Ethereum price prediction: risky pattern points to a breakdown

Ethereum price remains in a deep bear market, continuing to underperform other top cryptocurrencies like Tron, Bitcoin, and Solana. The ETH token was trading at $2,500 on Monday, a few points above last week’s low of $2,385. It has dropped by almost 40% from its highest level this year, giving it a market cap of $300 billion.

Ethereum sluggish ETF inflows

The first reason why Ethereum price has remained in a bear market is because of the ongoing sluggish demand of ETFs from institutional investors.

Ethereum ETFs have had cumulative outflows of $504 million, bringing the total assets to $6.8 billion. Before the ETF approvals, the Grayscale Ethereum Trust (ETHE) had over $10 billion in assets.

Blackrock’s ETHA has $1.09 billion in assets, while Grayscale’s ETHE now has $3.95 billion. Fidelity’s FETH has $423 million, while Bitwise’s ETHW has $241 million.

In contrast, Bitcoin ETFs are firing on all cylinders, with cumulative inflows of almost $22 billion. They all now hold over $65 billion in assets, a sign that investors are more comfortable holding them.

Read more: Bitcoin price prediction: 4+ reasons BTC could go parabolic

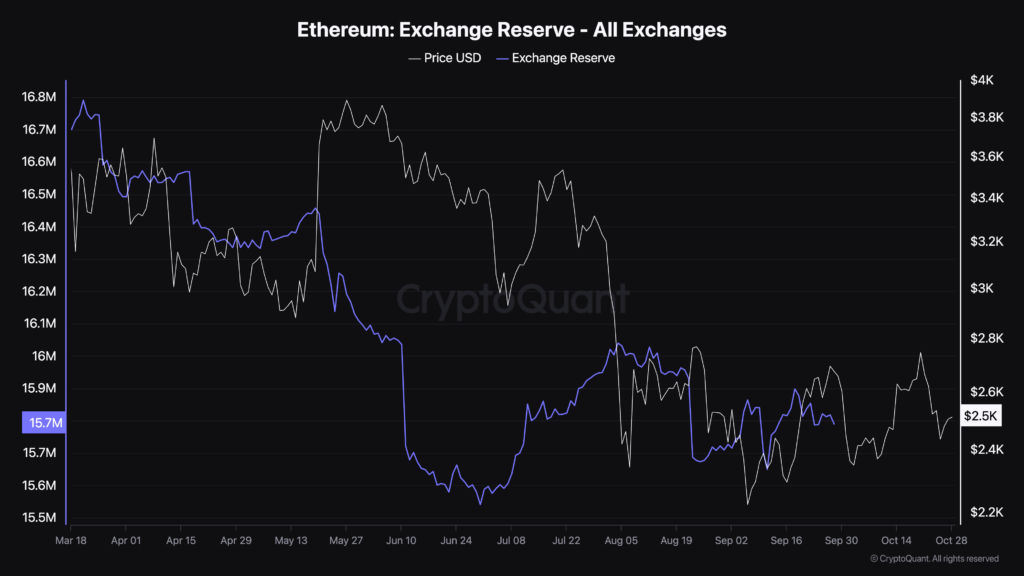

ETH exchange reserves have risen

The other important reason why Ethereum price has struggled is that the amount of coins in exchanges has risen in the past few months. Data by CryptoQuant shows that the amount has risen from 15.4 million in July to over 15.8 million.

A big increase in the amount of Ethereum in exchanges is a sign that many holders are starting to sell their coins. Some of the most prominent sellers were the likes of Vitalik Buterin and the Ethereum Foundation, who have deposited thousands of coins to exchanges in the past few months.

There are signs that many investors have started to sell their coins. For example, data by Bybit shows that a user deposited Ethereum worth $44.8 million coins to Coinbase on Monday morning. Another user deposited coins worth $750k, while another one moved coins worth $33 million on Saturday.

Ethereum is losing market share

The other important reason why Ethereum price has underperformed the market is that it has continued to lose market share across all sectors.

First, on stablecoins, it has lost its share to Justin Sun’s Tron, which has now become the biggest mover of Tether, the biggest stablecoin in the industry. Data by TronScan shows that the network had a Tether trading volume of $34 billion on Sunday. In most cases, the figure is usually much higher than that.

Second, Ethereum is no longer the favorite platform among developers because of its slow speeds and high transaction costs. A good example of this is in the meme coin industry, where Solana has become the best chain for that.

As a result, meme coins like Bonk, Popcat, and Cat in a Dog World have attained a $1 billion+ market cap. All Solana meme coins have a market cap of over $11.2 billion, a figure that may continue growing.

Third, data shows that Ethereum is not the favorite chain for DEX traders. According to DeFi Llama, Solana’s DEX transactions jumped by 20% in the last seven days to $15.7 billion, while Ethereum’s dropped by 0.20% to $8.8 billion.

Ethereum could lose more share when Uniswap, the biggest DEX in its ecosystem launches Unichain, its layer 2 network.

Additionally, Ethereum has lost market share in industries like Decentralized Public Infrastructure (DePIN) and Non-Fungible Tokens (NFT).

Ethereum price forecast

Ethereum price chart by TradingView

The daily chart shows that the ETH price formed a double-top pattern around the $4,000 level. It then moved below the neckline at $2,810, its lowest point on May 1, and the 50% Fibonacci Retracement point.

Ethereum also formed a death cross pattern as the 50-day and 200-day Weighted Moving Averages (WMA) crossed each other.

Worse, the token has formed a bearish pennant pattern, a popular bearish sign. In most periods, this is one of the most bearish signs in the market.

With the triangle part of the pennant nearing its confluence, there is a likelihood that it will have a bearish breakout soon. If this happens, Ethereum could drop to the next key support at $2,000, its lowest point in August.

The post Ethereum price prediction: risky pattern points to a breakdown appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom