Solana price forms rare bullish pattern, closes the gap with Ethereum

Solana price continued its strong recovery this week, soaring to a high of $180, its highest level since July 31st. It has jumped by about 65% from its lowest point in September, giving it a market capitalisation of $84 billion, and a fully diluted value of $106 billion.

If Solana was a company, it would be the 160th biggest one globally. It would be bigger than companies like ABB, Shopify, Rio Tinto, and Lam Research.

Closing the gap with Ethereum

Solana price has done well as the network continues closing the gap with Ethereum, a network that has dominated the industry for many years.

Data shows that Ethereum has a big edge against Solana in many industries. For example, data by DeFi Llama shows that Ethereum has over 1,200 decentralized applications (dApps) in the DeFi industry, while Solana has 171.

Ethereum’s applications have a total value locked (TVL) of $50 billion, while Solana’s applications have $6.36 billion in assets. This means that Ethereum is about 8x bigger than Solana in this metric.

Ethereum is also much bigger than Solana in terms of stablecoins. It has over $83 billion stablecoins in its ecosystem, a figure that is substantially higher than Solana’s $3.7 billion.

Stablecoins have become the most important parts of the crypto industry, because of their role in money transfers. For example, it has been widely reported that highly sanctioned countries like Russia and Venezuela have embraced these coins to fund their trades.

This happens because these stablecoins give them access to US dollars, which they may not have because of the substantial sanctions.

However, despite all this, there are signs that Solana is doing much better than Ethereum in terms of growth.

First, the network has 7.2 million active addresses, a figure that is significantly higher than Ethereum’s 389,347. This means that Solana is more popular than Ethereum among users.

This happens because of Solana’s lower transaction costs and fast speeds, which are substantially ahead of Ethereum. This is shown by the fact that Ethereum’s fees this year have soared to $2.06 billion, while Solana has made $421 million.

Solana DEX volume is soaring

Second, Solana has become the biggest chain in the decentralized exchange (DEX) industry, an industry that Ethereum has dominated.

Data shows that Solana’s DEX networks like Raydium, Orca, Lifinity, Phoenix, and Drift. These DEX networks have handled over $51 billion in volume this month, the highest level since July.

Raydium processed $9.7 billion in the last seven days, while Orca, Lifinity, and Phoenix handled over $1 billion in assets in that period.

Ethereum, on the other hand, handled $40 billion in October, with Uniswap and Curve Finance having the biggest market share. Only the two networks had a volume of over $1 billion, meaning that its network is dependent on Uniswap.

That is a big risk since Uniswap is now moving into the chain industry by launching UniChain, its layer 2 network, which will have lower costs and be more customizable.

Solana’s growth is mostly because of its strong presence in the meme coin industry. Data shows that Solana meme coins have attracted a market cap of over $12 billion, a notable thing since its first meme coin, Bonk, emerged in late 2022.

Dogwifhat, the biggest Solana meme coin now has a market cap of over $2.2 billion, while Popcat, Bonk, and Cat in a dogs world have valuations of over $1 billion.

Solana meme coins have more volume than most mainstream coins each day. For example, its 24-hour trading volume was almost $3 billion, a figure that will keep growing in the near term.

Solana has also become a big name in the Decentralized Public Infrastructure (DePIN) and artificial intelligence. Its network powers popular names in the DePIN industry like Render, Helium, and Hivemapper.

Solana price prediction

SOL chart by TradingView

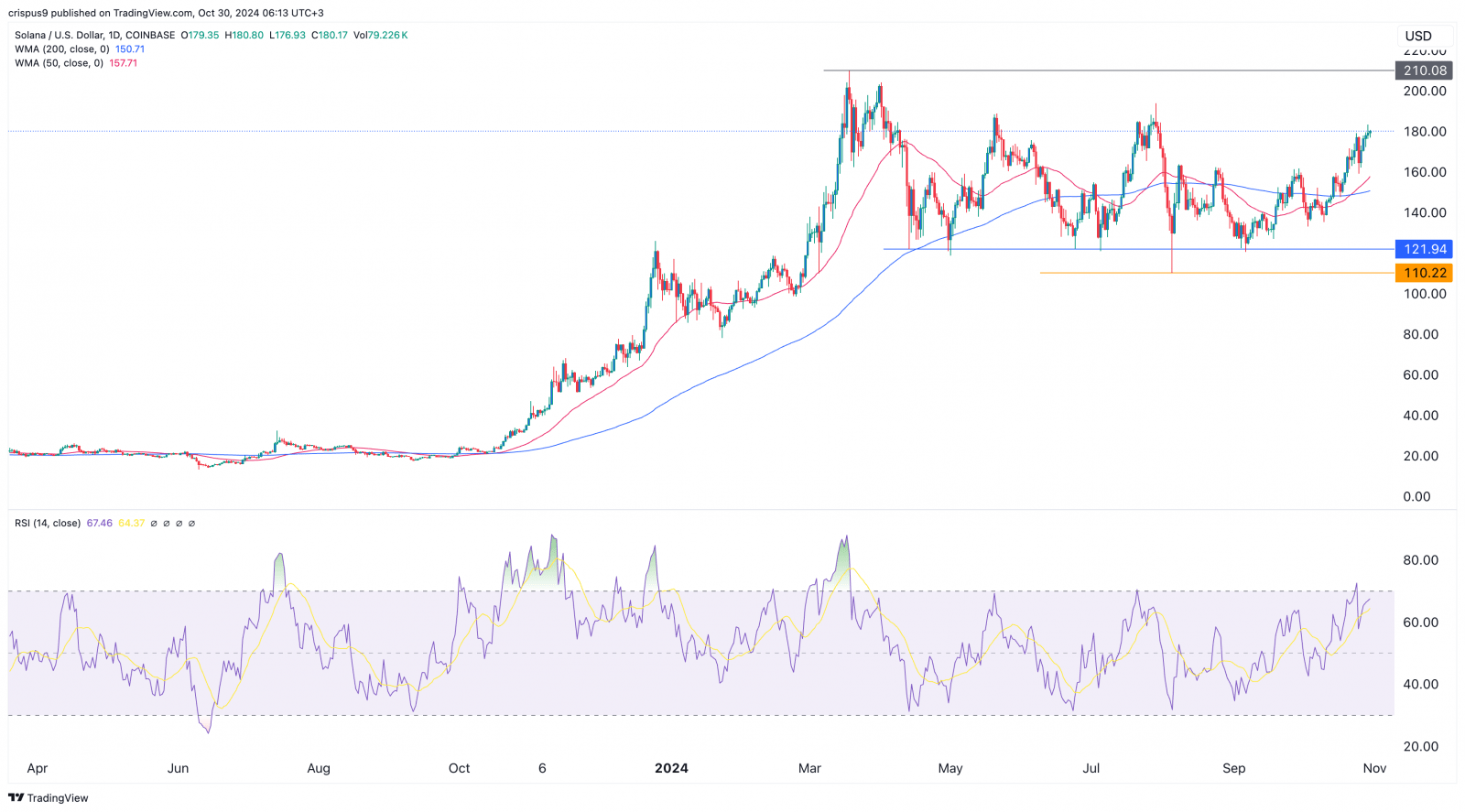

Technicals point to more Solana upside. On the daily chart, we see that the price of Solana bottomed at $110 in August as the Japanese yen carry trade unwound after the Bank of Japan delivered a surprise rate hike.

Since then, it has bounced back, moving to a high of $180, its highest level since July 30th. It is also approaching the important resistance point at $210, the year-to-date high.

Solana has found a strong bottom at $122, where it failed to move below since April this year. Most importantly, it has now formed a golden cross as the 200-day and 50-day Weighted Moving Averages (WMA) happened. In most periods, a golden cross leads to more gains over time.

The Relative Strength Index (RSI) and other oscillators have continued rising. Therefore, the Solana token will likely continue rising as bulls target the year-to-date high of $210, which is about 17% above the current level.

The post Solana price forms rare bullish pattern, closes the gap with Ethereum appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom