biggest cryptocurrency, is experiencing notable selling pressure due to continuous dumping by whales and institutions. Amid this market downturn, whales and Ethereum co-founder Vitalik Buterin have transferred a significant over 15,706 ETH worth $40.13 million in the last 24 hours, as reported by the on-chain analytic firm Lookonchain.

Ether Whale Dumps $40 Million of ETH

According to Lookonchain’s post on X (Previously Twitter), out of 15,706 ETH, 14,906 ETH were dumped to centralized exchanges (CEXs) including Binance and Coinbase. Meanwhile, Buterin moved 800 ETH to a multisig wallet and later swapped 190 ETH for $477,000 USDC.

Based on the price action and technical analysis, with this bearish outlook, there is a high possibility that ETH could decline by 12% to the $2,200 level in the coming days.

Key Liquidation Areas

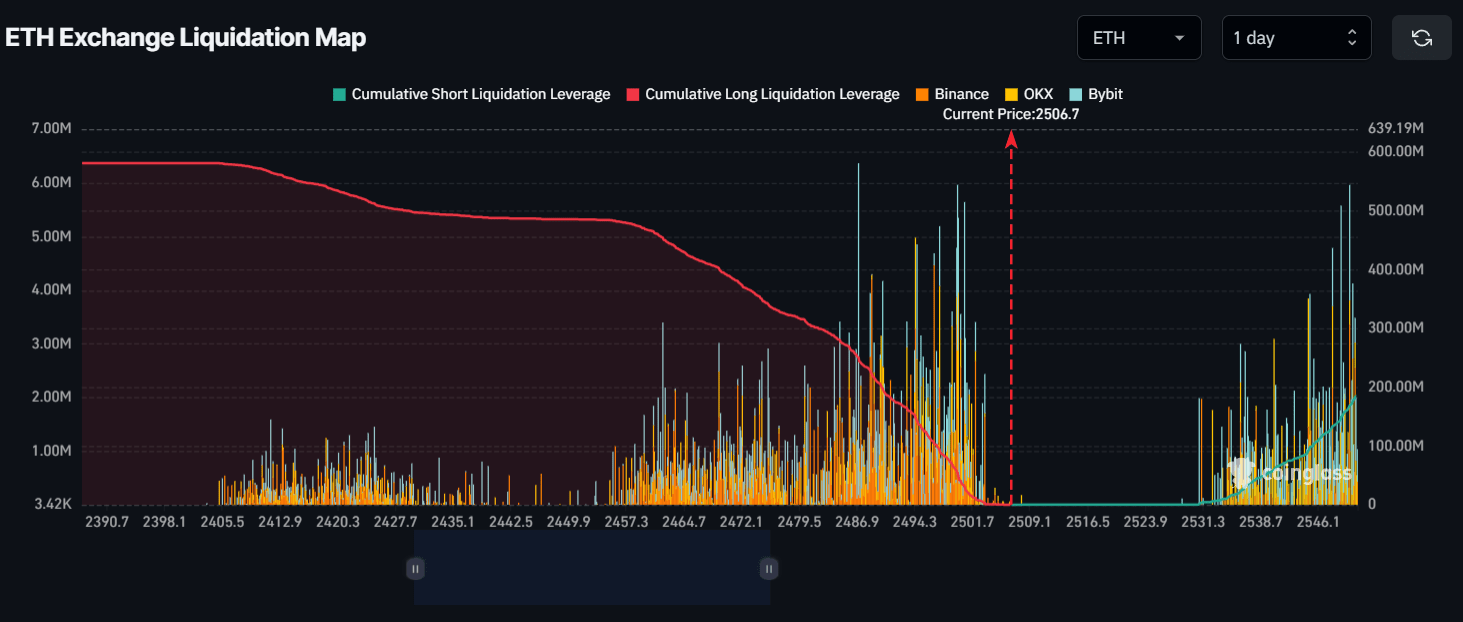

Meanwhile, short sellers are dominating and liquidating long positions. Currently, the major liquidation levels are near the $2,487 level on the lower side and $2,550 on the upper side, according to the on-chain analytic firm CoinGlass. This data indicates that traders have been over-leveraged at these levels in the last 24 hours.

If the market sentiment remains bearish and the ETH price falls to the 2,487 level, nearly $256 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to a $2,550 level, approximately $168 million worth of short positions will be liquidated.

Ether Price Analysis

These data show that ETH is currently $10 away from the massive long liquidation. At press time, Ether is trading near the $2,498 level and has experienced a price decline of over 2.65% in the last 24 hours. Meanwhile, its trading volume has dropped by 16% during the same period, indicating lower participation from traders due to the ongoing ETH dump and market sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Zcash

Zcash  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy