Should XRP Get Ready for Death Cross? Price Analysis

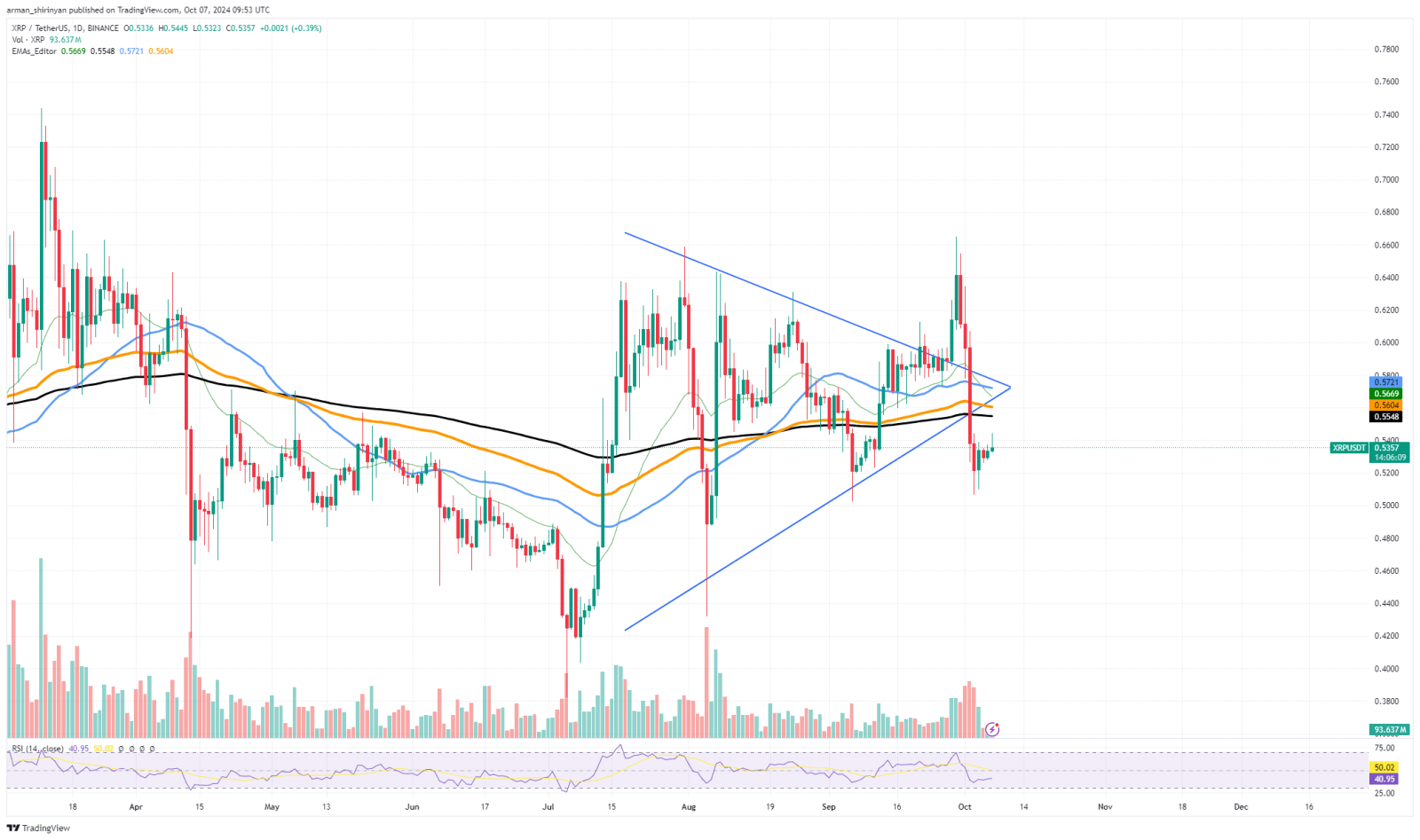

Technical analysts know that a death cross involving the 50-day and 200-day exponential moving averages (EMAs) is a bearish signal, and that is what XRP is facing. This predicament developed after XRP was unable to profit from a bullish breakout from the symmetrical triangle, a move that would have raised the price of the cryptocurrency.

Rather, the asset has undergone a substantial breakdown, and the EMAs are currently indicating a downward trend, which is paving the way for additional downside pressure. When the 200-day moving average crosses below the 50-day moving average, it forms a death cross, which is frequently interpreted as a sign of protracted bear markets.

Given the downward trends of both moving averages, XRP may be about to experience a longer-lasting decline. Recent trading sessions have seen a sharp increase in the selling volume, indicating that there is currently little-to-no buying support on the market.

Key price points

At the moment XRP is trading close to $0.54, which has emerged as a crucial resistance level. This price is in very close alignment with the downward-trending 100-day EMA. If XRP is unable to breach this barrier, it can be a sign of additional market weakness and a move lower for the asset.

One important area of support is at $0.50. A breach of this psychological barrier would intensify the bearish trend and might put more pressure on sellers. If XRP is unable to hold onto $0.50, the market’s negative sentiment could cause it to rapidly decline toward even lower levels.

The final line of defense is $0.46. At a lower level of historical support, or $0.46, is the location of the next significant support. A decline to this level would indicate that XRP has started a more serious correction, and as traders expect a long-term bearish trend, the death cross might lead to further downside pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom