DOGE, APE, DIA: Top cryptocurrencies to watch this week

The global crypto market cap added $140 billion, spiking 6.3% to close the week above a two-month peak of $2.35 trillion.

Bitcoin (BTC) championed the recovery, breaking past $68,000 and sparking a strong rally across the altcoin market.

Here are some of the assets that leveraged this rebound campaign and how they performed:

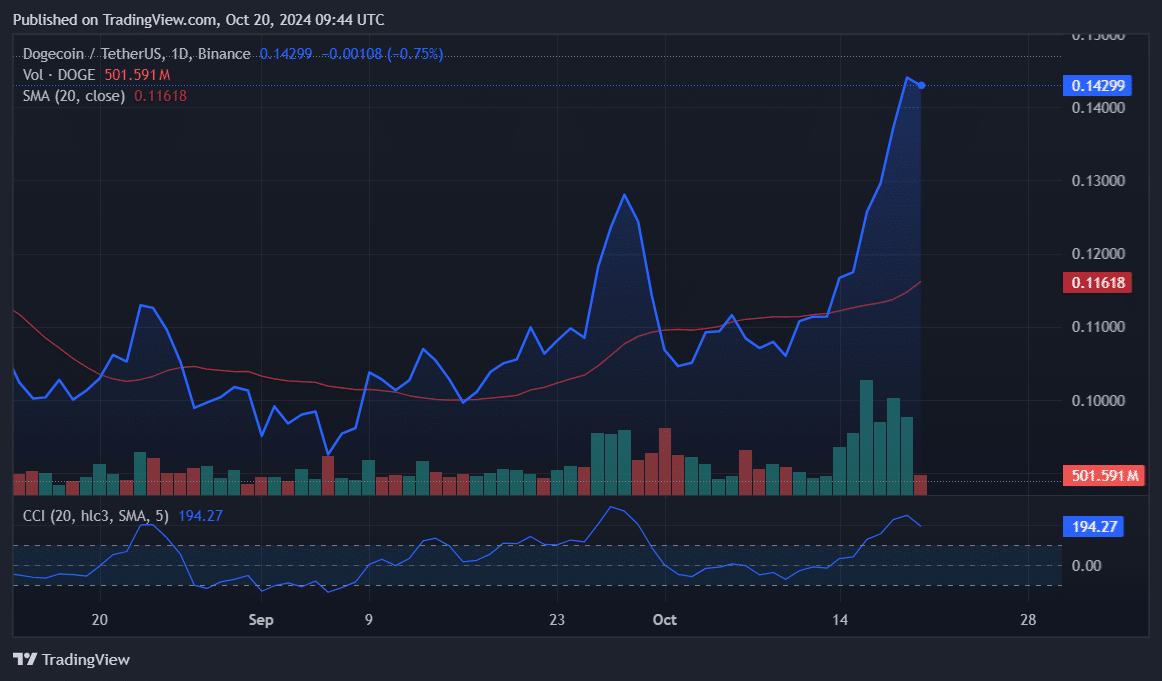

DOGE records seven straight intraday gains

Dogecoin (DOGE) was one of the biggest beneficiaries of the market recovery last week, recording seven consecutive days of gains throughout the week.

DOGE 1D chart – Oct. 20 | Source: crypto.news

The dog-themed meme coin closed the week at a four-month high of $0.144, having gained 27%. This marked Dogecoin’s best weekly performance since late February during the broader meme coin market rally.

However, the latest uptrend has faced a roadblock, following a spike in the Dogecoin CCI to 247. If this week introduces bearish pressure, DOGE would need to hold above $0.137 to avoid the 20-day SMA support at $0.116.

You might also like: POPCAT rally cools, WYAC and PHIL meme coins pump double digits

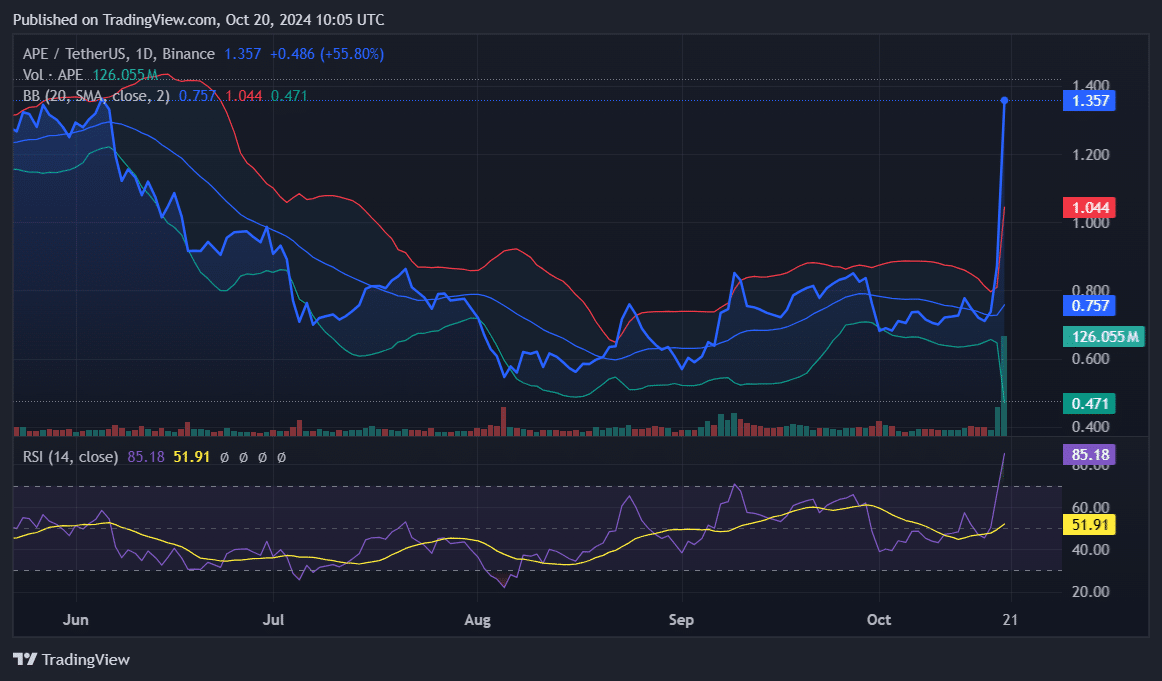

APE spikes 54% on mainnet launch

Despite underperforming throughout last week, ApeCoin (APE) engineered a last-minute rally that saw it close the week at $0.87 amid a 20% gain.

APE 1D chart – Oct. 20 | Source: crypto.news

This upsurge was mainly due to the mainnet launch of ApeChain, the project’s blockchain, yesterday.

Ok degens, the official bridge is https://t.co/aC2RId37gn

For the love of god @apecoin tweet this out on it’s own and pin it somwhere 🫡

You degens are already bridging like crazy and sending shitters nonstop, this is fun, can’t even imagine tomorrow with @Toptrader_xyz live 😂 pic.twitter.com/iOWHN80ppL

— ApeCoin (@apecoin) October 19, 2024

After breaching $0.92, APE faced major resistance at the upper Bollinger Band yesterday. However, the uptrend resumed in the new week, with APE surging 54% to breach the $1 mark for the first time in four months.

Meanwhile, its RSI has crossed into overbought territories at 85. This position suggests the rally might face exhaustion without renewed buying pressure. A drop below $1 could lead to steeper declines.

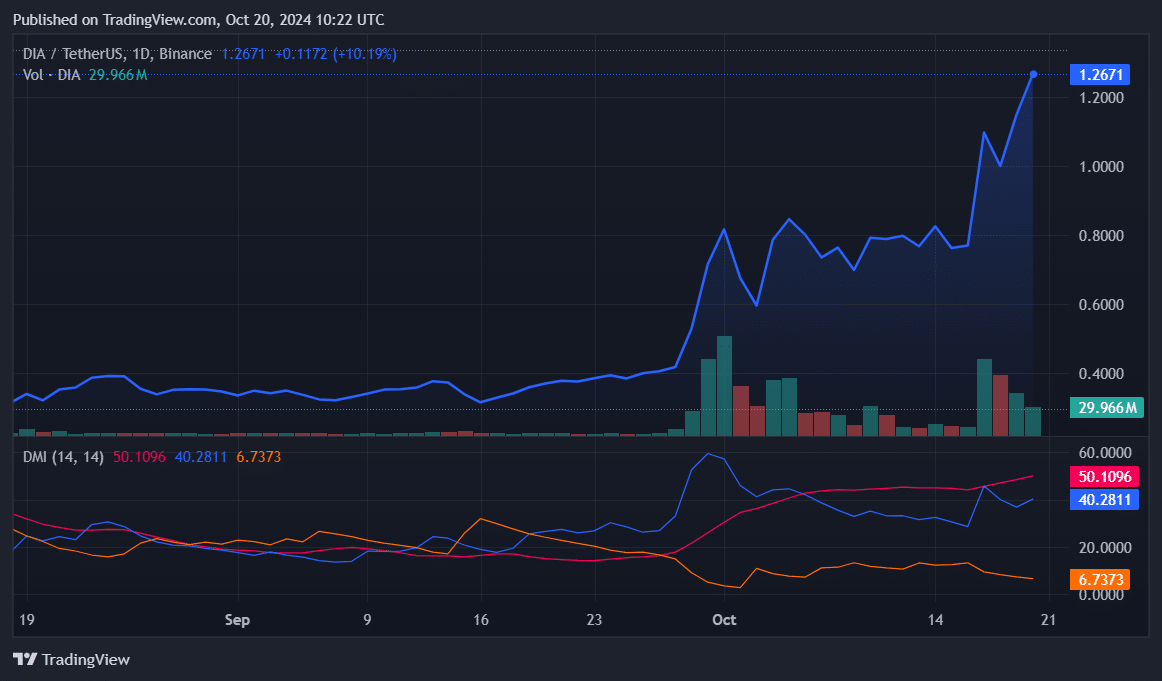

DIA hits 32-month peak

DIA (DIA) began the week bearish, but recovered to outperform most assets. After a mixed performance, DIA spiked by a massive 42% on Oct. 17, reclaiming $1 for the first time in two years.

DIA 1D chart – Oct. 20 | Source: crypto.news

Following an 8% correction the next day, DIA resumed the uptrend, gaining by another 14% on Oct. 19. This allowed it to close the week with a 44% gain, trading at a high last seen 32 months ago. Its monthly volume has spiked to 716 million DIA, the highest in history.

Meanwhile, the token’s +DI has spiked to 40.28, confirming immense bullish momentum. The ADX at 50.19 suggests that the push is especially strong. However, this could also indicate an overextension of the rally, with a correction looming.

Read more: Bitcoin ETFs surpass $2.1b weekly inflows, whale accumulation mirrors 2020 rally

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD