LATAM Crypto Roundup: Nexo Joins Colombia Fintech Association, Worldcoin Expands to Guatemala, and More

Latin America (LATAM) continues to assert its growing importance in the global crypto ecosystem. In Colombia, Nexo has joined the Fintech Association, marking a significant step in its regional expansion. Meanwhile, Worldcoin is extending its World ID verification service to Guatemala, addressing digital identity issues in a world increasingly dominated by bots.

This article explores these developments and more, including crypto adoption surges in Bolivia and Brazil’s advancement in developing its central bank digital currency (CBDC).

Bolivia’s Crypto Transactions Surge Following Ban Lift

Bolivia has seen a rapid rise in cryptocurrency activity since its central bank lifted the long-standing ban on digital assets in June 2024. The Central Bank of Bolivia (BCB) reported 100% growth in crypto transactions over just three months. Between July and August, the average crypto trading volume in Bolivia soared to $15.6 million, doubling from the $7.6 million recorded in the first half of the year.

Stablecoins have emerged as the preferred choice for many Bolivians, offering an alternative for e-commerce and international transactions. BCB President Edwin Rojas highlighted the significance of this shift.

“The use of virtual assets is a favorable step towards modernization and economic integration with the world to strengthen international commercial and financial activities. Since the regulation came into force, the population has an alternative mechanism to process transfers to and from abroad and electronic commerce payments, among other activities,” Rojas stated.

Despite these gains, Deputy Mariela Baldivieso, a proponent of cryptocurrency, stresses that more work is needed. Bolivia still faces challenges, particularly in the areas of financial literacy and regulatory infrastructure. Baldivieso believes that with stronger education initiatives and clearer regulations, Bolivia could become a hub for crypto innovation in the future.

Worldcoin Expands Digital ID Services in Guatemala

Worldcoin continues its expansion in Latin America by launching its World ID verification service in Guatemala. As of September 25, Guatemalan users can use Worldcoin’s orb technology to verify their identity as humans, countering the growing concern over online bots. With a quick download of the World App and an appointment at one of the orb locations, users can ensure their online interactions are genuine.

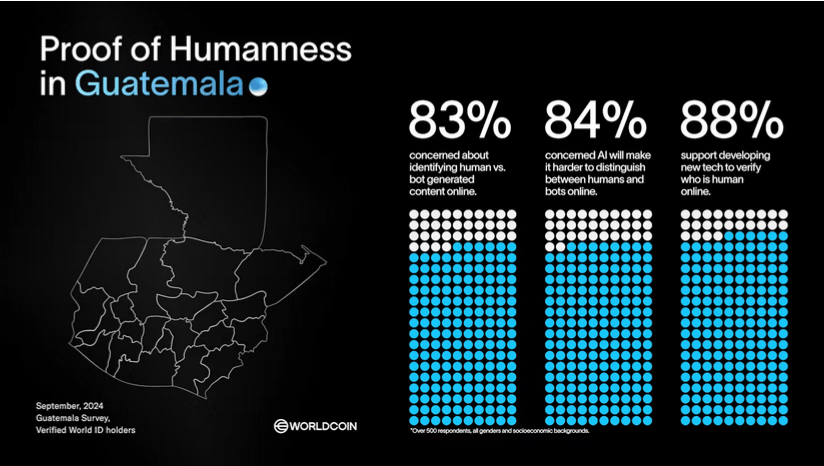

In a recent survey, 83% of Guatemalans expressed concerns about distinguishing between human-generated and bot-generated content online. The launch of World ID is seen as a solution to this issue, providing increased security and transparency in digital interactions.

Worldcoin’s Survey in Guatemala. Source: Worldcoin

Worldcoin’s expansion into Guatemala follows its previous launches in Ecuador and Mexico, where the technology has already gained traction. However, as Worldcoin grows in Latin America, it has sparked privacy debates in countries like Argentina, where concerns over biometric data protection have prompted regulatory discussions.

Nexo Eyes Growth in Colombia with Fintech Association Membership

On September 26, crypto lending platform Nexo officially joined the Colombia Fintech Association. This partnership enables Nexo to integrate into Colombia’s financial environment and offer digital asset solutions. Joining the association also enables Nexo to further engage with the local fintech community and explore synergies within the sector.

In a statement shared with BeInCrypto, Elitsa Taskova, Nexo’s Chief Product Officer, stated that the partnership with the Colombia Fintech Association reflects Nexo’s commitment to providing advanced digital asset solutions.

“Colombia presents a unique opportunity: with an astounding 92.1% of the population already having access to crypto-related services, the country is making a notable leap towards digital finance. […] We’re not just entering a market; we’re empowering millions of Colombians with accessible digital asset tools and shaping the future of finance in Latin America,” Taskova said.

These solutions meet the country’s growing demand for stablecoins and secure cross-border transactions. Over the past year, Nexo has observed a 73% rise in local clients using its crypto-yield products. Colombia’s interest in cryptocurrencies, particularly stablecoins, has been driven by remittances and a growing need for digital financial services.

Paraguay Develops World’s First National Blockchain to Push Sovereignty

Paraguay is making waves with the development of Legaledger, the world’s first third-generation blockchain network with national sovereignty. The Paraguayan Blockchain Chamber drives this initiative, aiming to provide secure blockchain-based solutions for the public and private sectors. These solutions encompass financial, civil, and military transactions.

Ricardo Prieto, the director of the Blockchain Chamber, explained that Legaledger is built on Hyperledger technology. It is designed to offer legal certainty in blockchain transactions, addressing concerns over security and fraud.

“Our blockchain network model is fractal. […] It can be implemented in a company, conglomerate, state, and country, with the same schematic design, and all would remain interoperable for the purposes of what we call sequencing, publication of the procedure or transaction, including international operations,” Prieto explained.

Through its sovereign blockchain model, Legaledger aims to position Paraguay as a global leader in blockchain governance and innovation. The organization plans to expand its solutions internationally by 2026.

Brazil’s CBDC Initiative DREX Enters Second Phase of Development

The Central Bank of Brazil is making progress with its CBDC project—DREX. The institution recently entered the second phase of its DREX pilot program. This phase focuses on 13 strategic projects that will test the viability of smart contract-based financial services.

“We will also test the use of assets not regulated by the Central Bank. To this end, we are working together with the Securities and Exchange Commission (CVM). Other regulators have also shown interest in testing operations with assets under their jurisdiction in order to expand the usability of the platform,” Fabio Araújo, Coordinator of the Drex Initiative and Consultant of the Department of Banking Operations and Payment System of Brazil’s Central Bank, elaborated.

The projects cover various sectors, including international trade financing, real estate transactions, and credit collateralized in public securities. Major financial players such as Bradesco, Itaú, and Santander are part of the consortium leading the development of DREX, which focuses on privacy and regulatory compliance.

Brazil’s push toward a CBDC is part of its broader strategy to modernize its financial infrastructure. The country plans to roll out more advanced digital solutions by mid-2025.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Stellar

Stellar  Monero

Monero  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD