Ethereum (ETH) Price Eyes $2,600, Could Trigger $700 Million Short Squeeze

Ethereum’s (ETH) price is eyeing a significant rebound after losing nearly 9% of its value in the last seven days. As the altcoin builds momentum for the potential surge, shorts, who expect ETH’s price to keep decreasing, might face increased pressure.

In this analysis, BeInCrypto looks at the factors that could drive Ethereum’s value higher. It also highlights the possible impact on traders looking to profit from the cryptocurrency’s price movement.

Ethereum Targets Comeback, Shorts Under Pressure

In anticipation of “Uptober,” a term used to describe a bullish October, several analysts predicted that ETH could reach $3,000. But after a sorry start to the month, Ethereum’s price fell from $2,600 to $2,360, driving large-scale liquidation in long positions.

However, recent data shows that the table might be able to turn, and shorts might be at risk. One key metric forecasting this is Ethereum’s Coin Holding Time. This metric measures how long a coin has been held without being transacted or sold.

A decrease in holding time suggests that more holders are selling their assets, which typically signals bearish sentiment. Such activity often precedes downward price pressure, indicating that confidence in holding the coin may be waning.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

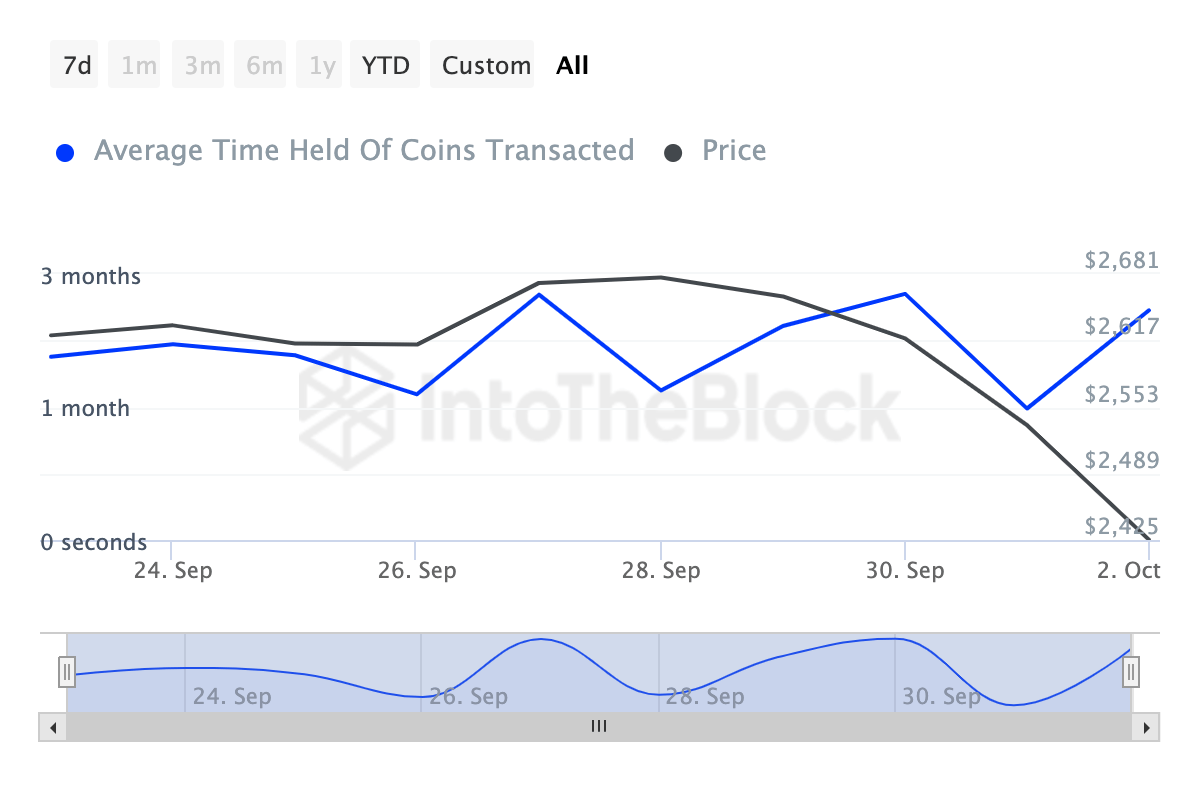

Ethereum Coins Holding Time. Source: IntoTheBlock

However, in this case, the Coins Holding Time has surged by 58% during the same period as Ethereum’s recent price decline. This increase is a bullish indicator for ETH, as it suggests that long-term holders are accumulating or maintaining their positions despite the price drop.

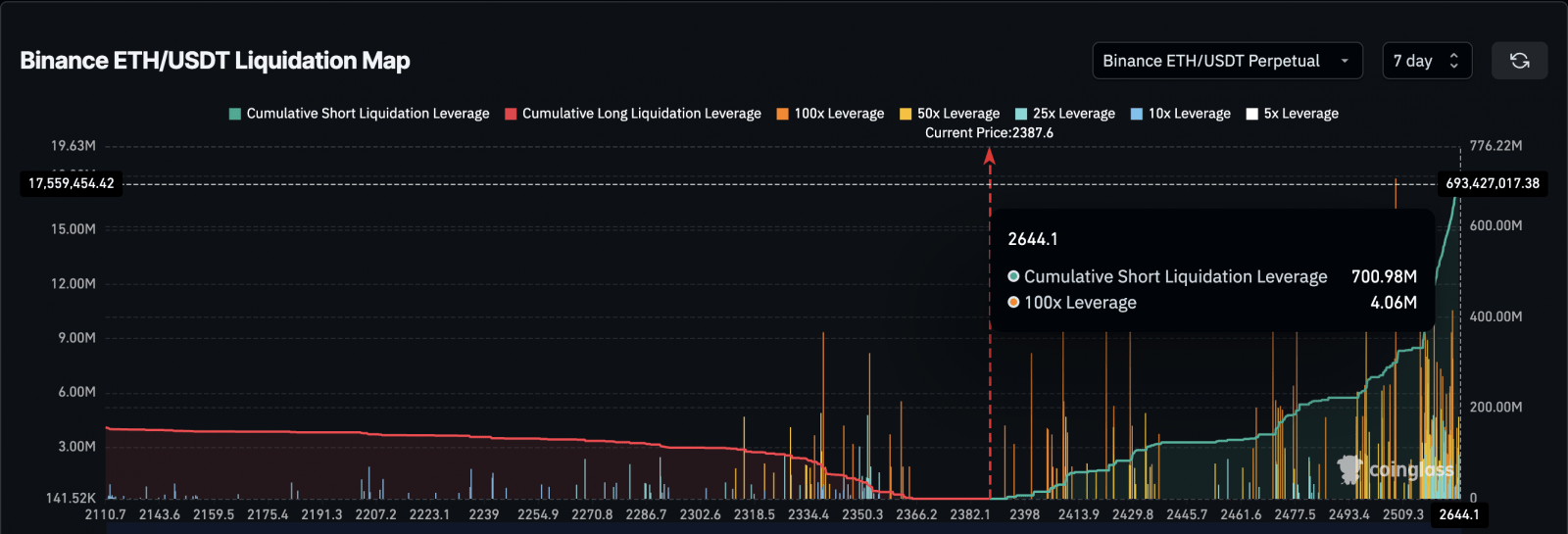

Such behavior could be crucial in helping the cryptocurrency recover and potentially erase some of its recent losses. If this continues, ETH’s price could jump toward $2,600. According to Coinglass, an increase to $2,644 could drive over $700 million in short liquidations

If validated, this development could also lead to a short squeeze. For those unfamiliar, a short squeeze happens when a cryptocurrency’s price moves significantly higher, prompting traders who bet on a decrease to close their positions.

Ethereum Liquidation Map. Source: Coinglass

ETH Price Prediction: Bull Market Could Return

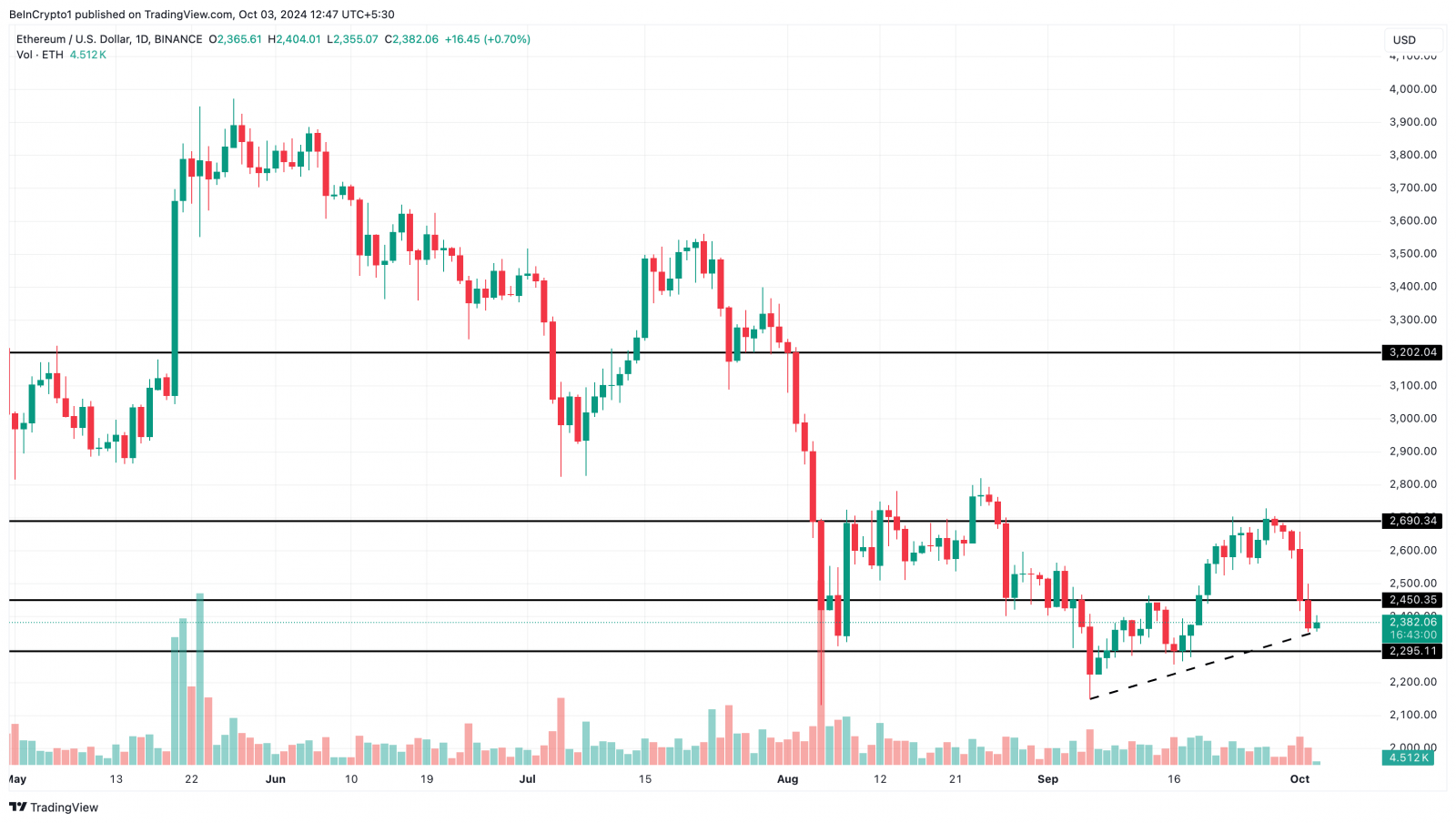

Despite ETH’s decline, bulls appear to be defending the price as the swing lows still formed an ascending line. As long as this stays the same, then it might not take a long period for ETH to rebound and resume its uptrend.

However, it is important to note that significant buying pressure is needed to bring this prediction to life. From the daily chart below, Ethereum’s price might climb to $2,450 if the uptrend line remains intact.

Should buying pressure intensify, the altcoin’s value could also climb to $2,690. In that scenario, Ethereum would no longer bid goodbye to the bull market, which could help drive the price toward $3,202.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Daily Price Analysis. Source: TradingView

On the other hand, a breakdown below the section trendline might invalidate this forecast. In that scenario, ETH’s price might drop below $2,300 to $2,295.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom