AAVE Price Surges 6%, Sees Mixed Technicals, What’s Next?

AAVE ranked 49th as per market cap size. As per the Chainbroker, the fundamentals are highly rated as 8.55 out of 10. AAVE price action has been a tad bit suspicious though, here’s how.

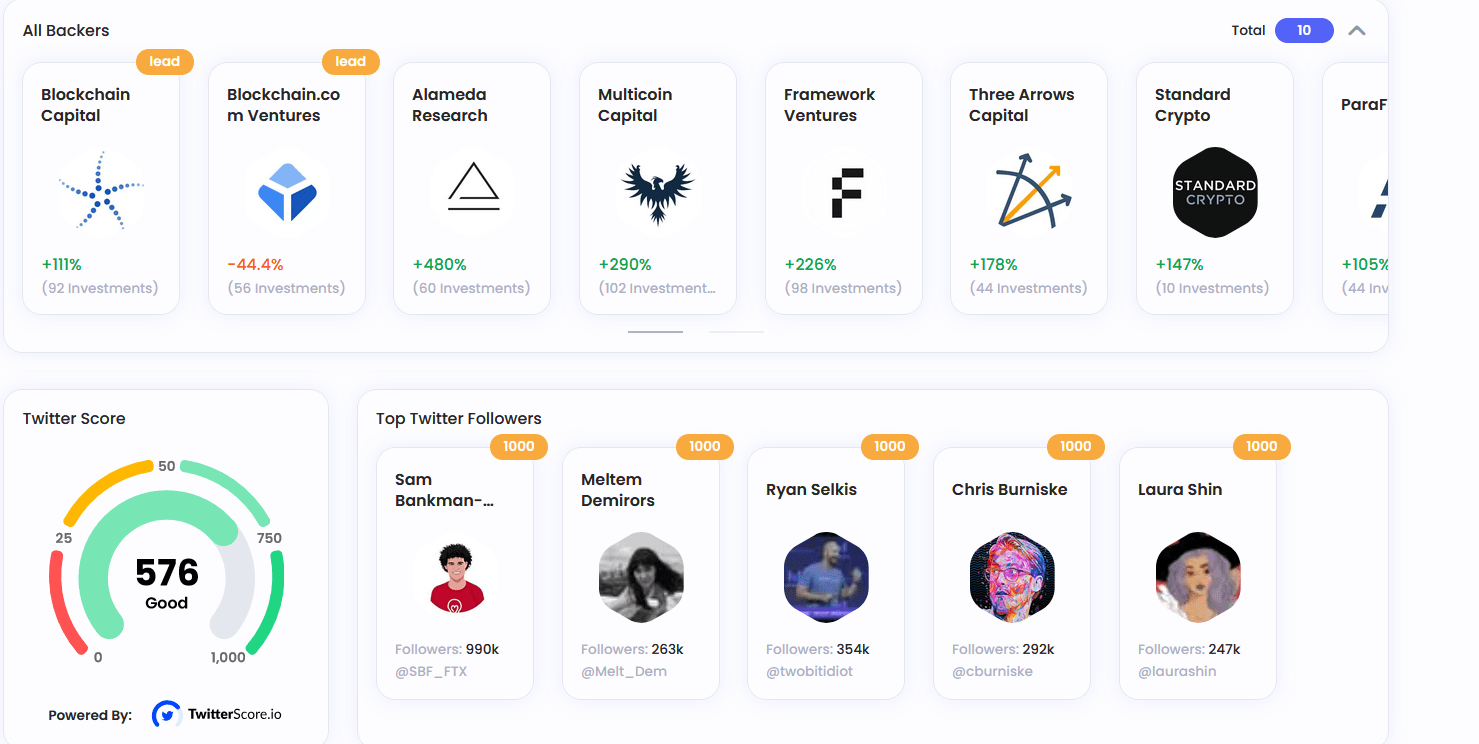

Meanwhile, it has strong backing from various organizations, who have made multifold investments in the asset. The most popular backers are @Blockchain Capital, @ Blockchain.com Ventures, and a few more.

Fundamental Stats | Source: Chainbroker

Even the asset happens to be socially active, too, with a Twitter score exceeding 576 and significant followers like @Sam Bankman and others.

What Does AAVE Price Action Signify?

As of writing, the AAVE managed to advance 6% but has been facing a tough time beating the 50-day and 200-day EMA bands.

AAVE price sawmore than 27% with a major spike from the $90 support over the last week.

The investors who have aped larger quantities have been waiting for AAVE to pierce through the EMA bands for a quick rise in the northward direction.

This support has been tested many times in AAVE and has proved resilient on the daily chart.

Overall, the scenario looks like one of range-trapped movements. Where its price has shown movement in the $80 to $120 range in the past 12 months (at press time).

On July 5th, the price rose with a liquidity grab after a major decline that led to beneath $70, but bulls regained from there and displayed more than 40% gains in the past 40 days. Where, the AAVE price last traded at $95.94, with 1.43 Billion market capitalization, and a spot volume inflow of $120.91 Million

What’s The Forecast For AAVE?

Since the AAVE price has shown a run from the range’s lower boundary to its higher border, mostly. Then, in the bullish case, the short-term rise could lead towards the upper boundary, delighting traders and cruisers in the asset.

However, the price has been showing a struggle at the upper border, and history has been evidence of it. Based on such a hypothesis, once it clears by piercing it, the bullish arrow could pierce the hurdle, which could lead to capturing the $134.01 and $145.01 price targets.

But, AAVE Dipping below $80.01 would mean deterioration piercing below the lower border of the range. Where $60 could be a support to watch out for.

Indicators, at the time of writing, showcased mixed signals, while price has been suppressed by both the 50-day and 200-day EMA bands, which has been stopping growth.

Meanwhile, the MACD has formed a bearish cross above the zero line with a histogram negative at -1.50. The RSI was above the median line at 47.69.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom