Ethereum Price Analysis: ETH Explodes Above $3K, Charts 20% Weekly Gains

Ethereum has seen a significant uptick in buying pressure near the $2.4K support level, driving an impulsive price surge and reclaiming several key resistance regions. This action is signaling a potential shift towards a bullish market sentiment, with higher price levels expected in the mid-term.

Ethereum Price Analysis

By Shayan

The Daily Chart

The daily chart shows that intensified buying near the channel’s middle boundary of $2.4K has sparked a substantial upward move, allowing Ethereum to break through several critical resistance points:

- The 100-day moving average at $2.5K

- The descending channel’s upper boundary is around $2.8K

- The 200-day moving average at $3K

This strong performance suggests a bullish shift, with Ethereum reclaiming these resistance levels. Additionally, crossing the psychological $3K threshold reinforces a positive market sentiment, raising the possibility of reaching a new all-time high by year-end. However, a brief consolidation corrections phase might be necessary to sustain this trend healthily, allowing for potential profit-taking and market stabilization.

The 4-Hour Chart

The 4-hour chart shows an initial surge from $2.4K, the lower boundary of the descending flag pattern, where buying pressure has been strong. Ethereum has now surpassed the $2.8K resistance, which had acted as a significant barrier in recent months.

This break highlights buyers’ intent to increase the price, with eyes potentially set on a new ATH.

Currently, Ethereum is approaching $3.1K, the flag’s upper boundary, where notable selling pressure may emerge. Given the impulsive nature of the recent increase, a short-term rejection followed by a temporary corrective retracement seems possible. In this case, a brief correction toward the support range of $2.7K —$2.6K (bounded by the 0.5 and 0.618 Fibonacci retracement levels) would be beneficial, setting the stage for a healthier uptrend.

Onchain Analysis

By Shayan

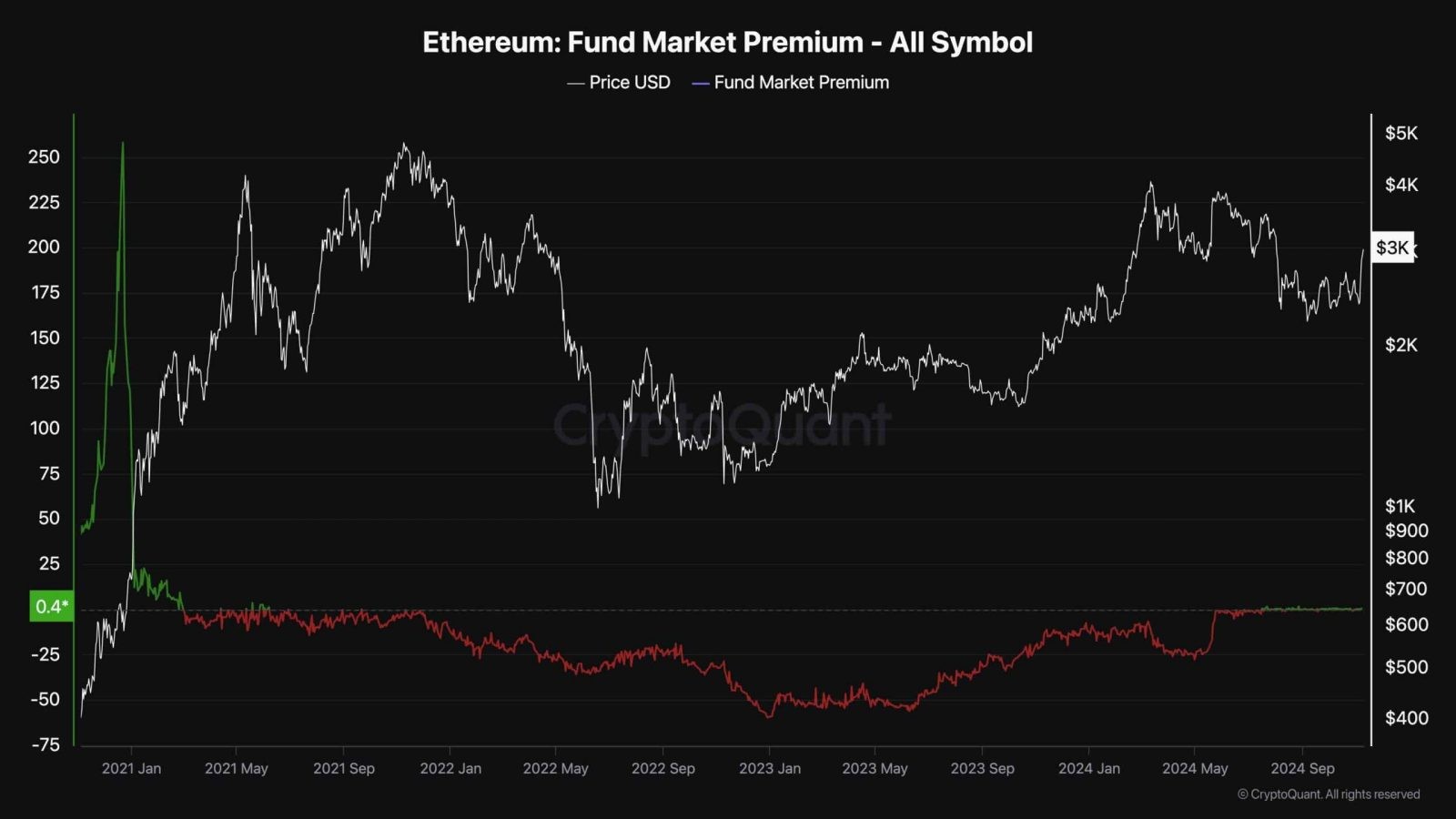

The fund market premium metric is an essential indicator, as it reflects the difference between a fund’s market price and its Net Asset Value (NAV). When the premium is elevated, it suggests strong buying pressure within a specific region, indicating that investors are paying a higher price for fund shares relative to the underlying assets.

This premium metric substantially declined from mid-November 2021, when Ethereum reached its all-time high. This decline aligned with waning interest in Ethereum funds, a typical response as investors became cautious during the subsequent bear market.

However, a pivotal shift occurred as Ethereum reached its bear market low. The premium metric started to rise modestly, marking a return on investor interest. Since January 2023, this premium has steadily increased, signaling a resurgence in confidence for Ethereum-backed assets. Recently, the premium moved above zero, revealing positive market sentiment and suggesting robust demand for Ethereum funds.

In summary, the positive shift in the premium metric is a promising sign of renewed market optimism. If this trend persists, it could reinforce Ethereum’s broader price momentum, potentially contributing to its future price growth trajectory.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  IOTA

IOTA  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Holo

Holo  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy