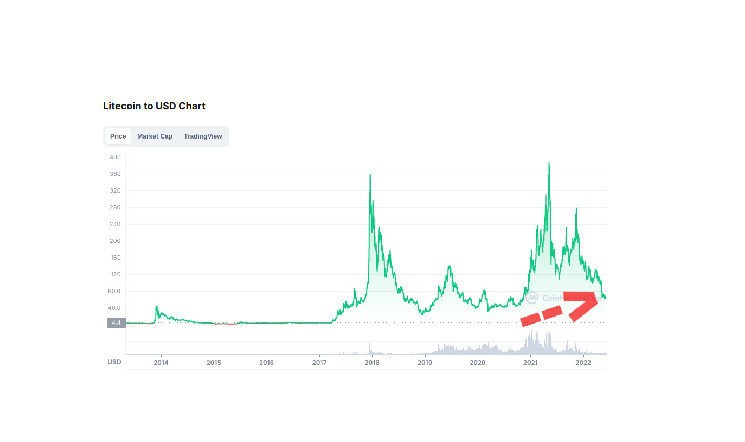

These Litecoin Metrics Surge to Monthly Peaks as LTC Price Rises Above $70

Litecoin experienced a mini-run, with the price surging above $73 for the first time since July. Over the week, the crypto asset attracted 12% in gains.

This marks its first notable breakout from Bitcoin and altcoins since the spring.

Litecoin Poised for a Comeback?

According to Santiment’s latest analysis, two key factors appear to be fueling this bullish trend in Litecoin.

Litecoin is enjoying a nice mini run, jumping above $73 for the first time since July. This is its first mid-sized breakout from Bitcoin and altcoins since the spring. Two major factors are:

⚡️ LTC’s continued rise of on-chain transaction volume, which has nearly crossed $4B… pic.twitter.com/oSKt7mRC2L

— Santiment (@santimentfeed) October 17, 2024

First, Litecoin’s transaction volume neared $4 billion this week, its highest level since June 3, 2023. Secondly, social dominance is also on the rise, with 1.08% of all cryptocurrency discussions now related to Litecoin, the highest since April 1, 2024.

This spike in both price and engagement indicates a growing interest in Litecoin, driven by its increased network activity and a renewed focus from retail traders.

In tandem with its price surge, Litecoin recently celebrated its 13th anniversary on October 7th, having completed a record-breaking 77 million transactions this year.

Litecoin, which once held a prominent position among the top 10 cryptocurrencies, now ranks as the 26th largest digital asset with a market cap of $5.41 billion, as per data compiled by CoinGecko. Despite this dip in its ranking, Litecoin appears poised for a comeback.

Could Litecoin’s Resurgence Attract Institutional Investors?

Driving this momentum is the potential institutional demand that has prompted Canary Capital Group to file for a Litecoin ETF. Canary Capital Group is a newly established investment firm focused on digital assets and was founded by Steven McClurg, a former co-founder of Valkyrie Funds.

The firm recently filed the first Form S-1 for the same with the US Securities and Exchange Commission (SEC). If it secures approval, the ETF will provide direct exposure to Litecoin for both institutional and retail investors.

While talking about LTC’s potential for institutional adoption, Canary Capital told Fox Business that,

“As one of the longest-running blockchains with 100% uptime since its inception, Litecoin has demonstrated a proven track record of security and reliability with significant enterprise-grade use cases. With its strong foundation, Litecoin continues to play a leading role in the broader cryptocurrency ecosystem, which Canary believes could make it attractive to a wider range of institutional investors”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Polygon

Polygon  Tezos

Tezos  NEO

NEO  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy