Celestia (TIA) Nears $3.72 Year-to-Date Low Amid Growing Sell Pressure

TIA, the native token of the modular blockchain network Celestia, has extended its downtrend, losing over 15% of its value in the past week. Currently, the altcoin is trading at $4.23, hovering near its year-to-date low of $3.72.

The sustained value drop and technical indicators suggest that Celestia’s price decline may continue in the short term. This analysis highlights the price targets the token holders need to look out for and why.

Celestia Buyers Exit the Market

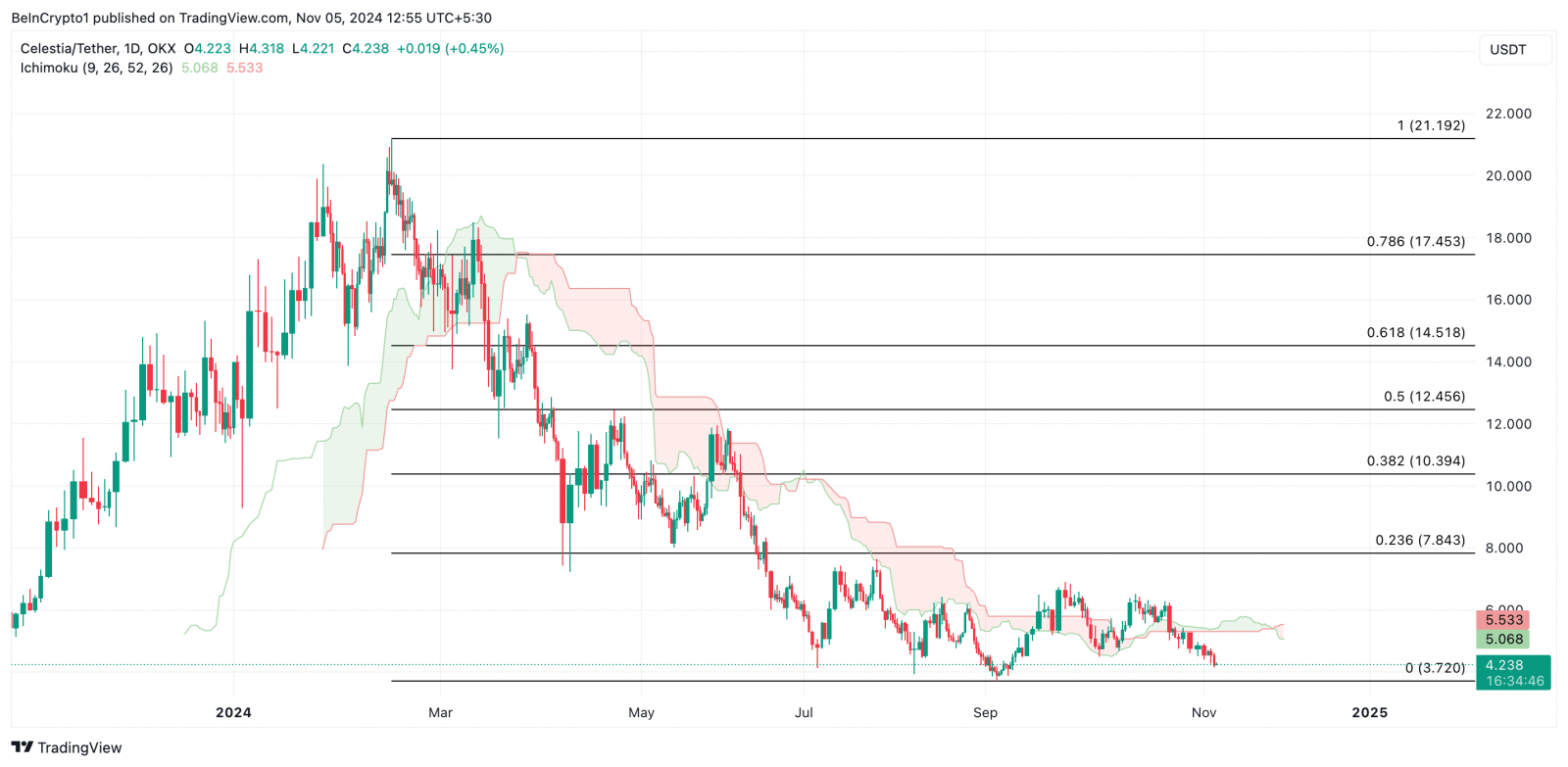

BeInCrypto’s assessment of the TIA/USD one-day chart shows that the coin’s double-digit decline over the past seven days has pushed its price below its Ichimoku Cloud.

This indicator tracks an asset’s market trends, momentum, and key support/resistance zones. When the price dips below it, it signals a bearish phase, indicating stronger downward momentum. In this case, the Cloud serves as a resistance zone, making it harder for the price to break back above without substantial buying pressure.

Read more: What is a Layer-1 Blockchain?

Celestia Ichimoku Cloud. Source: TradingView

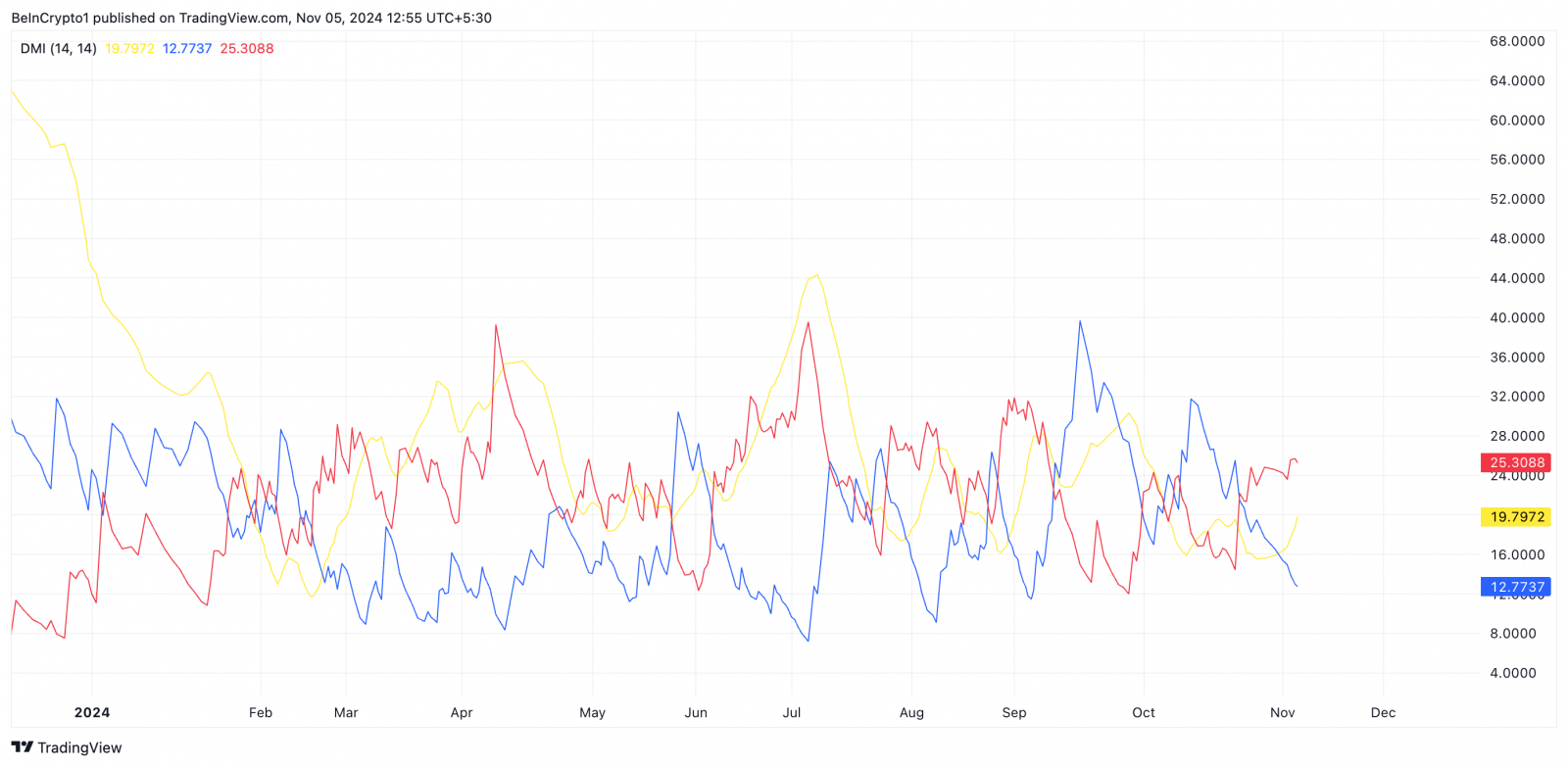

However, readings from TIA’s Directional Movement Index (DMI) suggest that such buying pressure is currently absent in the coin’s market, worsening the Celestia price decline. At press time, the altcoin’s positive directional indicator (+DI) (blue) rests below its negative directional indicator (-DI).

The DMI indicator measures an asset’s price strength and direction. When its +DI lies below its -DI, it signals that the asset’s price is experiencing more downtrend than uptrend movements. Traders view this as a bearish signal, suggesting that sellers are stronger than buyers.

Celestia DMI. Source: TradingView

TIA Price Prediction: A Pull Toward Year-To-Date Low

At press time, TIA is trading at $4.23, just 13% above its year-to-date low of $3.72, last reached on September 6. Increasing selling pressure could push TIA back down to this support level.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in November 2024

Celestia Price Analysis. Source: TradingView

If TIA experiences renewed demand, however, the price could rebound from this floor and begin an uptrend. In this bullish scenario, TIA would target breaking above the Ichimoku Cloud resistance levels at $5.06 and $5.53. Successfully surpassing these thresholds could position TIA for a potential rally toward $7.84, a peak it last achieved in June.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom