Ethereum Technical Analysis: ETH Price Consolidates Amid Market Uncertainty

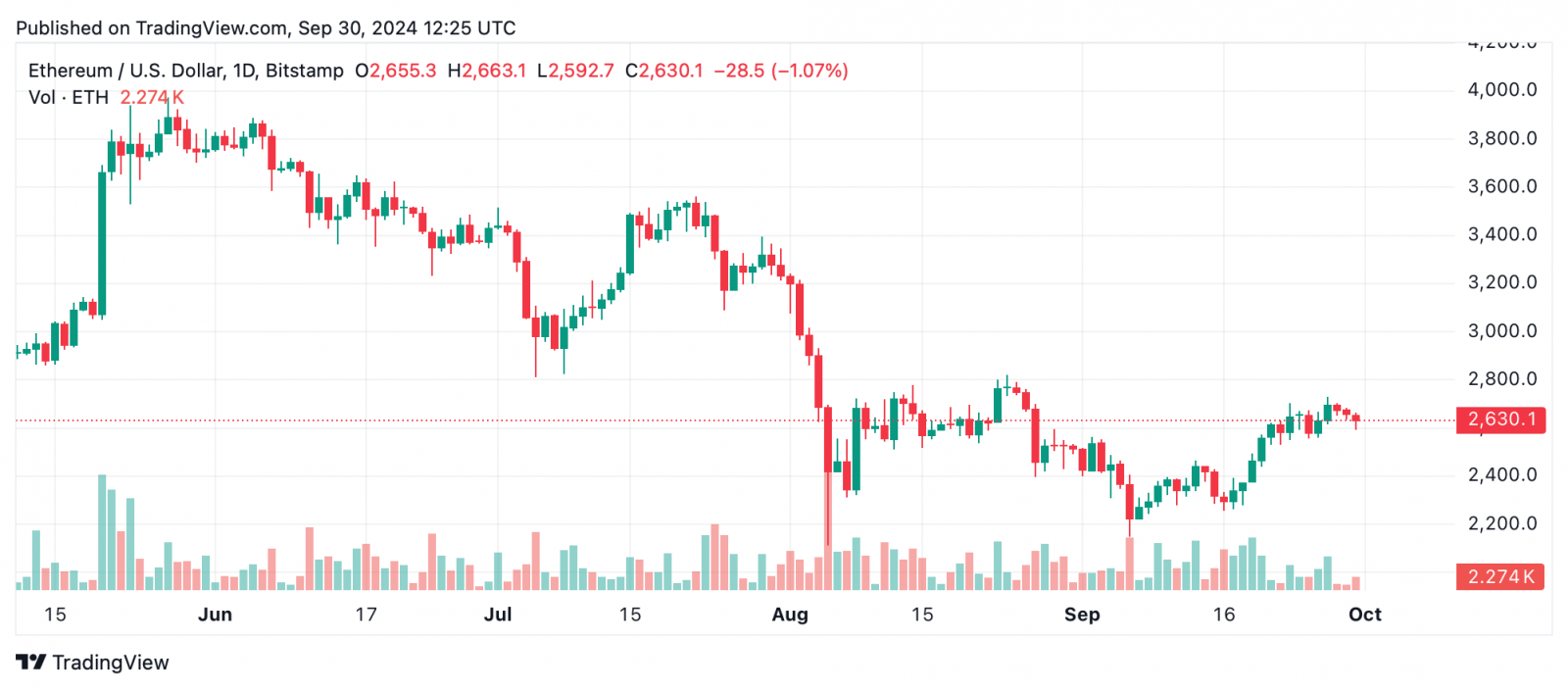

On Sept. 30, 2024, ethereum’s price showed consolidation near $2,630 after testing key support and resistance levels. The market exhibits mixed momentum, as oscillators point to neutrality while moving averages provide conflicting signals. Traders are closely watching whether the second leading crypto asset will break through resistance or test lower support zones, given the current indecision.

Ethereum

Ethereum’s 1-hour chart highlights recent price fluctuations, with the asset attempting to hold steady at around $2,630. After a drop to $2,591, buying volume spiked, reinforcing this level as significant short-term support. Despite the rebound, the current price action is marked by lower volume, signaling market hesitation.

The 4-hour chart reflects a slight downtrend, following ethereum’s recent high of $2,729. The price has since declined to the $2,620 region but shows no clear sign of breaking below key support levels. A consistent pattern of lower highs and lows points to potential selling pressure, with traders monitoring the $2,640 level closely. If ether holds this support and volume increases, a bounce toward $2,700 is possible, but failure could see the price retreat toward $2,600 or lower.

On the daily chart, ETH remains in an upward trend, moving from $2,149 to $2,729 over the past weeks. The market’s recent rejection near $2,729, coupled with bearish downturns on higher volume, suggests potential profit-taking. The price is currently testing support in the $2,650-$2,600 range. A sustained move below $2,600 could indicate the start of a deeper correction, but a rebound from this zone would confirm it as a solid entry point for long-term ETH traders.

Moving averages (MAs) provide conflicting signals. Short-term exponential moving averages (EMAs – 10, 20, 30, 50) are in a bullish posture, suggesting upward momentum remains intact. However, the longer-term moving averages, including the 100 and 200-period EMAs, signal bearish trends. The 200-day simple moving average (SMA), at $3,119, remains well above the current price, indicating the possibility of continued downward pressure unless ether can break through key resistance levels.

Oscillators are largely neutral, reflecting the market’s indecisiveness. The relative strength index (RSI) sits at 56, indicating neither overbought nor oversold conditions. Momentum indicators, like the awesome oscillator and the moving average convergence divergence (MACD), are mixed, with the latter flashing a buy signal while momentum shows a sell signal. This suggests that ethereum could consolidate further before making a decisive move, leaving traders waiting for clearer directional cues.

Bull Verdict:

Ethereum’s ability to hold above the $2,600 support zone, coupled with bullish short-term moving averages and a recent rebound from $2,591, suggests that upward momentum may resume. If buying pressure increases and ether breaks through the $2,700 resistance, a rally toward the recent high of $2,729 and beyond could unfold, making it a favorable environment for long positions.

Bear Verdict:

The bearish signals from longer-term moving averages and the rejection near $2,729 indicate caution. If ethereum fails to maintain support around $2,600, and momentum weakens further, a breakdown could lead to a deeper correction toward $2,500 or below. The current indecisiveness, combined with mixed oscillator readings, suggests traders should remain cautious of further downside risks

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Stellar

Stellar  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Zcash

Zcash  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Qtum

Qtum  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy