Ethereum exchange reserve increased by 163K ETH in five days amid price consolidation

- Ethereum’s exchange reserve increased by 163K ETH in the past five days.

- Ethereum has added over 4 million new holders in the past three months.

- Ethereum could bounce near $2,400 support after moving average resistance.

Ethereum (ETH) is down over 2% on Tuesday following an indication of selling pressure due to an uptick in its exchange reserve. However, other on-chain metrics indicate mixed investor sentiment amid ETH’s price consolidation.

Daily digest market movers: ETH rising exchange reserve, new holders uptrend

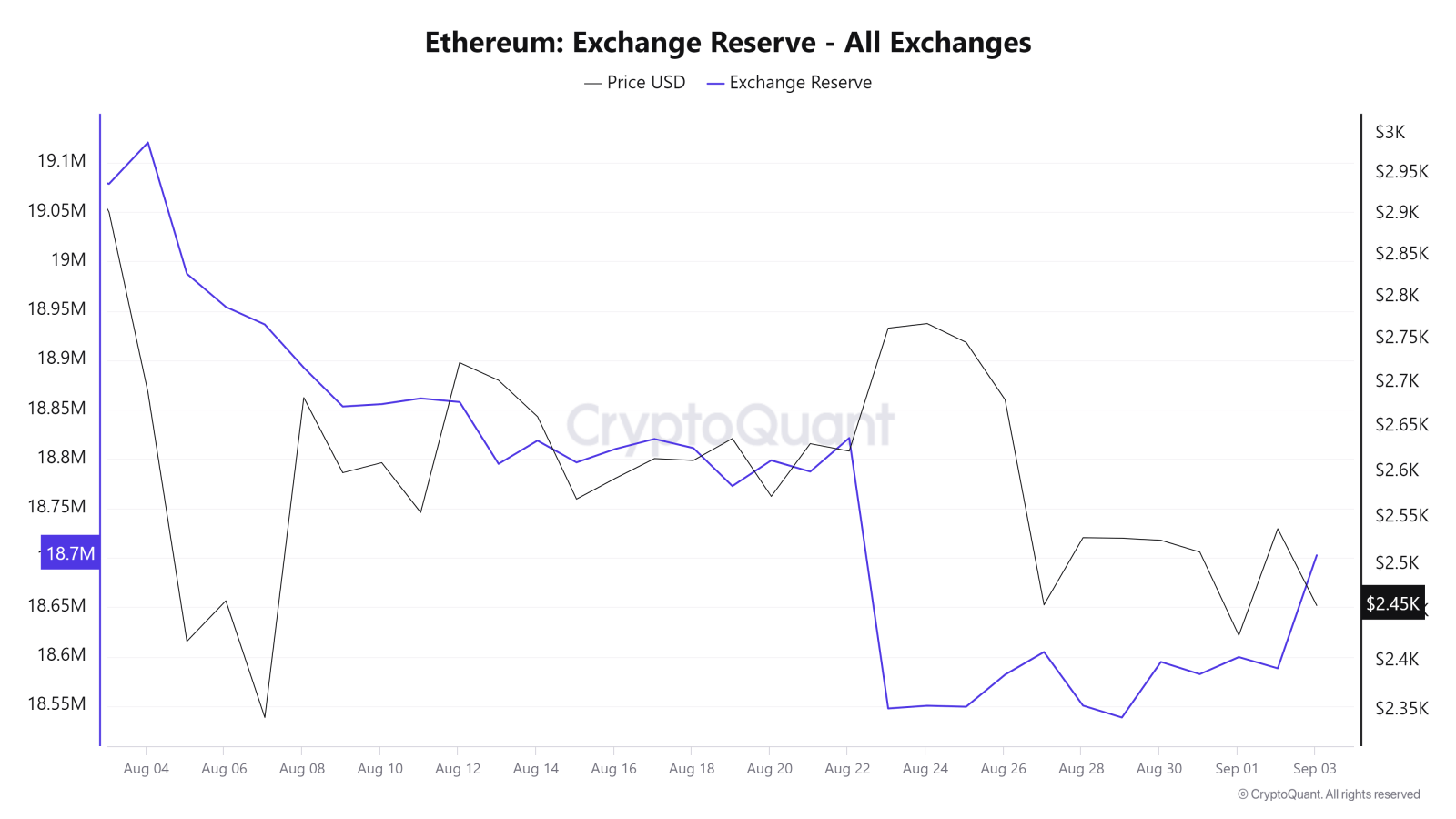

Since August 29, Ethereum’s exchange reserve has switched from a downtrend to an uptrend. Exchange reserve is the total amount of a cryptocurrency held in an exchange. An increase in an asset’s exchange reserve indicates higher selling pressure and vice versa for a decrease.

According to CryptoQuant’s data, Ethereum’s exchange reserve increased by about 163K ETH, worth about $407.5 million, in the past five days. As a result, ETH may likely see short-term selling pressure until its exchange reserve starts declining again.

ETH Exchange Reserve

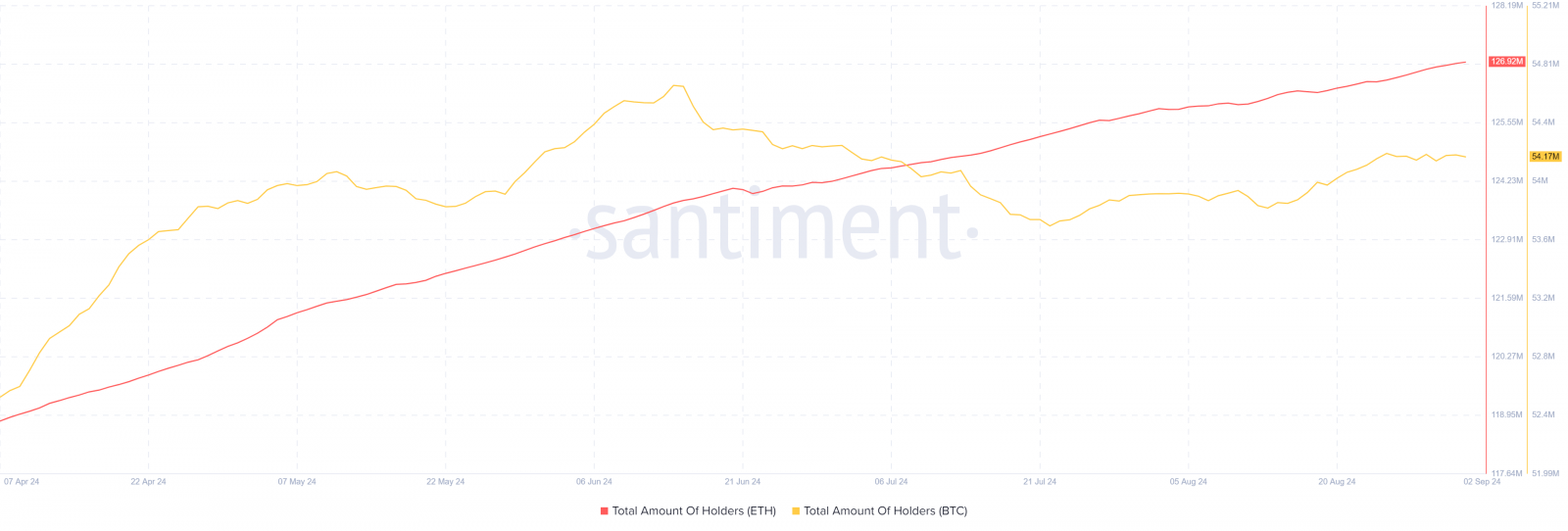

Meanwhile, despite Ethereum’s price lag, its total number of holders has been in an uptrend, adding over 4 million new non-empty wallets in the past three months, per Santiment data. This takes the total number of ETH holders to nearly 127 million, meaning new market participants may be betting on an ETH price increase in the long term. In comparison, BTC’s total holders declined by 50K during the same period.

ETH vs BTC Total Holders

While the Ethereum holders’ count is growing, whale activity within the network has declined considerably from its peak during the market rally in early March. According to Santiment’s data, Ethereum’s whale transaction count declined from over 115K whale transactions between March 13-19 to 31.8K between August 21 and 27 — only about one-quarter of the March whale transaction count.

The decline is evidenced by the reduced volatility of ETH in the past few months, with the only exception being the market surge on May 20 and the crash on August 5. Whale activity often peaks when volatility increases, noted Santiment analysts.

ETH technical analysis: Ethereum could bounce around key support level

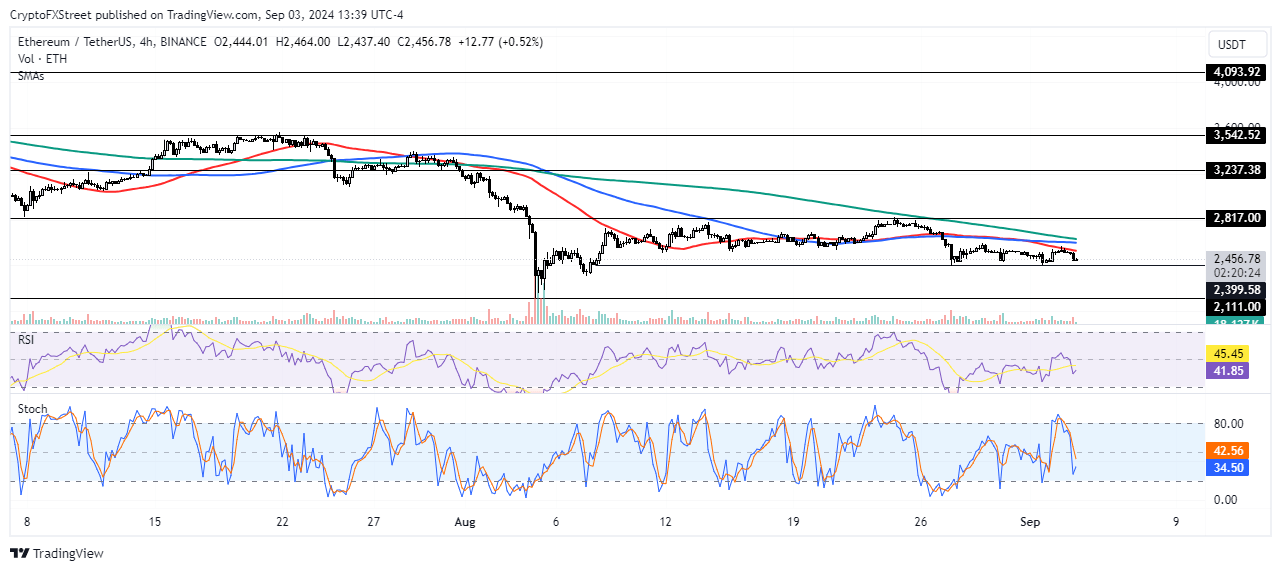

Ethereum is trading around $2,450 on Tuesday, down 2.5% on the day. In the past 24 hours, ETH has seen liquidations worth $26.94 million, with long and short liquidations accounting for $22.13 million and $4.81 million, respectively.

On the 4-hour chart, ETH’s upward move was restricted by a convergence of the 200-day, 100-day and 50-day Simple Moving Averages (SMA) in the European trading session. As a result, ETH is attempting a move downward within a key rectangle with support and resistance levels at $2,400 and $2,817, resepectively.

ETH/USDT 4-hour chart

ETH may bounce around the $2,400 support level and stage another move up, but only after potentially liquidating positions worth $40.8 million at the $2,424 level, per Coinglass data.

A move outside the key rectangle will likely determine ETH’s next price trend. A breach of the $2,400 support level could send ETH toward $2,111. A successful breakout above the $2,817 level and SMA resistance will see ETH rally toward $3,237.

The Relative Strength Index (RSI) and Stochastic Oscillator’s (Stoch) %K line are trending below their midlines, indicating a short-term bearish outlook.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Waves

Waves  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD