MARA: Largest Bitcoin Miner on Wall Street Unlocks $200M BTC-Backed Credit Line

The biggest publicly listed Wall Street Bitcoin (BTC) miner, MARA Holdings (NASDAQ: MARA), has announced the acquisition of a $200 million line of credit. The credit facility is secured by a portion of the company’s crypto holdings, highlighting the growing trend of cryptocurrency-backed financing in the corporate world.

MARA Leverages Bitcoin Stack in $200 Million Credit Deal

The statement presented yesterday (Tuesday) by MARA doesn’t delve too deeply into details, only informing that the cryptocurrency miner used a portion of its substantial Bitcoin stack to secure a $200 million line of credit.

Fred Thiel, CEO, MARA, Source: LinkedIn

What will the funds be used for? Here too, no detailed information was provided beyond a general statement that “MARA may use the funds to capitalize on strategic opportunities and for other general corporate purposes.”

It’s worth noting that MARA, known as Marathon Digital Holdings until August, is the largest BTC producer listed on Wall Street, with a current market capitalization of nearly $5 billion. It significantly outpaces Core Scientific, which is in second place with a value of $3.3 billion.

The move comes a few months after MARA decided to purchase Bitcoin for $249 million. In August, it successfully completed a $300 million offering of convertible senior notes, most of which was allocated to buying BTC.

MARA is currently the second-largest public holder of Bitcoin, right behind MicroStrategy. According to Bitbo data, it holds 0.12% of the total BTC supply, or nearly 26,000 tokens, with an estimated value of almost $1.8 billion.

Source: Bitbo

MARA Stock: Potential for a 50% Rebound According to Macquarie

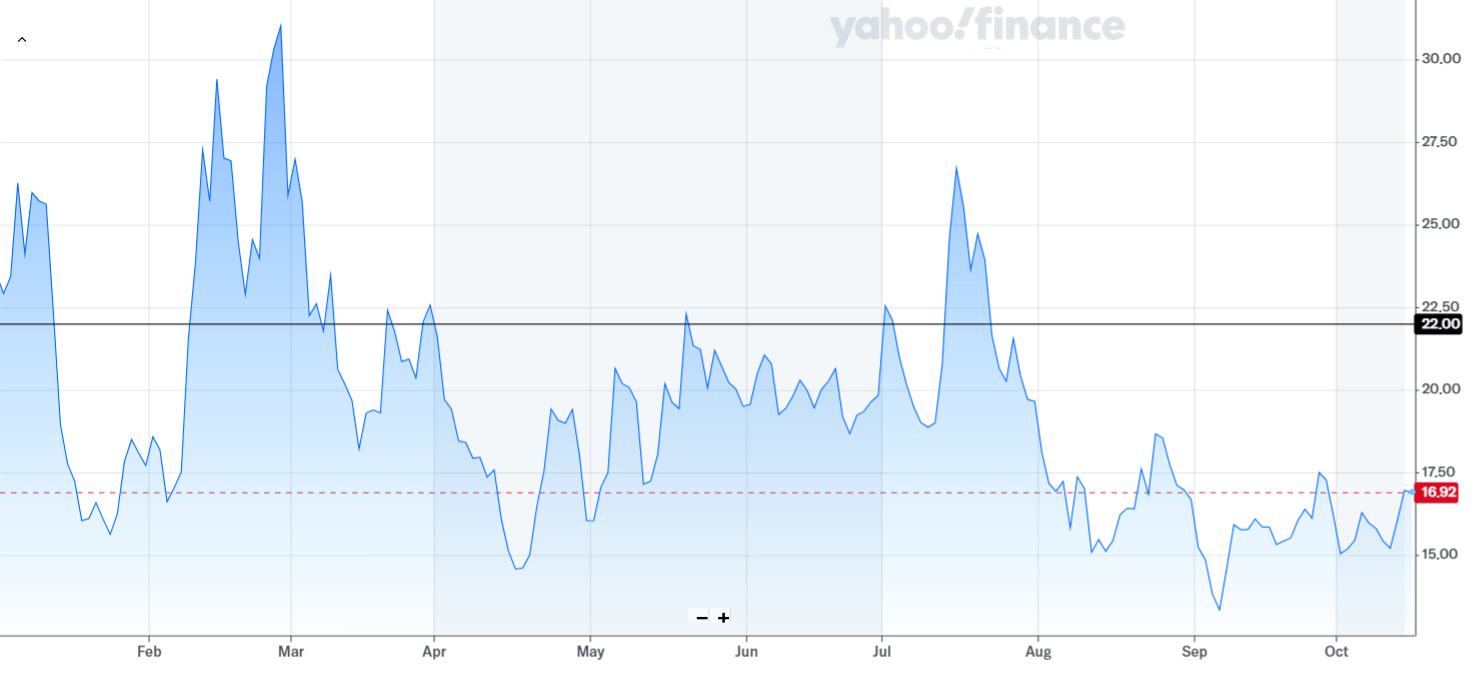

Despite the recent rebound in Bitcoin’s price, which is returning to around $68,000 this week and has grown by 60% in 2024, MARA shares haven’t given holders as much joy. Year-to-date, they’re down 28% and tested nearly year-long lows in September.

However, the latest report from financial group Macquarie suggests that this situation may soon change. The firm initiated coverage of the company’s shares with an “Outperform” rating and claims that its move towards artificial intelligence (AI) and high-performance computing (HPC) could lead to a 50% increase in valuation. Macquarie’s current price target for MARA shares is $22, the highest since July.

Source: Yahoo Finance

Wall Street Bitcoin Miners Move to AI and HPC

MARA is at the forefront of a trend among Bitcoin miners, which involves seeking new sources of income from their massive data centers (so-called mines) in the face of growing competition and difficulties in the mining sector, while industry margins are declining.

While MARA has not made any official announcements regarding a shift towards AI, recent changes in leadership suggest a potential move in this direction. The company has bolstered its Board of Directors with new appointments, including individuals with significant experience in artificial intelligence and data center operations.

VanEck’s head of digital assets research, Matthew Sigel

Industry analysts are taking note of the potential for Bitcoin mining companies to pivot towards AI and high-performance computing. Matthew Sigel, head of digital assets research at VanEck, projects that this strategic shift could generate substantial value for mining firms in the coming years.

Sigel points out the synergy between AI companies’ energy needs and Bitcoin miners’ access to power resources, stating, “AI companies need energy, and Bitcoin miners have it. As the market values the growing AI/HPC data center market, access to power—especially in the near term—is commanding a premium.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Bitcoin Gold

Bitcoin Gold  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Lisk

Lisk  Huobi

Huobi  Waves

Waves  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond