US Bitcoin ETFs see largest single-day inflow since late July, Bitcoin climbs past $60,000

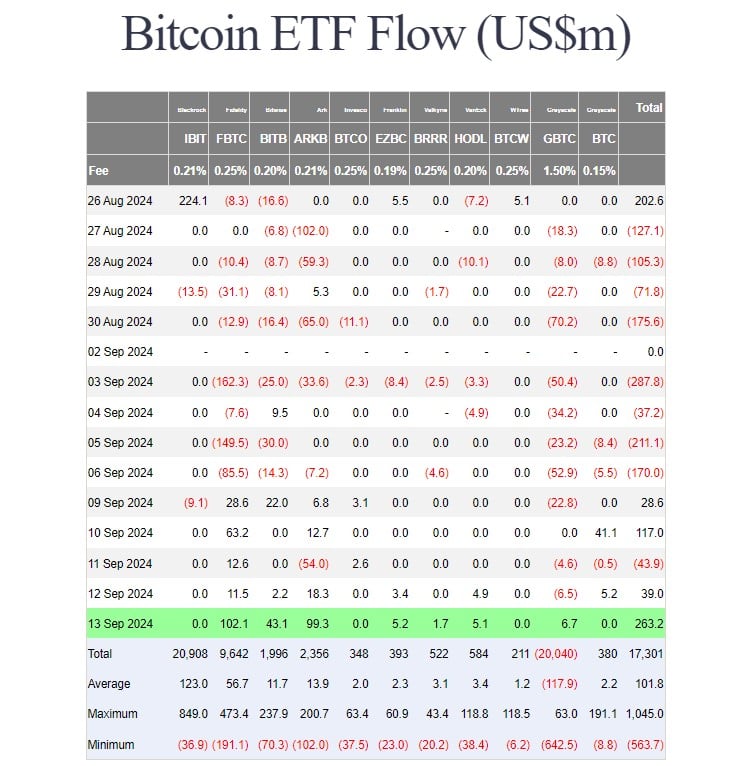

Inflows into US spot Bitcoin exchange-traded funds surged on Friday, with net buying topping $263 million, the largest single-day inflow since July 22. The strong performance returned on a day that saw Bitcoin jump above $60,000, registering a 12% increase in a week, per TradingView.

According to data from Farside Investors, investors poured around $102 million into Fidelity’s Bitcoin (FBTC), bringing the fund’s weekly gains to approximately $218 million.

Source: Farside Investors

FBTC made a strong comeback and led the group this week after suffering two consecutive weeks of negative performance. During the stretch, around $467 million was drained from the fund.

ARK Invest/21Shares’ Bitcoin Fund (ARKB) followed FBTC, ending Friday with around $99 million in net capital. Other competing Bitcoin ETFs managed by Bitwise, Franklin Templeton, Valkyrie, VanEck, and Grayscale also experienced positive inflows.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT), WisdomTree’s Bitcoin Fund (BTCW), and Grayscale’s Bitcoin Mini Trust (BTC) saw zero flows.

IBIT’s recent performance has been lackluster, with no inflows observed on almost every trading day over the past two weeks.

The fund even experienced net outflows on two separate days during this period, August 29 and September 9. Since its launch, IBIT has recorded a total of three days of net outflows.

With Friday’s massive gains, US spot Bitcoin ETFs closed the week with over $400 million in net inflows.

The positive sentiment extended beyond US Bitcoin funds, as the broad crypto market also experienced a green day. Bitcoin (BTC) surged from $54,300 on Monday to $60,600 yesterday. The flagship crypto now settles around $60,200, according to TradingView’s data.

Ethereum (ETH) jumped 8% to $2,400 in a week. Among the top 20 crypto assets, Toncoin (TON), Chainlink (LINK), and Avalanche (AVAX) posted the most gains, data from CoinGecko shows.

Bitcoin ETF investors in the red: ARK Invest

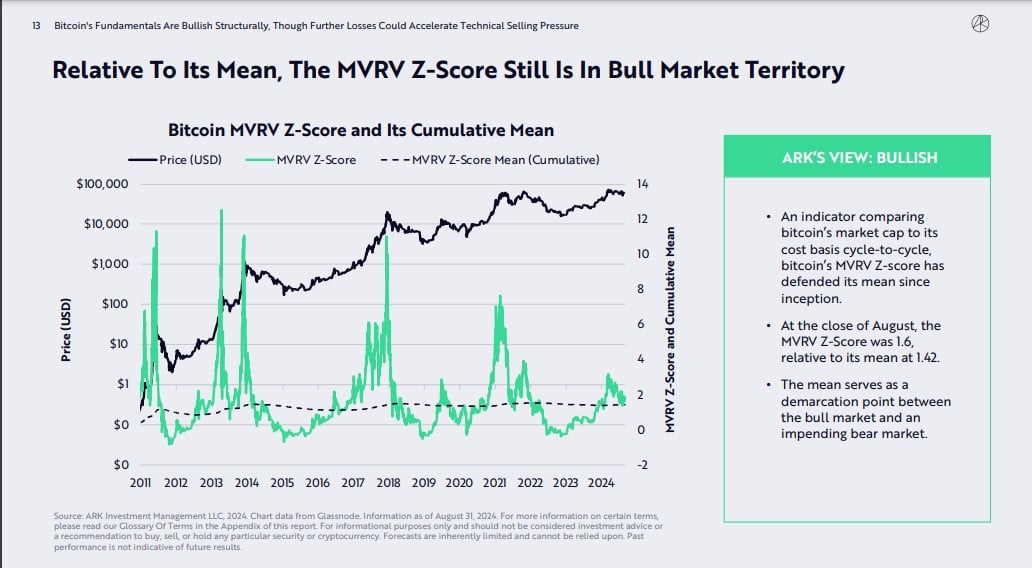

A recent report from ARK Invest shows that the average cost basis of US spot Bitcoin ETF investors stood above the current market price as of late August. This indicates that the majority of these participants are currently underwater.

The flow-weighted average price used to calculate the cost basis indicates that investors who bought in earlier may have purchased at higher prices, exacerbating the negative impact of the recent price decline.

However, based on the MVRV Z-Score, an indicator comparing Bitcoin’s market capitalization to its cost basis, Bitcoin’s fundamentals remain bullish, ARK Invest notes. The overall sentiment towards Bitcoin is still positive.

The Bitcoin Monthly by ARK Invest

All eyes on Fed’s rate decision

The recent surge might be driven by the anticipation of a Federal Reserve (Fed) interest rate cut. Market participants expect a potential 25-50 basis point reduction in rates at the Fed meeting next Wednesday, September 18.

The adjustment is supported by the recent inflation report, which came in at 2.5%, below expectations, and well on track toward the Fed’s 2% target.

The global context also reflects similar monetary easing, with the European Central Bank and the Bank of Canada recently lowering their rates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond