Hopes for recovery dashed after ‘altcoin reckoning’ market stage arrives

The altcoin market may never recover as the general trading mood has shifted to new asset classes. Older coins and tokens may be due for another crash without even making the anticipated altcoin recovery.

Altcoin markets did not achieve the bull run they expected in 2024, although some of them managed to return to higher ranges. In the final quarter of the year, Bitcoin (BTC) regained its dominance, while the most promising altcoins have either underperformed expectations or even failed to launch a rally.

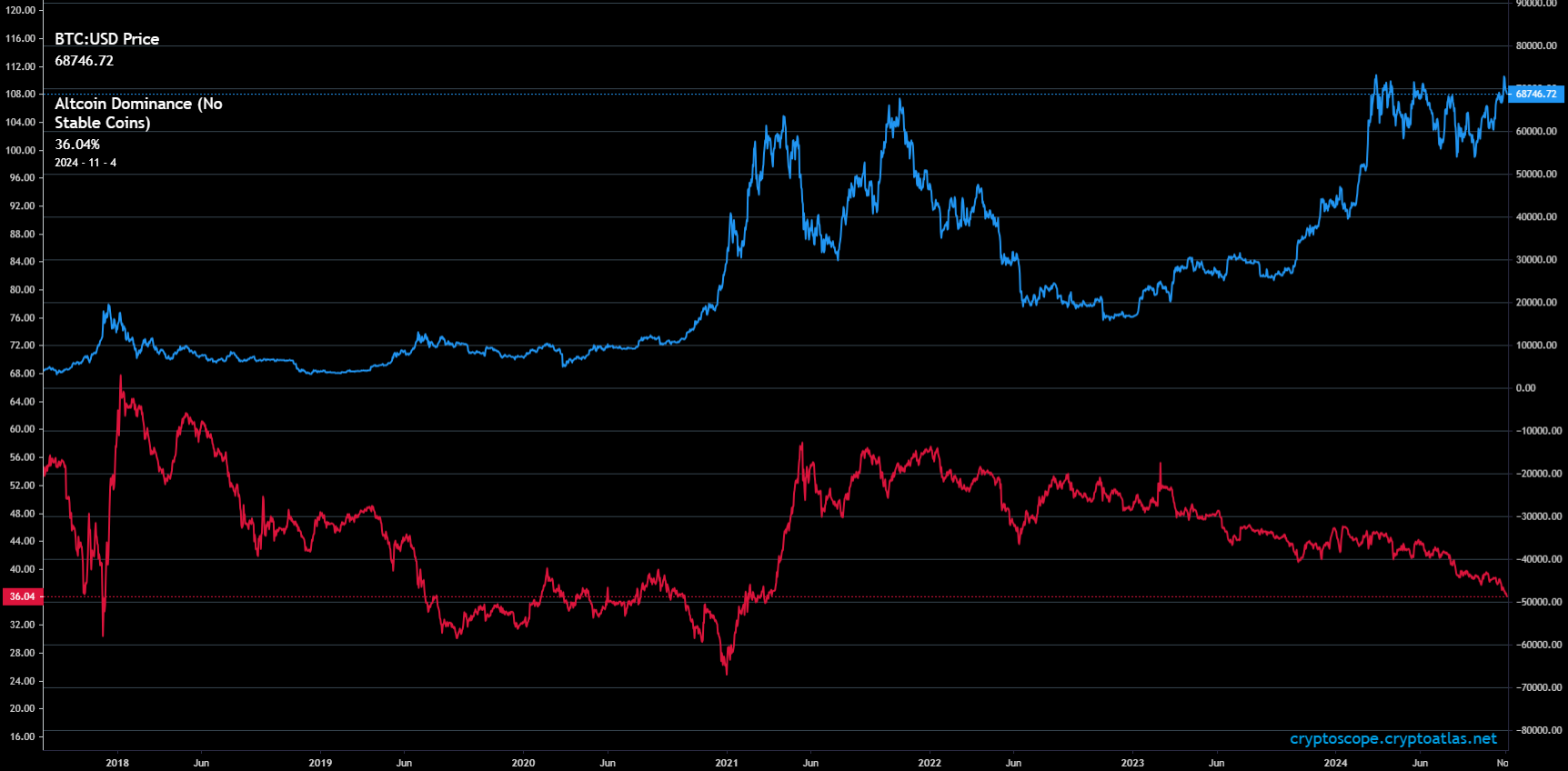

The rise of BTC coincided with a reversal of altcoin market shares.

The recent BTC rally coincided with a reversal in altcoin dominance. | Source: Cryptoscope

According to Benjamin Cowen, altcoins are set to behave similarly to the market crash of 2020, when the entire market crashed to local lows. The last stage of altcoin crashes is just around the corner, in what Cowen calls an “altcoin reckoning.”

The problem with altcoins is that they have been dipping for a long time, with no relief rally coming. The market is also not guaranteed a return, even if the last months of 2024 lead to an even deeper altcoin correction.

VC-backed projects continue to attract seed rounds, though at a much lower pace. The market also has to absorb the previous batch of VC-backed tokens with significant unlocks on their schedule.

Long-term projects like XRP and Cardano (ADA) have yet to prove their utility, and they lag behind on all trends. L2 tokens are also still being pressured by their long unlocking schedule.

TRON (TRX) was one of the exceptions, getting close to its 2018 peak at $0.17, though the asset achieved this with regular token burns and a deflationary supply.

There are multiple signs that some altcoins may not be coming back, with projects either pivoting or failing. Blue chip and utility altcoins like Ethereum (ETH) and Solana (SOL) retain their value, though without moving into new price ranges.

The altcoin capitulation may not be the end of trading interests for them. There are predictions for a bounce and a new altcoin season in early 2025. However, this time, a new selection of assets may lead the market, with some older meme tokens in the mix.

Altcoins diverge from BTC

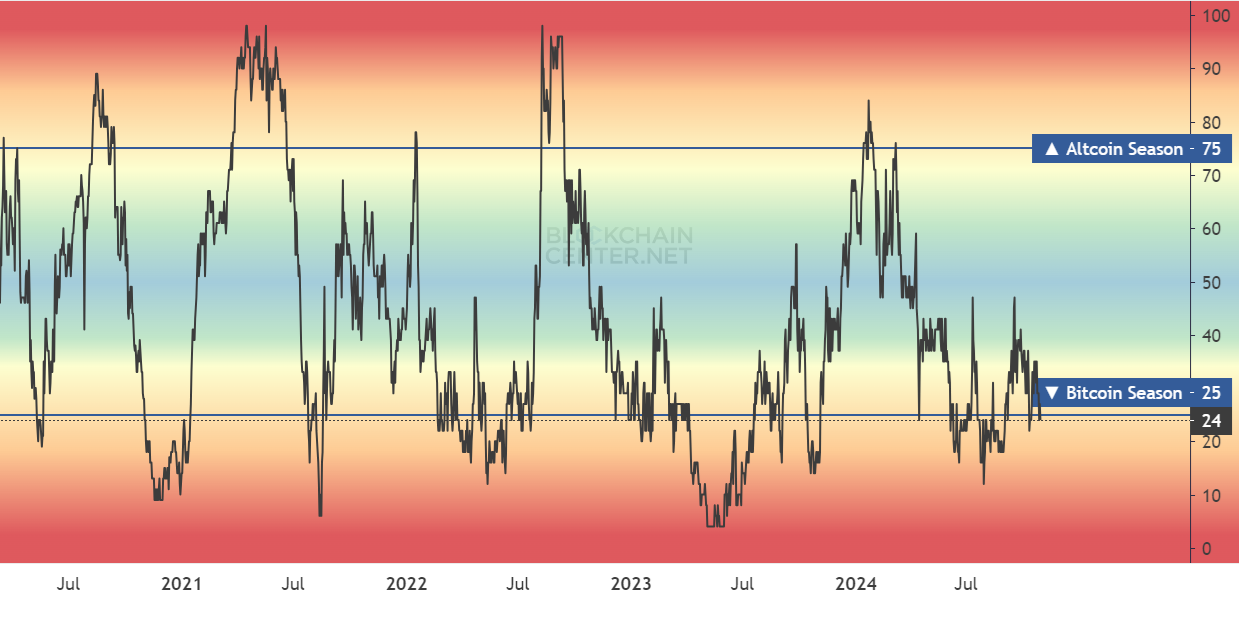

The altcoin season index is back to 26, after peaking at 46 points in September. The index suggested three very short periods to realize gains from the top 100 altcoins in 2021 and 2023.

The altcoin season index is down to 26 points, after a small breakout in September. | Source: Blockchain Center

During those times, altcoins outperformed BTC, based on new types of assets. In 2024, the altcoin rally was smaller and again failed to bring back assets from previous bull markets. Even former blue chips like Monero (XMR), Litecoin (LTC), and Ethereum Classic (ETC) remained stagnant.

As BTC now trades under $69,000, the altcoin market suffered deeper losses. BTC’s dominance expanded to 59.4%, while smaller altcoins held just 27.7% of the market capitalization. Ethereum’s dominance is down to 12.7%, dashing hopes that ETH could inspire an altcoin rally.

Meme and community tokens may replace altcoins

One emerging trend on social media is the emphasis on community by crypto assets. Even VC-backed projects leverage hype for their success.

The altcoin index is formed by tracking assets in the top 100 based on market capitalization, though that list may shift with new tech trends. However, there is a noticeable shift of altcoins becoming meme coins or movements. Trading and short-term pumps are still one possible scenario for altcoin traders, but crypto has always served the demand for relatively easy 100X gains.

Altcoins can offer fast recovery and some upside, but most established assets have already gone through their most active growth stages. According to Murad Mahmudov, there is more demand for memecoins than altcoins.

Altcoins are trying to tap the meme frenzy. Even ETH and SOL retain their levels partially due to meme token trading. Some altcoins try to retain their utility by offering voting, rewards, or other forms of community participation to avoid sustained sell-offs.

Some utility coins also try to emulate the community-driven ethos. Altcoins are often used for staking, as one incentive to avoid selling. However, memecoins perform better on the matter of irrational holding, where the buyers do not capitulate even with a 70% drawdown.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  OKB

OKB  Stacks

Stacks  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi