Fantom (FTM) Eyes 25% Surge as Whales Lead $160 Million Buying Spree

Although Fantom (FTM) ‘s price has increased by 20% in the last 30 days, the altcoin’s value could move higher. This prediction is based on the large-scale accumulation it has faced in recent times.

Earlier today, FTM’s price approached $0.80 but has retraced to $0.76. This on-chain analysis explains why the setback is temporary and how the token could soon surpass the peak it hit in May.

Fantom Whales Scoop Up 210 Million Tokens

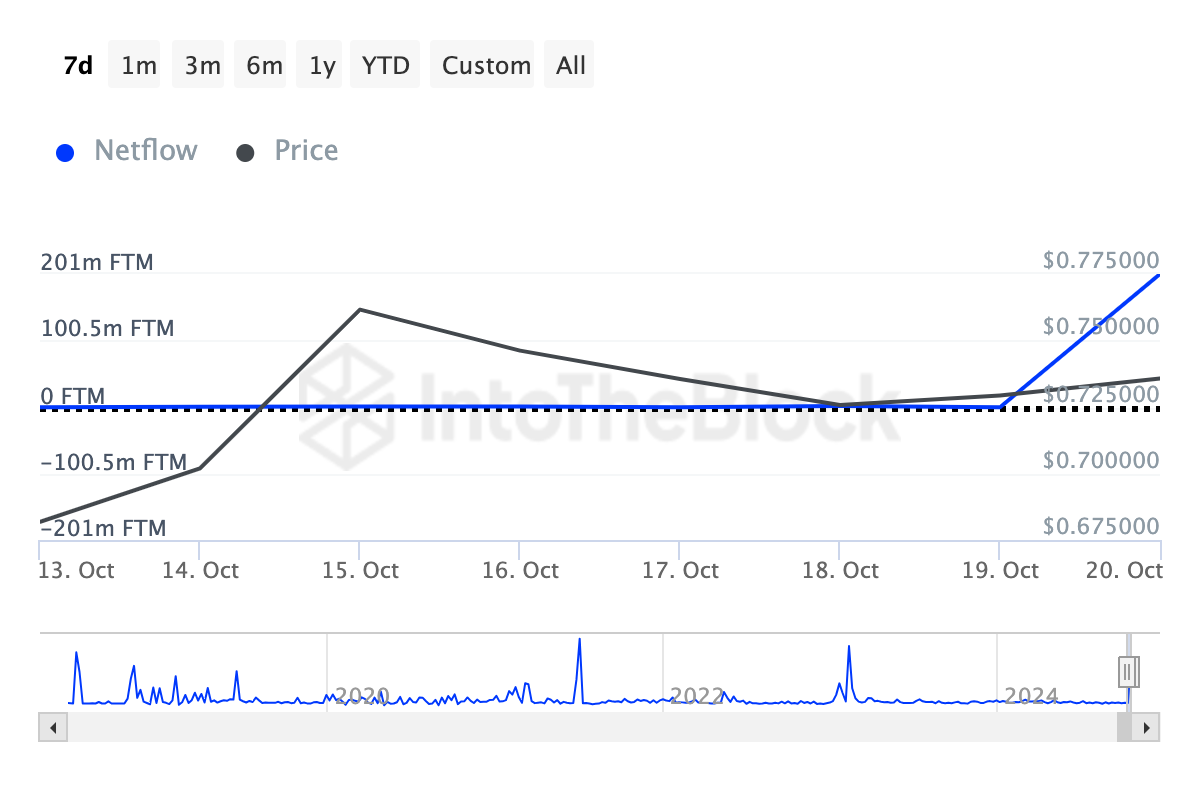

Initially, on October 19, the netflow was negative, signaling that most crypto whales were selling more FTM than they were buying. However, as of now, the netflow has risen to 201 million, which indicates a shift in sentiment and could be a bullish signal.

Large holder netflow tracks the activity of addresses buying and selling around 1% of the total circulating supply. When the netflow is positive, it indicates that whales have bought more tokens than they sold, typically signaling a price increase.

Conversely, a decline in this metric suggests that more tokens were sold than bought, usually leading to a price drop. Therefore, the recent positive netflow suggests that whales have accumulated approximately $160 million in FTM, based on its current price.

Read more: How to Add Fantom to MetaMask: A Step-by-Step Guide

Fantom Coins Holding Time. Source: IntoTheBlock

However, crypto whales are not the only ones expressing a bullish outlook. An analysis of the coin’s holding time shows a significant increase over the past seven days. Holding time refers to the duration a coin is held without being transacted or sold.

A decrease in holding time suggests that holders are selling. In contrast, the current trend indicates that several FTM addresses are holding onto their assets, which could exert upward pressure on its price if this behavior continues.

Fantom Coins Holding Time. Source: IntoTheBlock

FTM Price Prediction: Target to Close In on $1

On the daily chart, FTM reached $0.76, finding support at the $0.70 level. However, bears prevented the price from breaking the overhead resistance at $0.88. Despite this minor pullback, a significant correction appears unlikely.

This outlook is backed by the Chaikin Money Flow (CMF) indicator, which tracks accumulation and distribution. A declining CMF signals heavy distribution, potentially leading to a price drop. In Fantom’s case, the CMF has been steadily rising, suggesting ongoing accumulation.

Read more: Top 4 Crypto Passive Income Ideas That Really Work in 2024

Fantom Price Analysis. Source: TradingView

If this trend holds, FTM could climb by 25%, reaching $0.95 in the short term. However, if the price falls below the $0.70 support, it could trigger a deeper correction down to $0.63.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom