Solana (SOL) Price Shows Signs of Recovery After 27% Correction

Solana (SOL) price reached a new all-time high on November 22 but has been in a corrective phase since, currently trading 27% below that peak. Recent technical indicators highlight mixed signals, with bearish momentum showing signs of easing but still dominating the market.

The BBTrend, though improving from its recent low, remains in negative territory, while the DMI suggests that the current downtrend is losing strength. As SOL hovers near critical resistance at $195, its price trajectory will depend on whether bullish signals gain traction or bearish pressure intensifies.

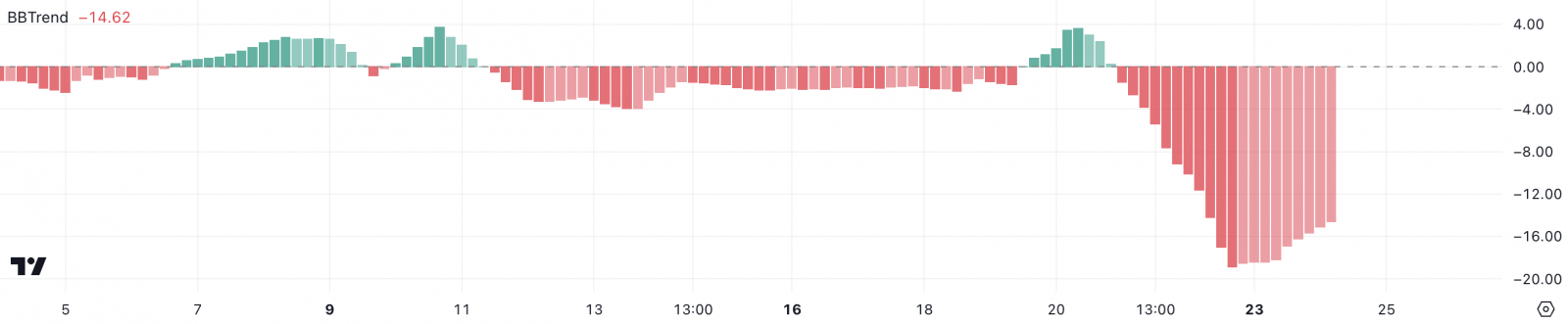

SOL BBTrend Is Still Very Negative

Solana BBTrend recently reached its lowest level since August, hitting -18.89 on December 22. It has remained in negative territory since December 21.

Currently at -14.64, the BBTrend shows signs of improvement, indicating a potential shift in market sentiment. This upward move, while still in the negative zone, suggests that selling pressure might be easing as buyers begin to re-enter the market cautiously.

SOL BBTrend. Source: TradingView

BBTrend, or Bollinger Band Trend, is a momentum indicator derived from Bollinger Bands. It measures the difference between an asset’s price and the midpoint of its Bollinger Bands, providing insights into trend strength and direction. Negative BBTrend values indicate bearish momentum, while positive values suggest bullish trends.

With SOL BBTrend rising from -18.89 to -14.64, it implies that bearish momentum is weakening, potentially setting the stage for a price recovery in the short term. However, until BBTrend crosses into positive territory, the market may remain cautious, with the price movement likely subdued or range-bound.

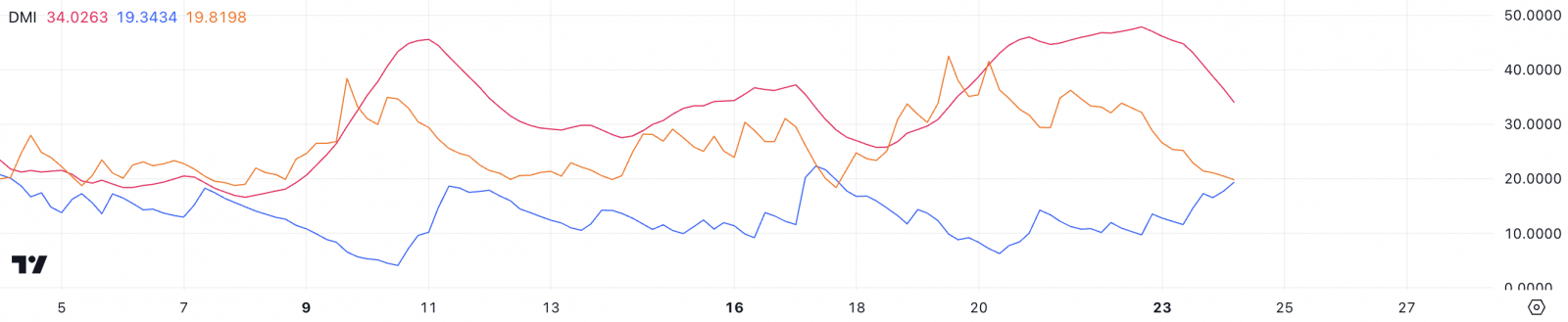

Solana DMI Shows an Uptrend Could Appear Soon

The Solana Directional Movement Index (DMI) chart reveals that its Average Directional Index (ADX) is currently at 34, a sharp decline from nearly 50 just a day ago. While an ADX above 25 still signals a strong trend, the recent drop suggests that the strength of SOL’s current downtrend is weakening.

This decrease in trend strength comes as SOL continues to exhibit bearish price action, but the diminishing ADX could indicate that selling momentum is starting to fade.

SOL DMI. Source: TradingView

ADX, a key component of the DMI, measures trend strength on a scale from 0 to 100 without specifying the direction. Values above 25 signify a strong trend, while those below 20 suggest weak or absent trends. Meanwhile, the positive directional indicator (D+) at 19.34 and the negative directional indicator (D-) at 19.81 reflect near-equal pressures from buyers and sellers, with a slight bearish dominance.

This combination of a declining ADX and nearly balanced D+ and D- suggests that while SOL remains in a downtrend, the bearish momentum may be losing steam. In the short term, this could lead to a consolidation phase or a potential reversal if buyer strength gains traction.

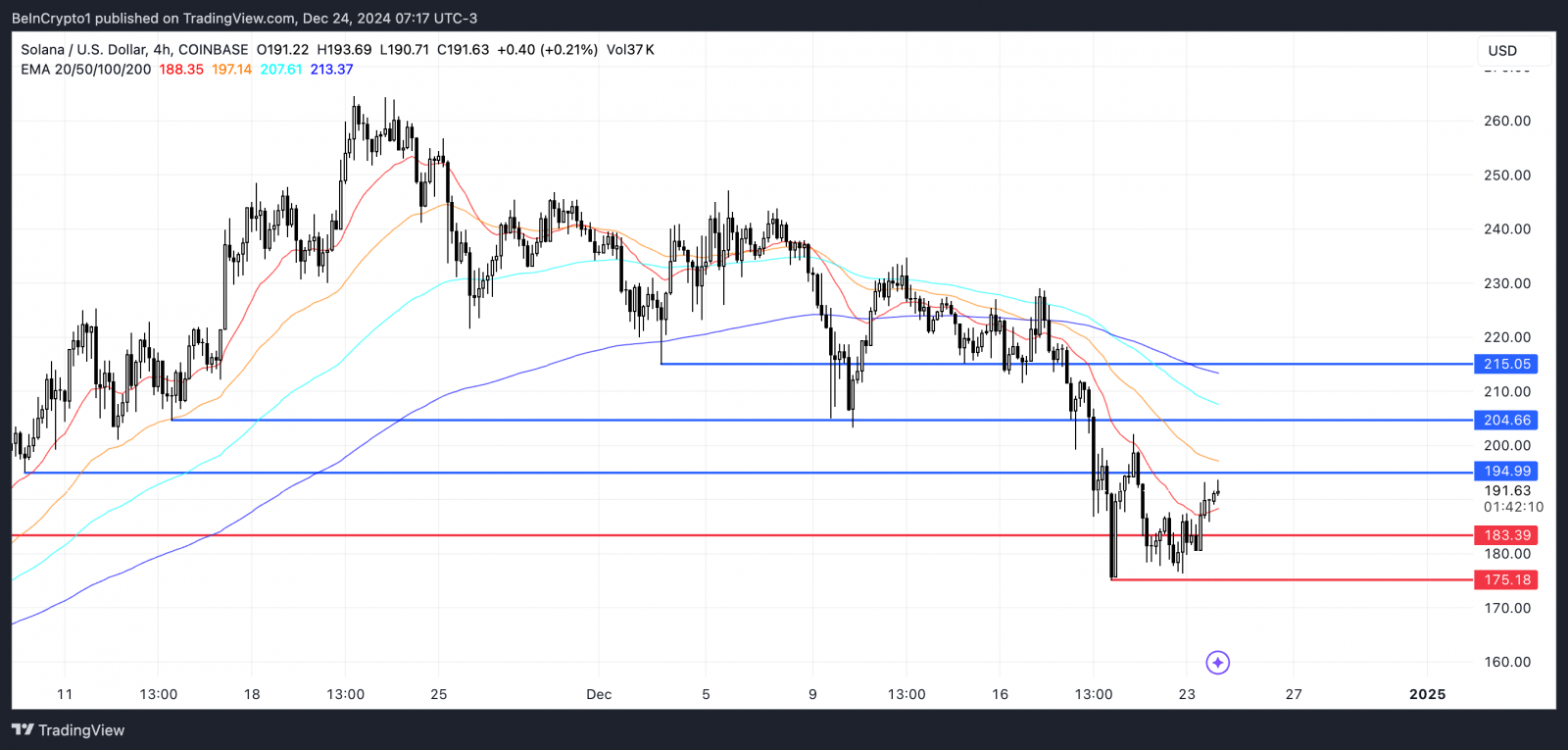

SOL Price Prediction: Back to $200 In December?

SOL price closest resistance around $195 is shaping up to be a critical level for its upcoming price movements. Currently, the Exponential Moving Average (EMA) lines are in a bearish configuration, with short-term lines below long-term ones.

However, the recent upward shift in short-term EMAs hints at a possible golden cross, a bullish signal that could indicate a trend reversal.

SOL Price Analysis. Source: TradingView

If Solana price successfully breaks the $195 resistance, it could target $204 next, with the potential to climb further to $215, marking a significant recovery.

On the downside, if the BBTrend remains deeply negative and the ongoing downtrend gains strength, SOL price could retest the $183 support level. A failure to hold this support could lead to a further decline, with the price potentially dropping to $175.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  Zcash

Zcash  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Huobi

Huobi  Status

Status  Lisk

Lisk  Waves

Waves  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond