AAVE secures top gainer spot with 9% surge in 24 hours

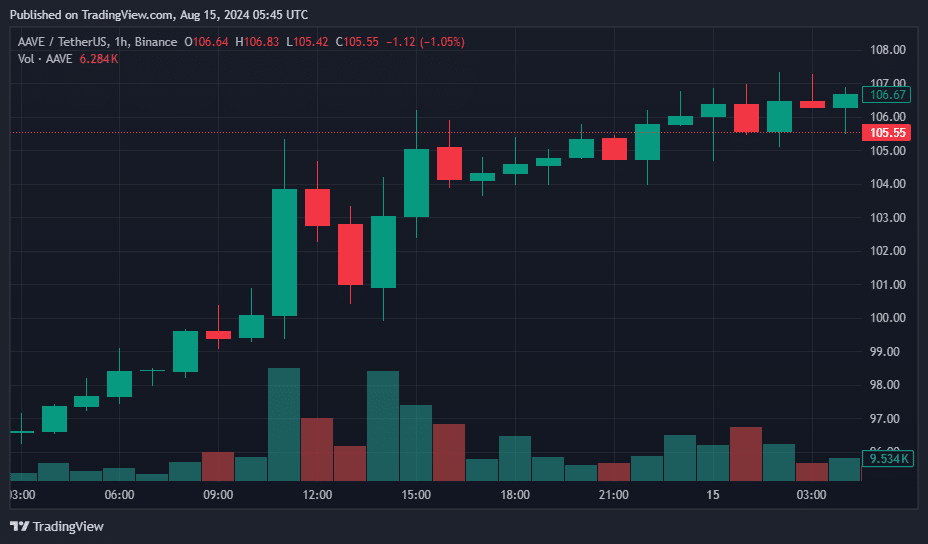

Aave, a decentralized crypto lending platform, experienced a 9% price surge on Aug. 15 morning, positioning it as the top performer in the crypto market.

At the time of this report, Aave’s (AAVE) price remained 8% higher, trading at $106.4, with its daily trading volume increasing by 78% to approximately $262 million. The market capitalization of Aave reached $1.57 billion, ranking it 54th among the largest cryptocurrencies.

AAVE 24-hour price chart — Aug. 15 | Source: crypto.news

Despite the recent surge in price, Aave is still 84% below its all-time high of $661.69, which was recorded in May 18, 2021.

Aave operates as a decentralized platform across 12 blockchain networks, specializing in overcollateralized loans. Users can deposit cryptocurrency to take out loans, with smart contracts automating the entire process, including fund distribution, collateral management, and fee assessment.

The recent surge in Aave’s price coincides with a broader recovery in decentralized finance protocols, particularly in lending and borrowing platforms.

Aave has set a new record for weekly active borrowers, according to an X post by its founder, Stani Kulechov, on Aug. 14. The platform reached around 40,000 active borrowers in a single week, surpassing the previous high from late 2022.

You might also like: Aave rallies 10% amid surging whale activity

This growth has been fueled by the emergence of new lending markets like Base and Scroll. Base (BASE) now accounts for nearly 30% of the unique wallets on Aave V3, with Layer-2 platforms Arbitrum (ARB) and Polygon (MATIC) following closely with 23.4% and 21% wallet shares, respectively, according to Dune Analytics.

Kulechov also mentioned that the number of weekly depositors on Aave is nearing peak levels. Earlier this month, the number of Aave depositors saw a significant spike, based on data from Dune Analytics.

Aave is currently the third-largest DeFi protocol by total value locked, with a reported TVL of $11.85 billion, according to DeFiLlama. Although the protocol’s TVL has increased by 70% this year, it remains below its peak of approximately $20 billion in October 2021.

The Aave token is currently trading within a horizontal channel pattern, suggesting a sideways trend with resistance levels at $115 and support at $80.

Technical indicators for 2023 appear positive, with the 50-day moving average pointing to an uptrend and the 14-day Relative Strength Index standing at 50.74, indicating a neutral position and the potential for continued sideways trading.

Throughout 2023, Aave has introduced several significant updates, including enhanced lending and borrowing features, improved security, and the integration of new DeFi protocols. The community also approved a fork called Seamless, designed to offer an alternative decentralized lending solution.

Earlier this year, Aave’s token price surpassed $100, and by June, wallets holding staked AAVE accounted for 17.09% of the token’s total supply, signaling growing adoption of the platform.

Read more: Chart of the week: Aave and Sui predictions hit the mark

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom