Bitcoin (BTC) Golden Cross Coming, Ethereum (ETH) Reclaims Bullish Trend, Binance Coin (BNB) Breaks 65-Day Resistance

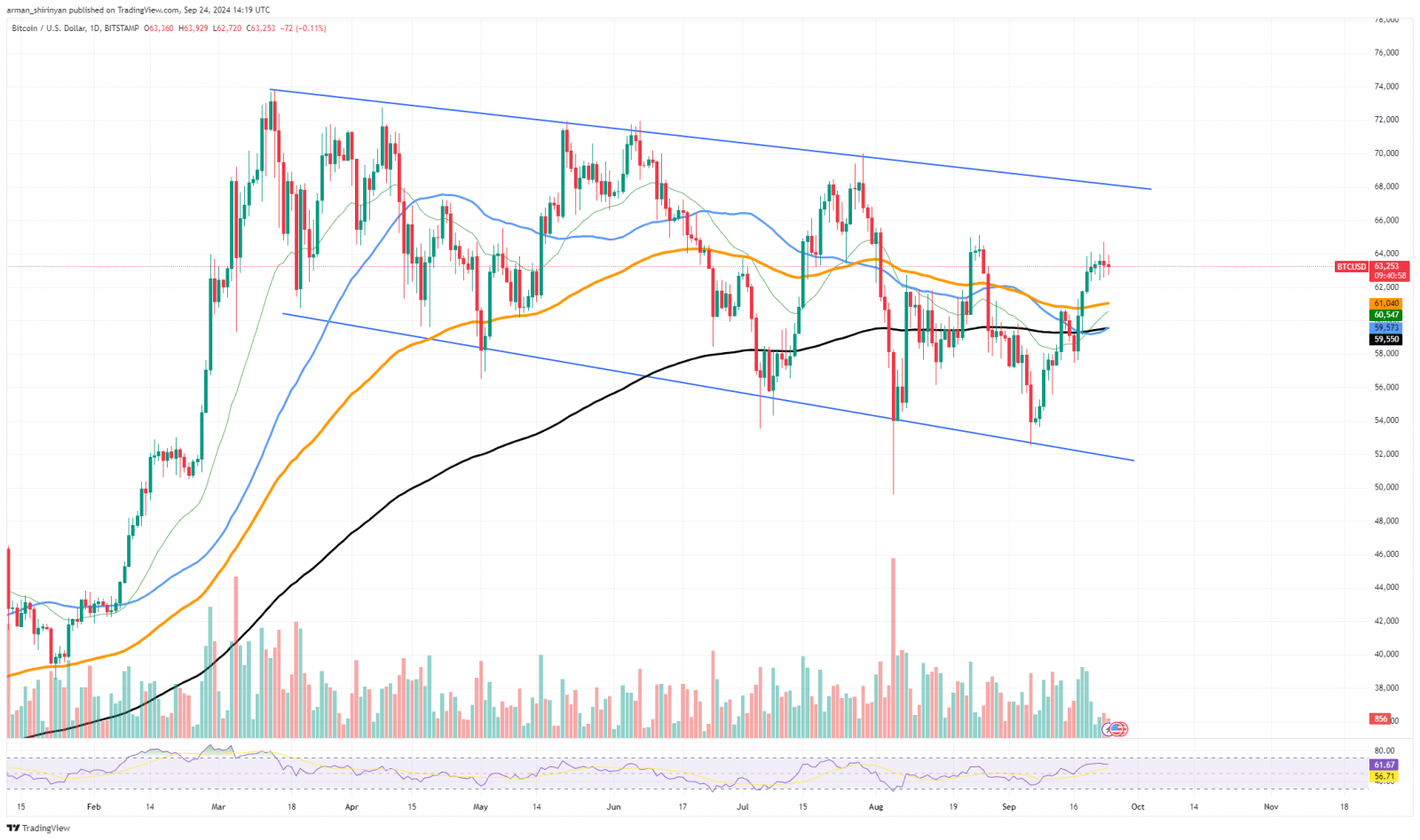

One of the most anticipated technical indicators on the cryptocurrency market, a golden cross is getting closer for Bitcoin. It is common to interpret this pattern — where the 50-day moving average crosses above the 200-day moving average — as a bullish indication of possible upward momentum.

Traders and investors are keeping a close eye out for this crossover, which could spark the next big rally, as Bitcoin is currently trading around $62,000. Technical indicators alone will probably not be enough to overcome the $65,000 resistance, though. A psychological barrier at the $65,000 level has proven difficult for Bitcoin to overcome in recent attempts.

To get past this obstacle, Bitcoin currently needs a new wave of market enthusiasm and momentum. In line with the 100-day EMA, the next level of support for Bitcoin is located at $60,500. When the price has tested this important level of stability in recent market downturns, it has provided support.

The $59,500 region, where buyers have regularly intervened to support the price, would be the next downside target to watch if BTC is unable to hold above this. While the approaching golden cross is a very bullish signal overall, an early breakout is not guaranteed. To push Bitcoin above the crucial $65,000 barrier, the market will still require outside influences such as heightened buying interest or encouraging macroeconomic news.

Ethereum looks up

As it continues to trade above the 50-day EMA, a crucial gauge of market strength, Ethereum (ETH) is exhibiting indications of a sustained bullish trend. ETH has maintained its upward momentum after surpassing this significant moving average; as of this writing it is trading at roughly $2,646.

This development is encouraging for Ethereum’s performance since it suggests that the market may be about to turn bullish again. The trading volume has been steadily declining, though, in spite of this technical success. This volume decline could be a sign of waning purchasing power, which begs the question of how long this upward trend can last.

In the near future, Ethereum might find it difficult to rise without the trading volume required to support additional expansion. A pullback to the $2,600 level seems likely given the state of the market. Ethereum could also enter a period of consolidation or sideways trading, as traders wait for more significant momentum.

Ethereum would probably trade in the range of $2,400 to $2,650, which would create a narrow range where price action could settle before making its next significant move. For buyers to step in if the price retraces further, the $2,500 level will serve as critical support during this phase. The asset will need a large volume boost to break through and attempt a further leg higher when Ethereum encounters resistance at $2,700 on the upside.

Binance moves forward

Finally, a 65-day resistance level that had been keeping Binance Coin (BNB) in a narrow range has been breached. Following multiple attempts to break through, BNB soared above $600, marking an important psychological and technical turning point. Although the breakout is encouraging, BNB appears to be lacking the necessary momentum to extend this rally without retracing.

BNB has had difficulty maintaining the upward momentum required to cross the $610 barrier, and it is currently trading at about $602. When trading volume seems to be leveling off following the initial surge, this level is the next resistance point, and failing to clear it could cause a pullback. BNB’s next support level is approximately $585, which coincides with the 50-day EMA.

This level is crucial to preserving the bullish structure that has developed if BNB does retrace. A break below this might indicate a longer correction, which could take BNB back to the $550-$560 region where the 100-day EMA offers stronger support. All the same, the breakthrough is still a good thing because it shows that BNB can overcome important resistance levels.

To continue rising, BNB will require a fresh wave of investor interest or a positive macroeconomic Catalyst, as the market as a whole is also beginning to slow. With the next significant target located around $650, traders should keep a careful eye on the $610 level as a sustained move above this resistance may pave the way for additional gains. Up until that point, the absence of momentum could keep BNB range-bound or cause a slight retreat.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom