Bitcoin Price May Drop Below $60,000 Due to Heavy Profit Taking

Bitcoin’s price has surged by 19% in the last few days, pushing it to $64,342. Despite this significant rise, the cryptocurrency is facing resistance at $65,000.

A key group of investors, known for profit-taking at this point, poses a potential threat to the continued bullish momentum. Bitcoin’s rally could reverse if selling pressure escalates, leading to a decline.

Bitcoin Investors Might Book Profits

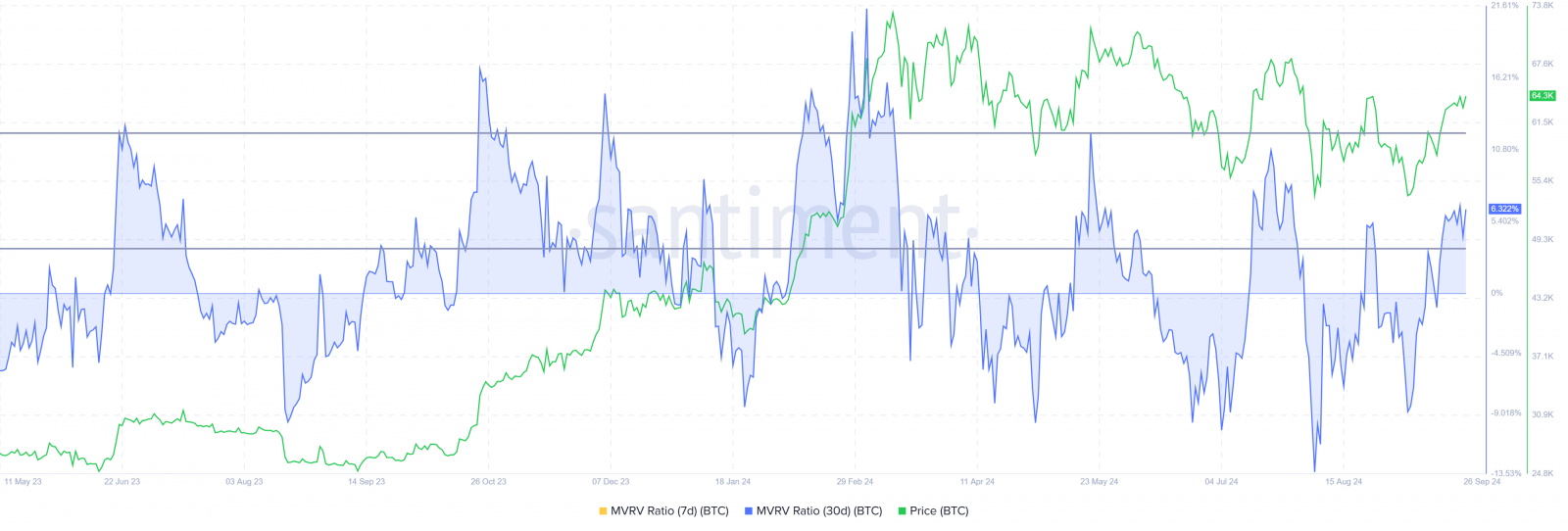

Bitcoin’s price is facing the threat of a correction, largely due to the potential of selling. Signs of the same can be noted in the Market Value to Realized Value (MVRV) Ratio.

A key indicator of profitability, this metric has reentered the danger zone after nearly a month. Bitcoin’s 30-day MVRV currently stands at 6.3%, signaling that investors are in profit.

Historically, when the MVRV Ratio ranges between 2% and 12%, it often triggers selling pressure, leading to corrections. Investors tend to lock in profits when this threshold is reached, which could lead to a decline in Bitcoin’s price.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin MVRV Ratio. Source: Santiment

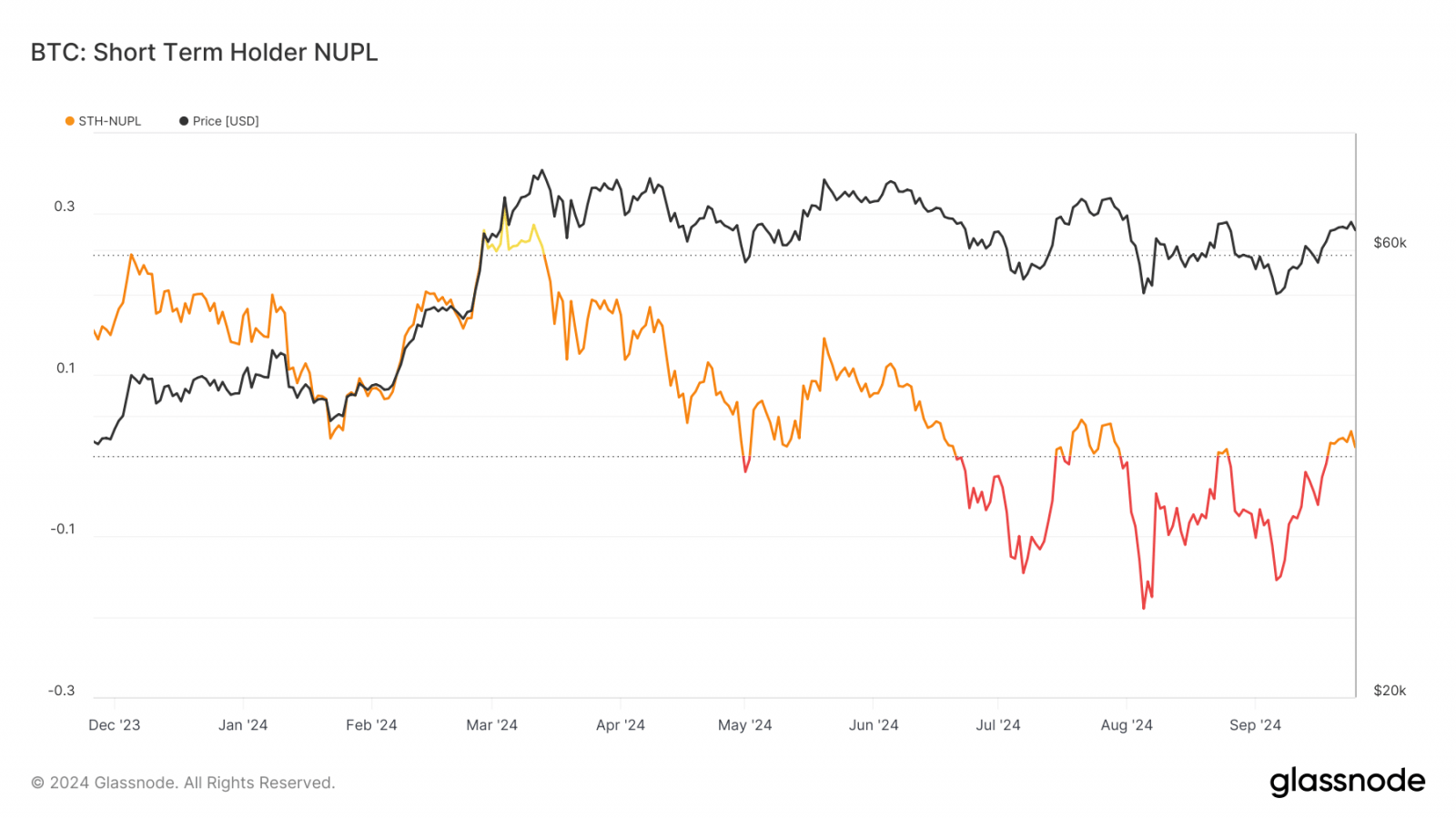

Another critical indicator, the short-term Net Unrealized Profit/Loss (NUPL), suggests that short-term holders are experiencing massive unrealized profits. This group of investors, known for holding assets for less than a month, is typically quick to sell once profits accumulate. The NUPL shows that the bullish momentum has reached a level where short-term holders are likely to start selling, increasing the risk of a price drop.

Short-term holders (STH) are expected to begin liquidating their positions as the bullish sentiment fades above the current threshold. Historically, when STH are in profit and above the threshold, they sell off their assets, putting downward pressure on Bitcoin’s price. This makes a potential decline in price highly likely if this trend continues.

Bitcoin STH-NUPL. Source: Glassnode

BTC Price Prediction: Fall Ahead

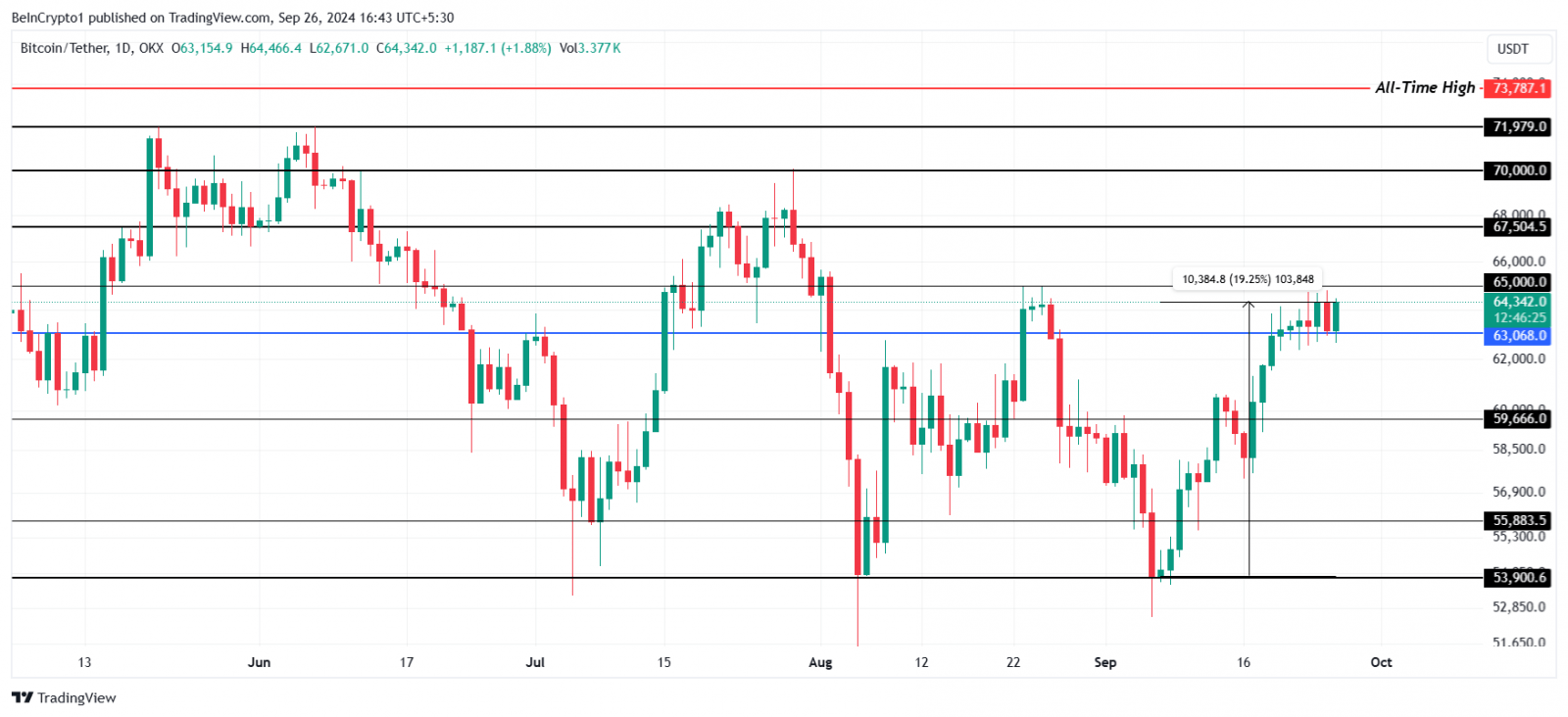

Bitcoin’s recent rise of 19% has brought its price to $64,342, with $63,068 now acting as crucial support. This level has established itself as a key area where Bitcoin could find stability if selling pressure increases. However, despite the recent gains, a breach of the $65,000 resistance level seems unlikely in the near term.

If profit-taking intensifies, Bitcoin could drop below the $63,068 support, potentially falling to $59,666, the next critical support level. This price floor may serve as a point for Bitcoin to bounce back if selling pressure weakens. However, failure to hold this support could lead to further declines.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Price Analysis. Source: TradingView

Conversely, if market optimism surrounding October continues, Bitcoin may have a chance to breach the $65,000 resistance. A sustained rise above this level would invalidate the current bearish outlook, potentially leading to further price increases and a continuation of the bullish trend.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  IOTA

IOTA  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy