Ethereum (ETH) Long-Term Holders Eye $3,000 Amid Growing Optimism

Long-term Ethereum (ETH) holders have displayed strong confidence in the cryptocurrency’s potential for continued price growth, especially compared to short-term investors. BeInCrypto noted this trend after analyzing market sentiment using on-chain data.

This sentiment could be linked to ETH’s recent resurgence, which has pushed its price above $2,600. However, the key question remains: will Ethereum’s value keep climbing?

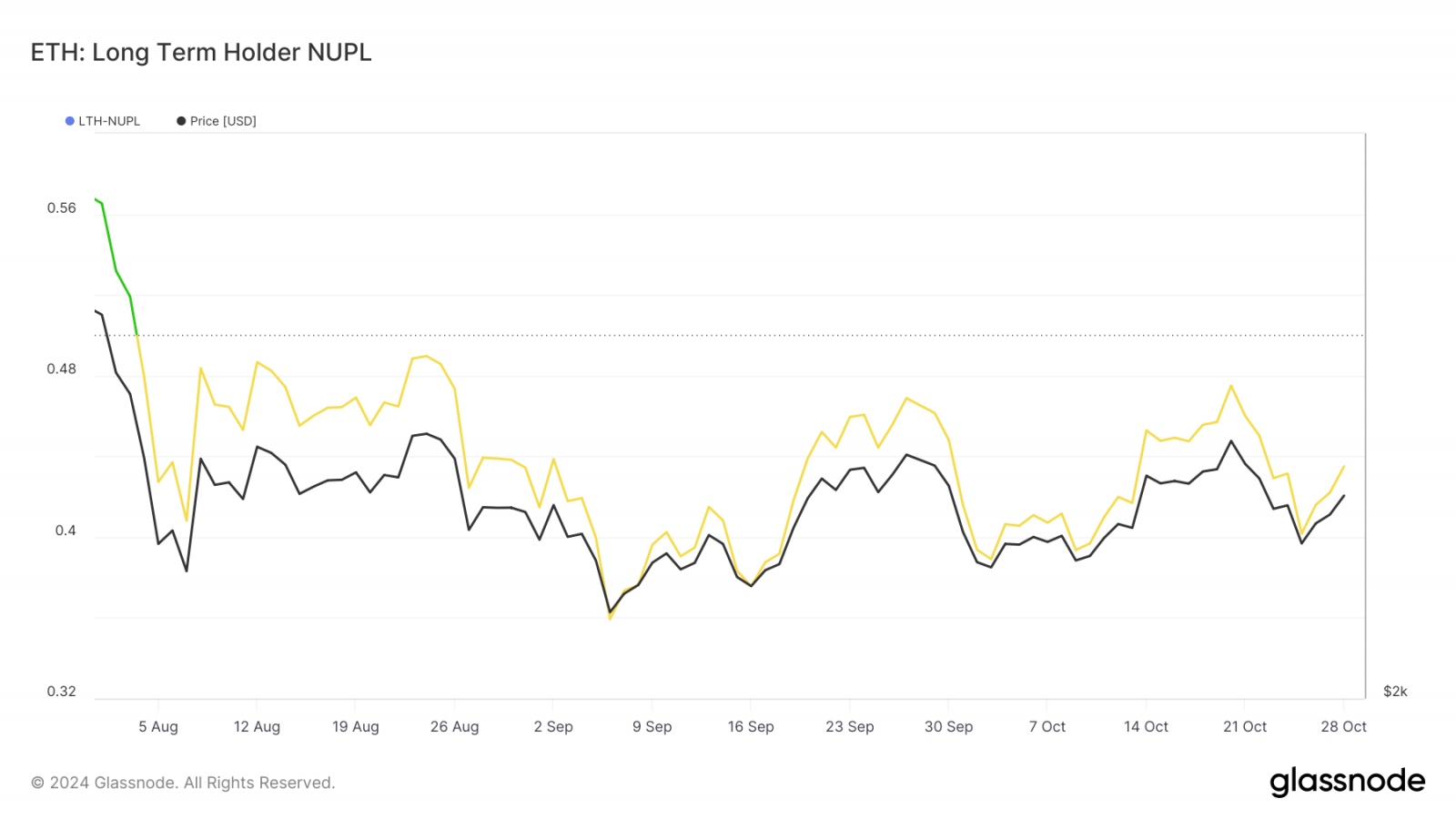

Ethereum LTH-NUPL Suggests Growing Confidence

In August, Ethereum’s Long-Term Holders Net Unrealized Profit/Loss (LTH-NUPL) positioned in the “belief zone” (green). The LTH-NUPL metric assesses the sentiment of investors who have held onto their ETH for at least 155 days, gauging their unrealized profits or losses.

This zone suggests that long-term Ethereum holders are confident of sitting on more unrealized gains. After ETH’s price dropped below $2,400 in early October, the sentiment shifted to be bearish.

Since ETH climbed above $2,600, the LTH-NUPL has shifted into the “optimistic” (yellow) zone. This change indicates that holders are experiencing solid unrealized gains, which can boost market sentiment and encourage further accumulation.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Ethereum LTH-NUPL. Source: Glassnode

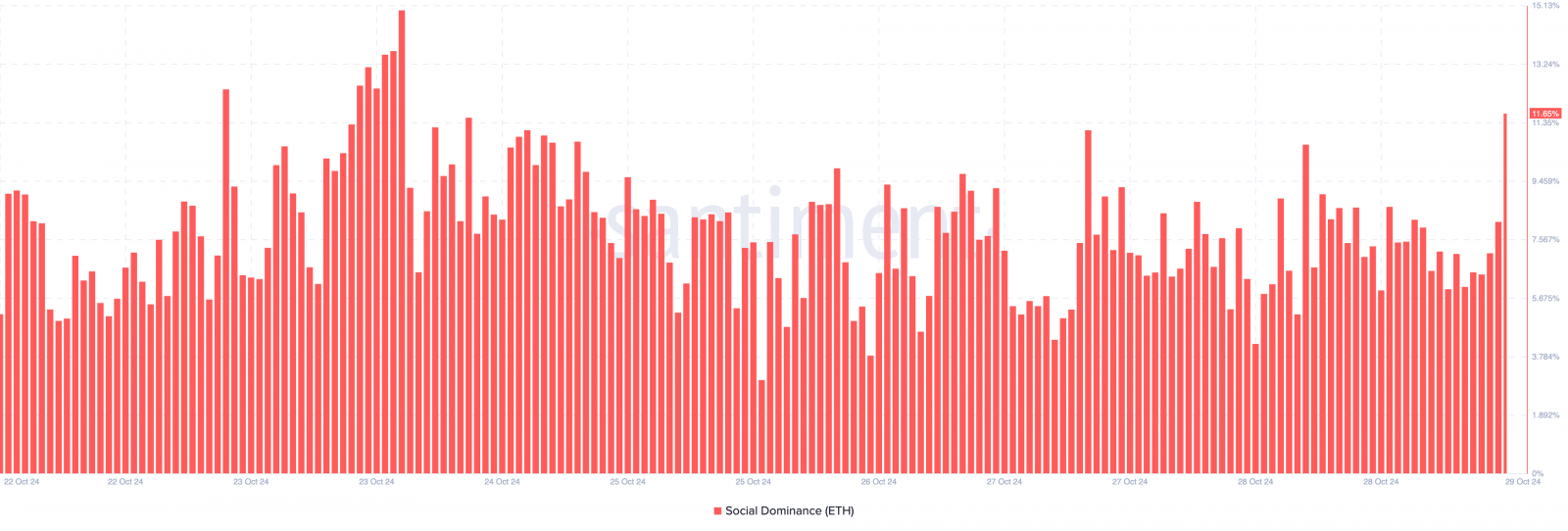

Beyond that, Ethereum’s social dominance has surged, indicating heightened interest in and discussions of the cryptocurrency on social platforms.

Increased social dominance often reflects growing attention from the broader market, which can amplify demand as more investors become aware of Ethereum’s recent price movements. If sustained, the traction could act as a catalyst to drive ETH’s price higher.

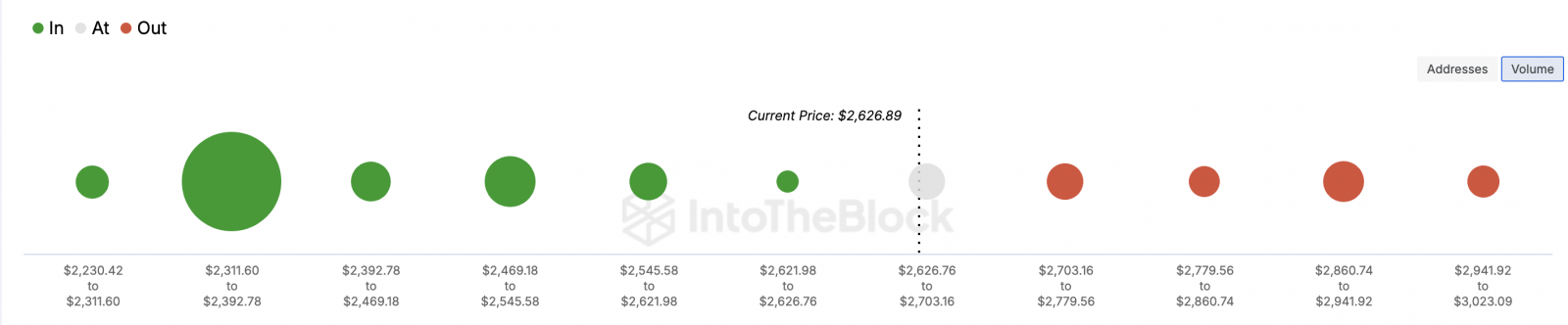

Ethereum IOMAP. Source: IntoTheBlock

ETH Price Prediction: Uptrend Likely to Continue

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) revealed that ETH could rise much higher in the short term. The IOMAP classifies addresses based on those making money at the current price, those not, and holders at the breakeven point.

When an address purchases a crypto at a lower price than the current value, it is in the money. On the other hand, if addresses accumulated at a value higher than the current one, it is out of the money.

In terms of price, the larger the “in the money” cluster, the stronger the support level, as these holders are less likely to sell at a loss. Conversely, if a large cluster is “out of the money, it creates a stronger resistance level, as holders may look to sell upon reaching break-even, potentially limiting further upward movement.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum IOMAP. Source: IntoTheBlock

As seen above, the volume of ETH and the number of Ethereum long-term holders in the money are much higher than those between $2,703 and $3,023. Therefore, it is likely that the cryptocurrency’s price might surpass $3,000 soon.

However, if buying pressure reduces, this forecast might not come to pass. Instead, Ethereum’s price could slide to $2,355.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Algorand

Algorand  Maker

Maker  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Dash

Dash  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD