Bitcoin (BTC) Bear Market Here, Warns Peter Schiff, and Here’s Why

Peter Schiff, a well-known critic of Bitcoin, is once again sounding the alarm, claiming that the digital asset is in a bear market. Schiff notes that Bitcoin has underperformed dramatically when compared to gold, noting that since its peak almost three years ago, the price of the cryptocurrency has dropped by roughly 40%.

Schiff gives HODLers a direct message: Bitcoin’s ongoing difficulties may indicate that investors are failing to acknowledge the realities of the market. Schiff contends that although Bitcoin is presently holding above the crucial $60,000 support level, this is only a temporary state of affairs.

Schiff claims that the weakness of Bitcoin in comparison to gold is becoming more obvious as long as global macroeconomic conditions continue to place a significant burden on risk assets like Bitcoin. However, information gathered by Glassnode offers a more complex picture of the recent behavior of the Bitcoin market.

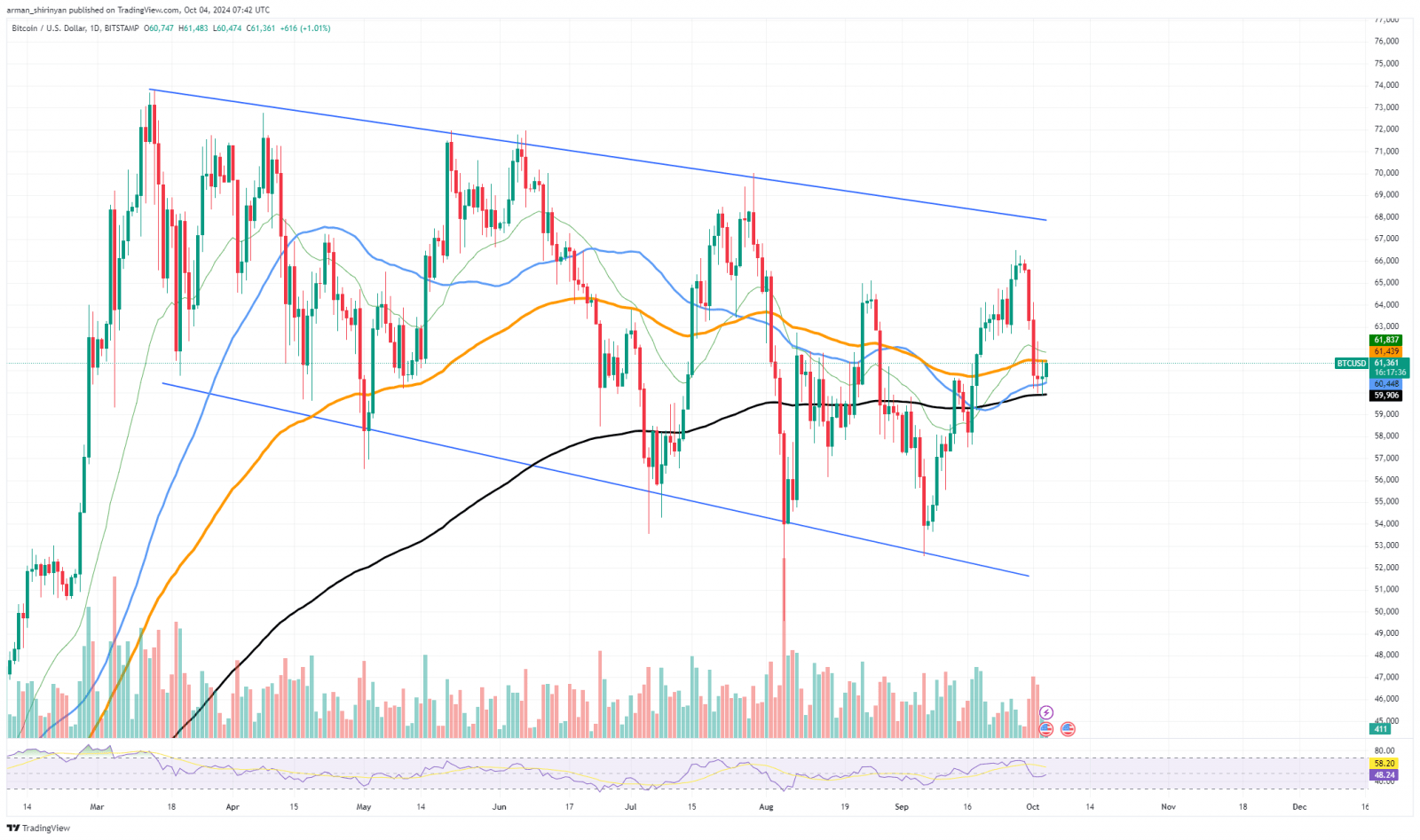

About 4-5% of all net capital inflows into Bitcoin since the beginning of January can be linked to U.S. spot ETFs. Given that the cost basis of these ETFs varies from $54,900 to $59,100, many institutional investors who made their initial investment in these funds are now getting close to the break-even psychological point.

There is a chance that investors looking to cut losses will start to sell Bitcoin if it falls below these levels. This paints a rather fragile picture for Bitcoin. Schiff is advising investors to reevaluate their bullish position even though the $60,000 support level has so far held firm. The larger trend is still unclear.

The pivotal points to keep an eye on are $59,000 below and $64,000 above. Bitcoin may enter even more bearish territory if it breaks below $59,000, but a rise above $64,000 might rekindle optimism for a wider rebound. As the saying goes, time is the best tool to determine who needs you the most, and only time will tell if anyone truly needs Bitcoin.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD