MicroStrategy’s MTSR Opens With 13% Surge

In premarket trading MicroStrategy’s stock MTSR surged an impressive 13%, riding high on the heels of Bitcoin’s most recent all-time high above $75,000. The company’s audacious plan to closely link its value to Bitcoin’s performance is reflected in this spike in MSTR.

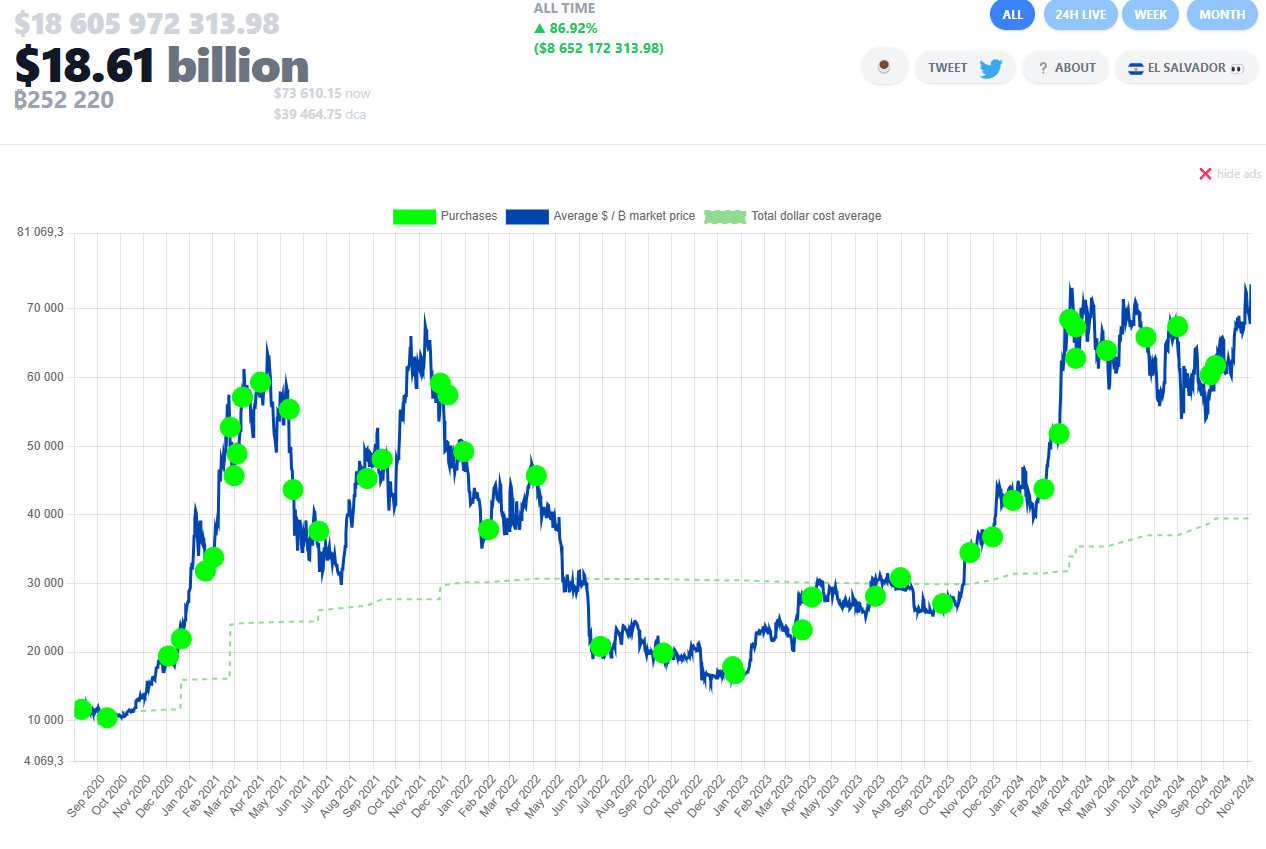

In addition to highlighting the worth of MicroStrategy’s sizable Bitcoin holdings, the rising price of Bitcoin also highlights how successful Michael Saylor’s strategy for cryptocurrency investing is. At current prices, MicroStrategy owns about 158,245 BTC, which is worth over $11 billion.

Significant profit in the company’s holdings suggests that the dollar-cost average strategy and the longer term bullish outlook for Bitcoin has worked well. MicroStrategy’s balance sheet appears to be even stronger in light of Bitcoin’s recent surge, which boosts shareholder confidence.

The recent break above $75,000 on the price chart of Bitcoin suggests that there may be more bullish momentum ahead. A rally toward $80,000 and higher may be possible if Bitcoin can hold levels above this one, which could support MicroStrategy’s stock growth trajectory. The critical support levels of $68,000 to $70,000 are probably being watched by investors to see if Bitcoin maintains its strength.

A move toward $80,000 would indicate a strong continuation of the bull run, which would be good for MSTR as well. In addition to highlighting the correlation between its stock price and Bitcoin, MicroStrategy’s optimistic performance points to a wider recovery trend on the cryptocurrency market.

Given the increasing dominance of Bitcoin and the improving mood of the market, MicroStrategy’s stock could continue to rise and gain from the robust digital asset market. It is crucial for MSTR investors to keep an eye on Bitcoin’s key levels because any changes in the price of the cryptocurrency will probably have an immediate effect.

This robust opening supports the argument for MSTR as a stand-in investment for Bitcoin exposure, providing a distinctive entry point for institutional and retail investors hoping to profit from the cryptocurrency’s surge, especially considering MicroStrategy’s strong correlation with Bitcoin’s performance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom