Coinbase’s 5 Predictions for The Crypto Market in 2025

Coinbase recently released a report outlining its predictions for the cryptocurrency market in 2025. The report focuses on key areas such as stablecoins, tokenization, ETFs, DeFi, and regulatory developments.

Reports from other industry players also suggest a positive outlook for the crypto market in 2025.

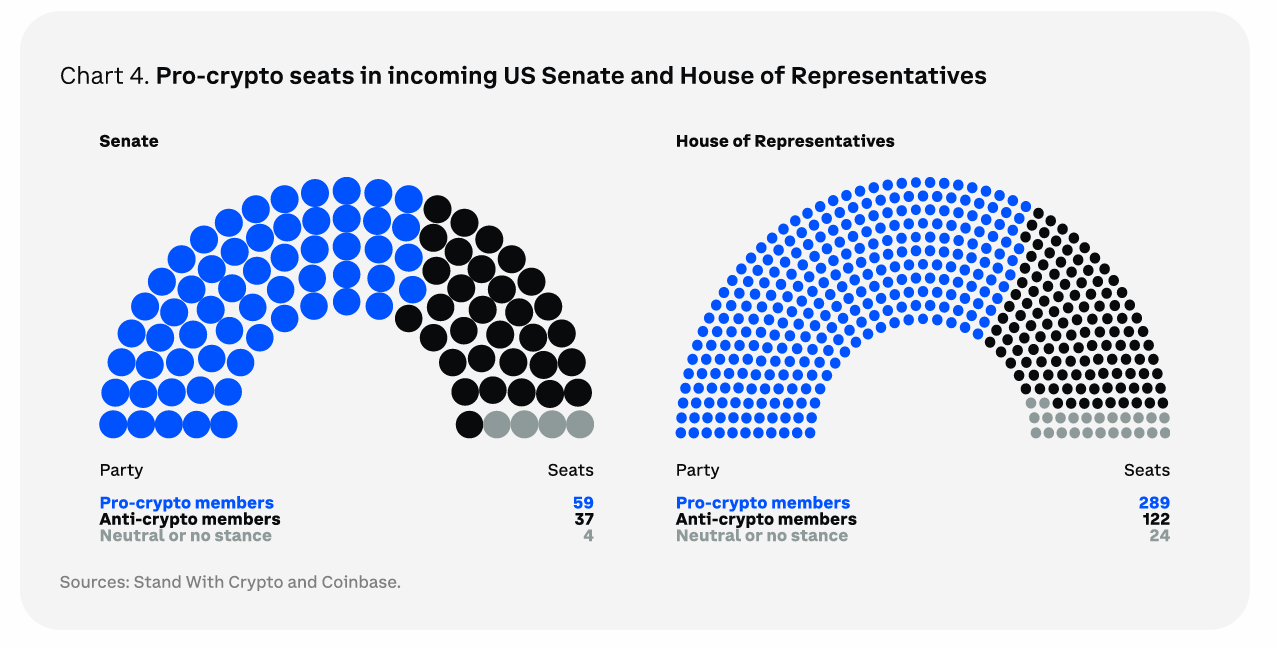

A Favorable Regulatory Environment Will Drive Market Growth

The first major prediction highlights that regulatory changes will benefit the overall crypto market. Coinbase refers to the incoming US Congress as “The Most Pro-Crypto US Congress … Ever.” Among potential developments, the establishment of a Strategic Bitcoin Reserve could become a reality.

Pro-crypto Seats in Incoming US Senate and House of Representatives. Source: Coinbase.

Notably, pro-crypto movements are not limited to the US; regions such as Europe, the G20, the UK, the UAE, Hong Kong, and Singapore are actively developing regulations to support digital assets.

Binance CEO Richard Teng also predicts that regulatory changes in the US will act as a growth catalyst in 2025, with other countries likely to follow suit.

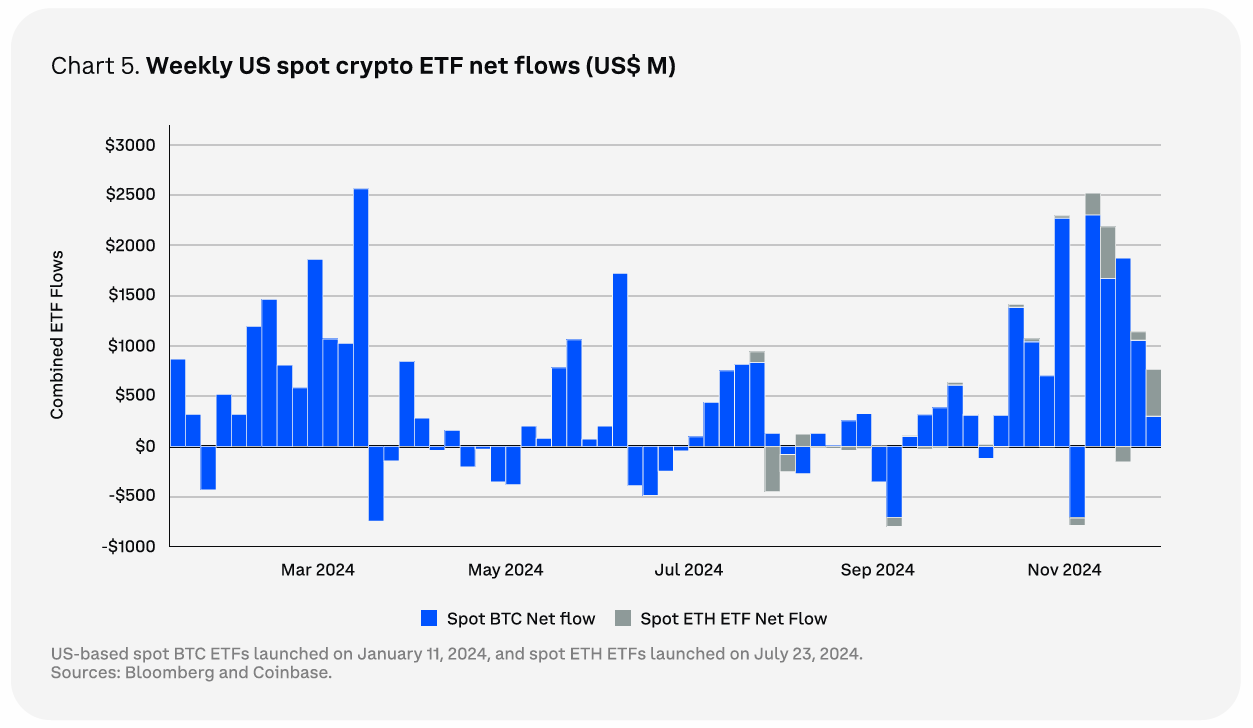

Positive Developments for Crypto ETFs

Coinbase highlights the significance of Bitcoin and Ethereum ETFs in attracting new capital. Data reveals that net inflows have reached $30.7 billion since their introduction.

Weekly US Spot Crypto ETF Net flows. Source: Coinbase

The report also suggests that ETFs linked to assets like XRP, SOL, LTC, and HBAR might gain approval, although their benefits could be short-term.

Crucially, Coinbase speculates that the SEC may approve staking in ETFs or eliminate the requirement for creating and redeeming ETF shares in cash, potentially broadening the ETF market. SEC Commissioner Hester Peirce has hinted that these developments could occur “early on.”

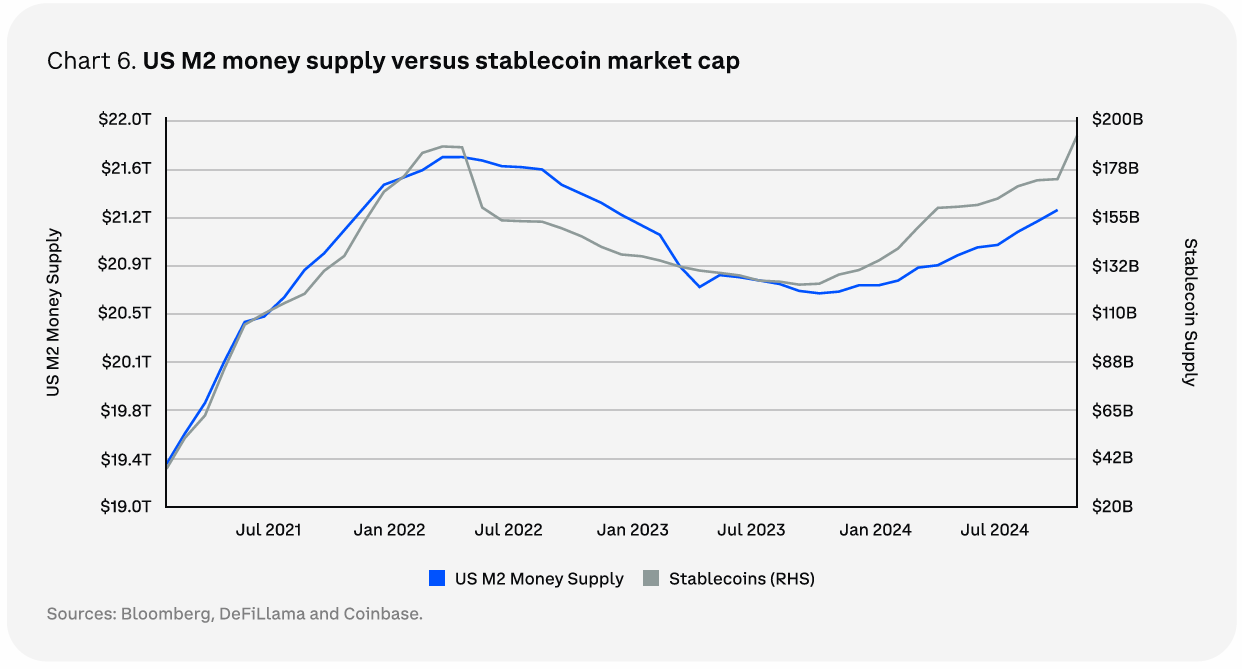

Global Adoption of Stablecoins

Coinbase projects a highly optimistic scenario for the adoption of stablecoins. With a market capitalization exceeding $190 billion, stablecoins currently account for 0.9% of the US M2 money supply.

US M2 Money Supply Versus Stablecoin Market Cap. Source: Coinbase

The report anticipates stablecoins could grow to comprise 14% of the $21 trillion US M2 supply, driven by their speed and cost efficiency compared to traditional methods.

“Indeed, we may very well be getting closer to the day when the first and primary use cases for stablecoins won’t just be trading but rather global capital flows and commerce.” Coinbase predicted.

Tokenization to Thrive Amid Regulatory Challenges

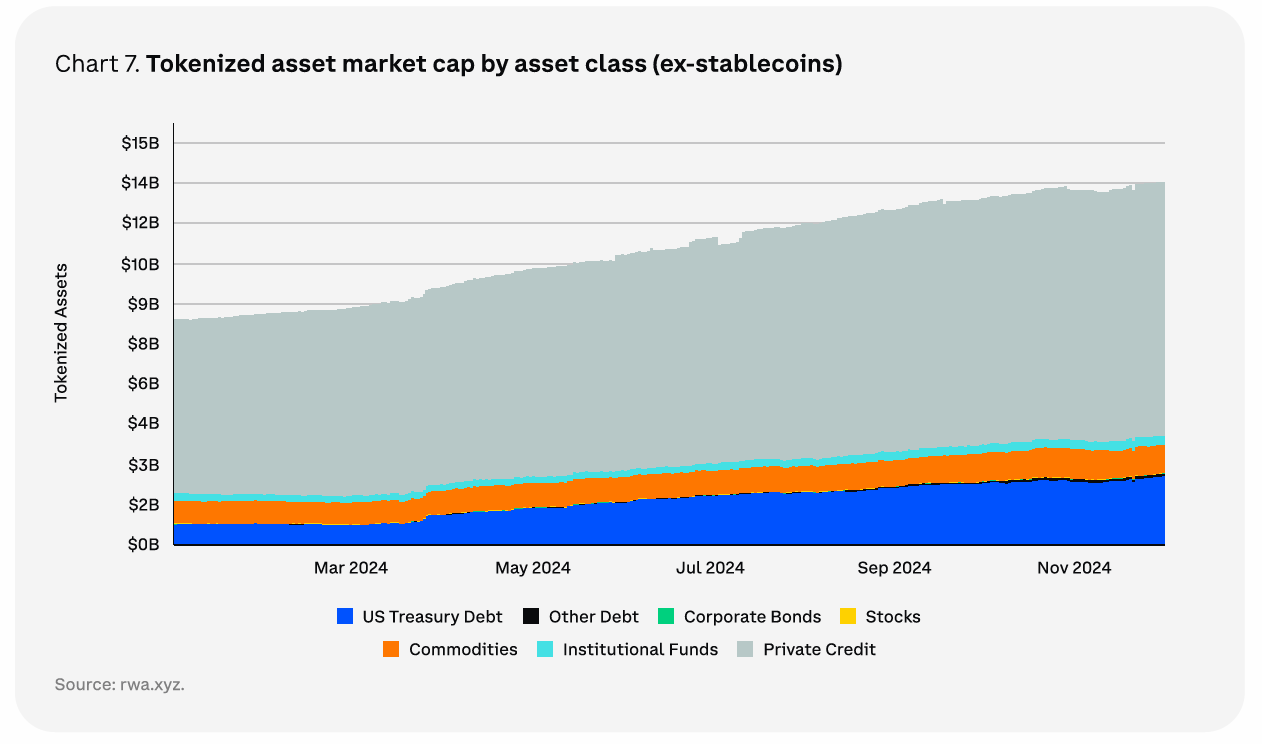

Coinbase expects tokenized assets to experience continued growth in 2025. The capitalization of tokenized real-world assets (RWA) has grown over 60% in the past year, reaching nearly $14 billion.

Estimates suggest that RWA capitalization could increase by at least $2 trillion over the next five years, bolstered by traditional financial giants like BlackRock and Franklin Templeton.

Tokenized Asset Market Cap by Asset Class (ex-stablecoins). Source: Coinbase

The tokenization trend extends beyond traditional assets such as US Treasury bonds and money market funds to areas like private credit, commodities, corporate bonds, real estate, and insurance.

“Eventually, we think tokenization can streamline the entire portfolio construction and investing process by bringing it onchain, although this may yet be a few years away. Of course, these efforts face their own set of unique challenges, including liquidity fragmentation across multiple chains and persistent regulatory hurdles.” Coinbase predicted.

A Messari report echoes these sentiments, forecasting that Bitcoin and tokenized RWAs will dominate 2025 discussions.

DeFi to Rebound in 2025

Despite the market’s peak capitalization exceeding $3.7 trillion, DeFi’s total value locked (TVL) has yet to reclaim its previous high of $200 billion; it currently stands at $120 billion.

DeFi Total Value Locked. Source: DefiLlama

Coinbase argues that DeFi faced significant challenges in the last cycle, as many protocols offered unsustainable yields. However, regulatory changes in the US could allow DeFi protocols to share revenue with token holders, fostering a revival.

The report also references comments by Federal Reserve Governor Christopher Waller, who stated that DeFi could complement centralized finance (CeFi) with distributed ledger technology (DLT), enhancing data storage efficiency.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom