Weekly Price Analysis: Yearly Selloffs Push Prices Lower

- The crypto market spent the greater part of last week trading consistently lower.

- Yearly profit-taking is a major reason for price declines as institutions close positions for the year, although the Fed’s hawkish stance at the Dec. 18 policy meeting also played a role.

- Open Interest in major cryptos showed weekly declines.

Bitcoin

Bitcoin’s price fell from the weekly high of $108,372 on Dec. 17 to a low of $92,555 before closing the week around $97,700. However, despite the 9.7% drop, Bitcoin’s price has not changed character to the downside.

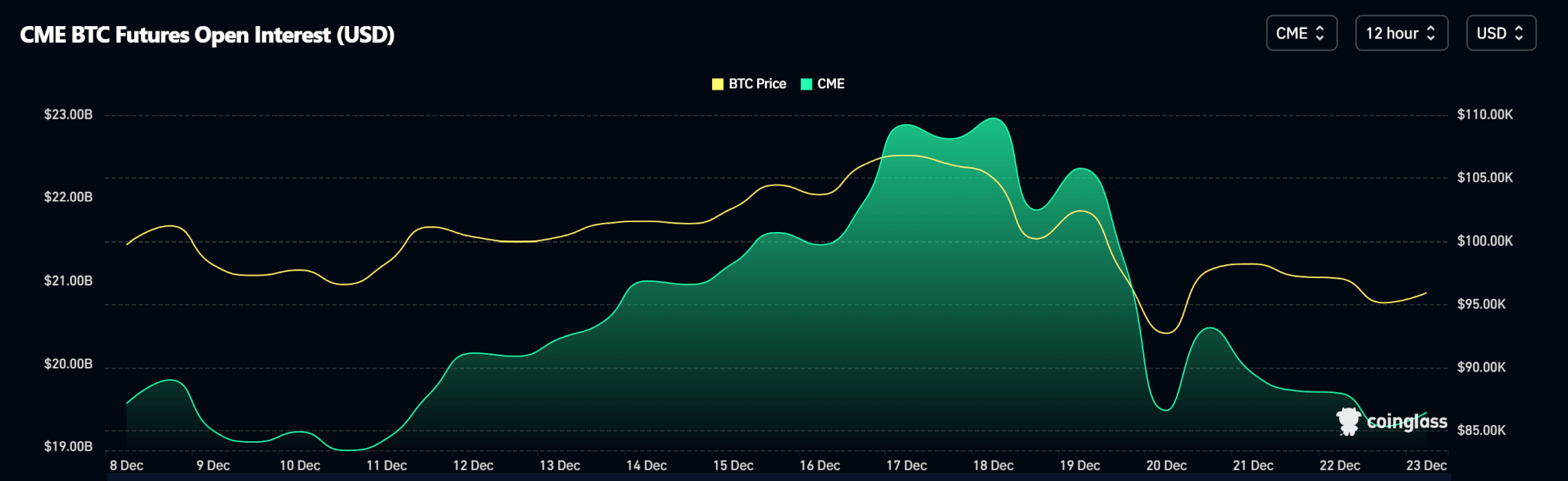

Open Interest data shows a reduction in open contracts at the CME which correlates with price declines.

The Fed’s policy decision on Dec. 18 favoured a 25bps slash. However, Fed Chair Jerome Powell expressed hawkish sentiments concerning slashing plans next year, exacerbating selloffs.

Meanwhile, Bitcoin spot ETF inflows data shows outflows on Dec. 19 and 20 totalling $948.90Mn. Net inflows from Dec. 16 to Dec. 20 were $447.00Mn.

Bitcoin trades at $95,700 as of publishing.

Ethereum

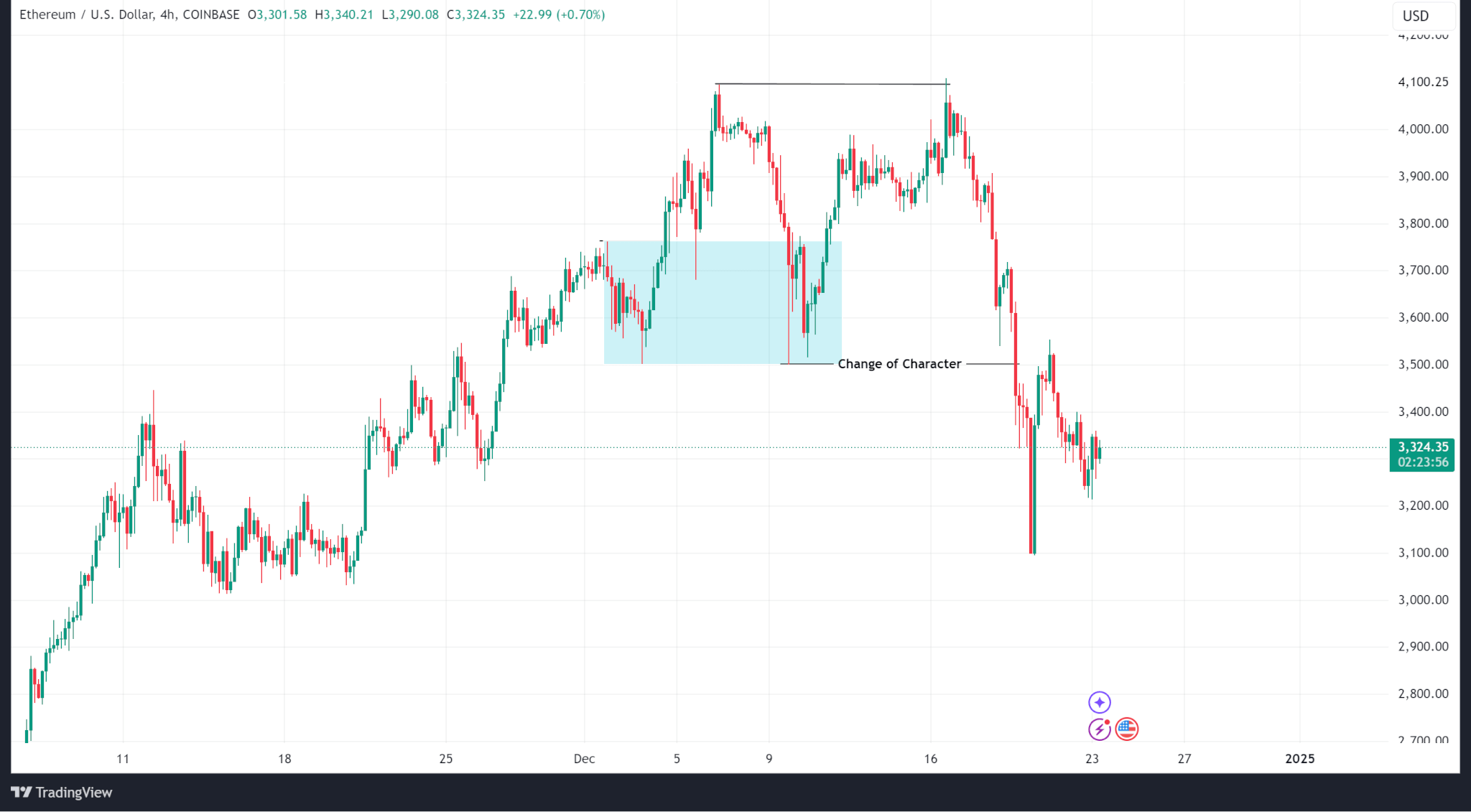

Unlike Bitcoin which maintained its bullish structure, Ethereum’s price changed character on the H4 time frame to trend lower after testing (but failing to break) the local high at $4,096.50.

Ethereum fell from a weekly high of $4,108.82 to a weekly low of $3,098.40 before eventually closing the week at $3,470.44 (a 15.51% drop).

Ethereum spot ETF inflows show a similar pattern with Bitcoin’s with outflows on the last two days of the week.

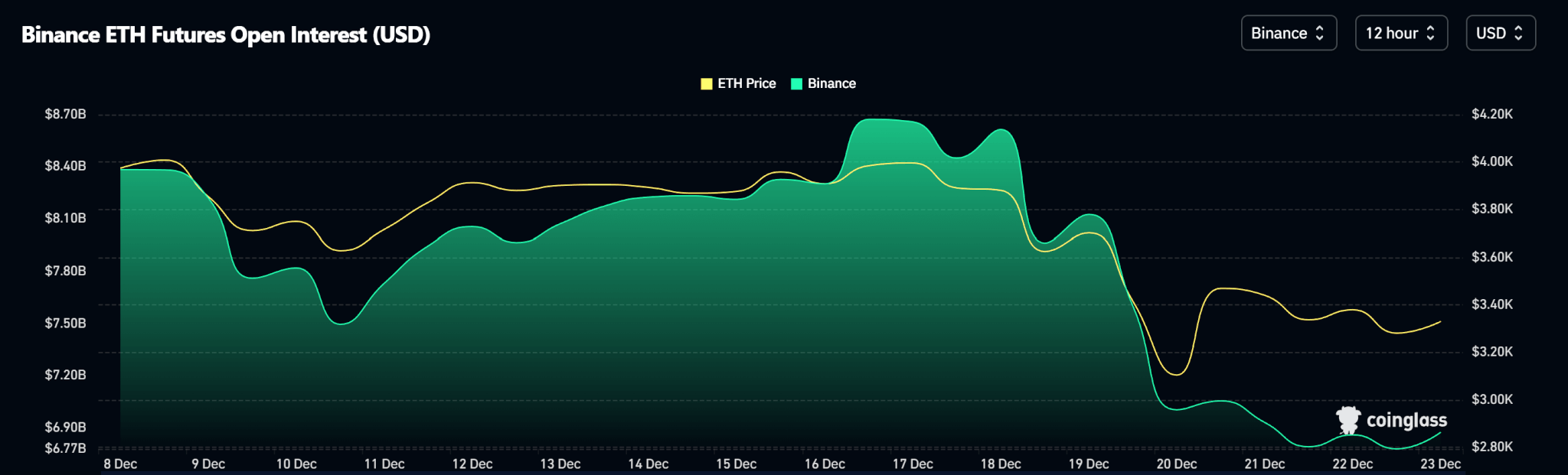

Meanwhile, Ethereum’s open interest shows a steep decline correlated with price.

Ethereum trades at $3,330.78 as of publishing.

Solana

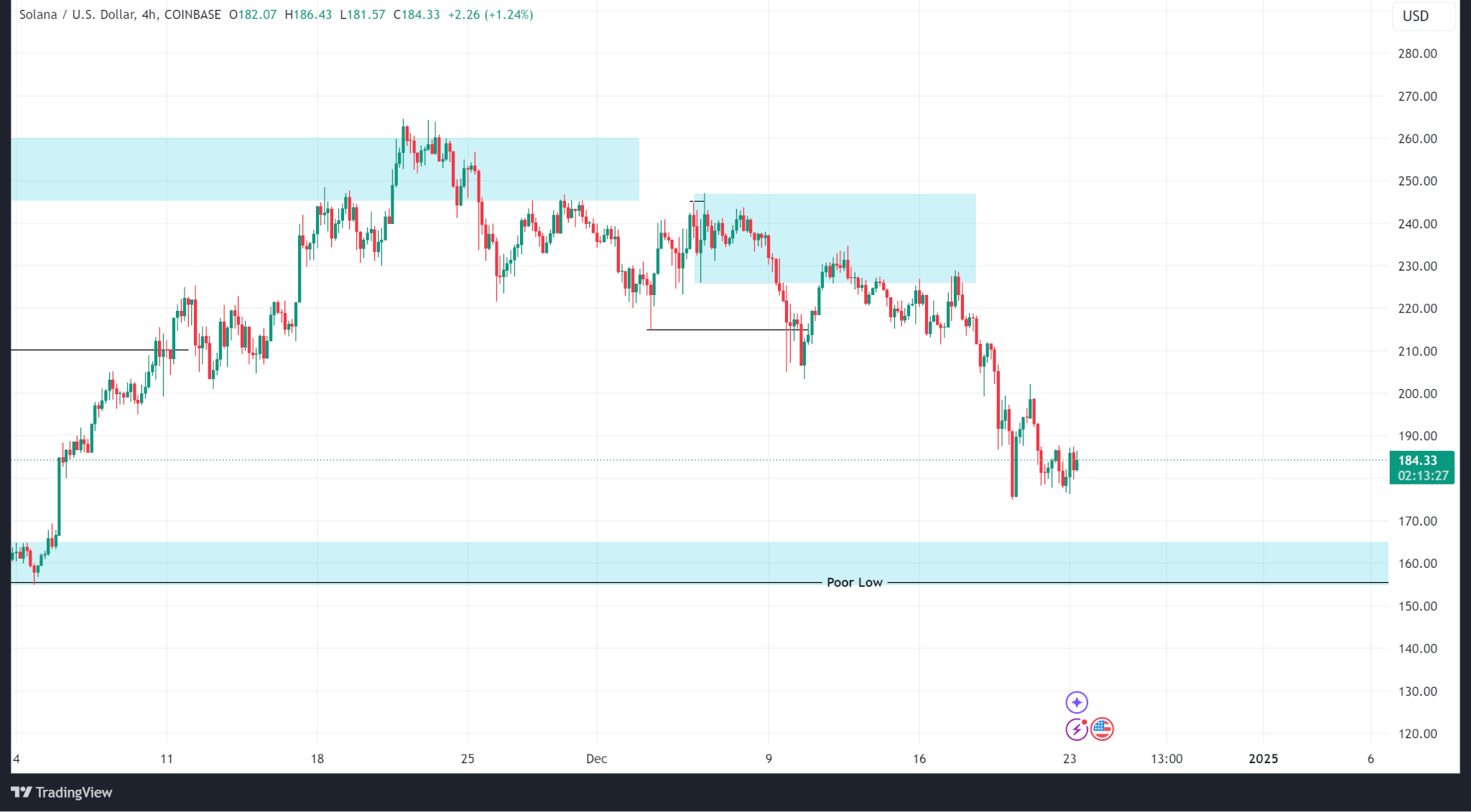

Solana’s price action continued a decline that began two weeks ago after it failed to break above the all-time high of $260.02.

Last week, price action traded into an internal supply zone around $227.71, continued selling to a weekly low of $175.12 and eventually closed at $194.44 (a 15.07% drop).

The demand zone around $160 (mentioned last week) remains the first logical support zone as open interest continues to fall.

Solana trades at $184.82 as of publishing.

Ripple

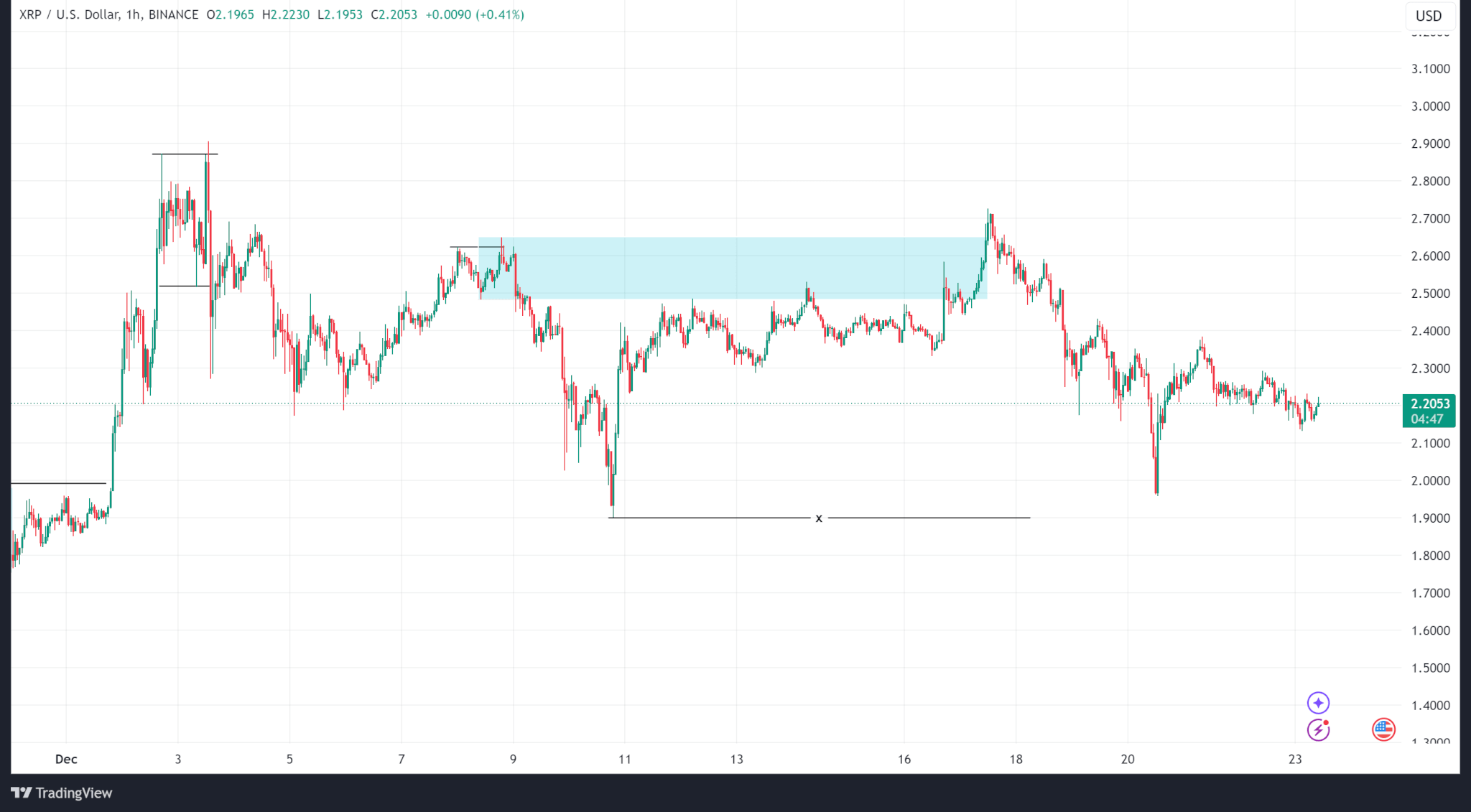

Since breaking previous all-time highs two weeks ago, Ripple’s price action has largely ranged between $1.89 and $2.90. However, within this range, the price has logged lower lows.

Ripple’s price traded into an internal supply zone and broke above it on Dec. 17 but melted to a weekly low of $1.95 before eventually closing at $2.27 (a 16.42% drop).

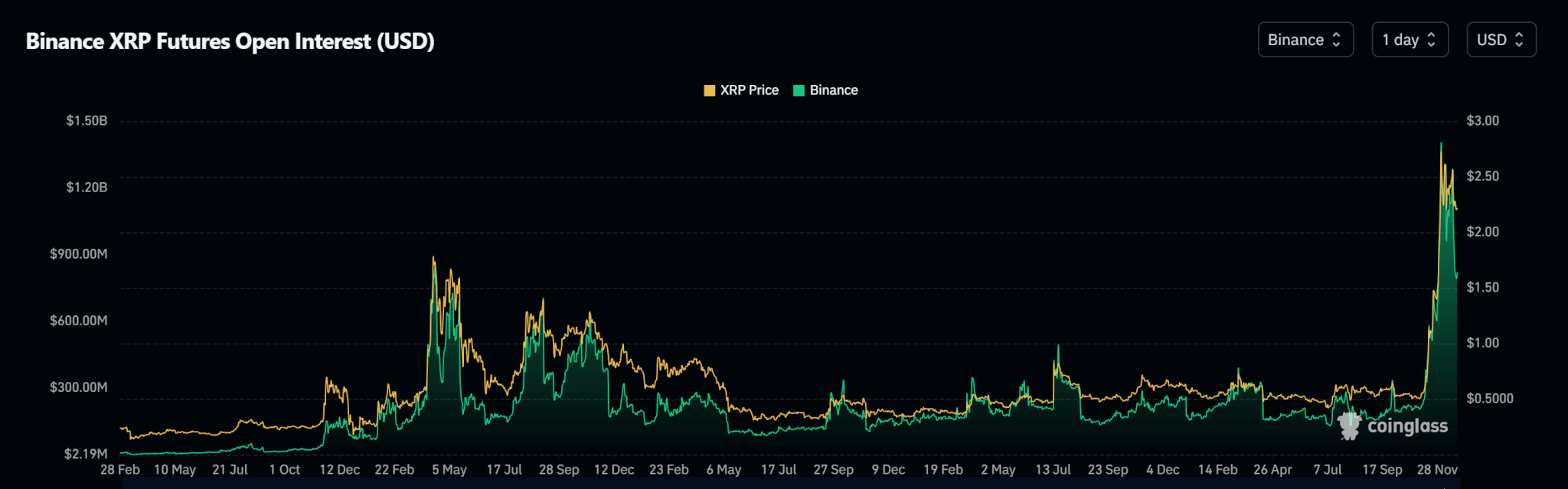

Ripple’s open interest data shows a decline in open contracts since Dec. 3.

Ripple trades at $2.21 as of publishing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom