Analysts say Bitcoin is poised for $100k now that long-term holders have stopped selling

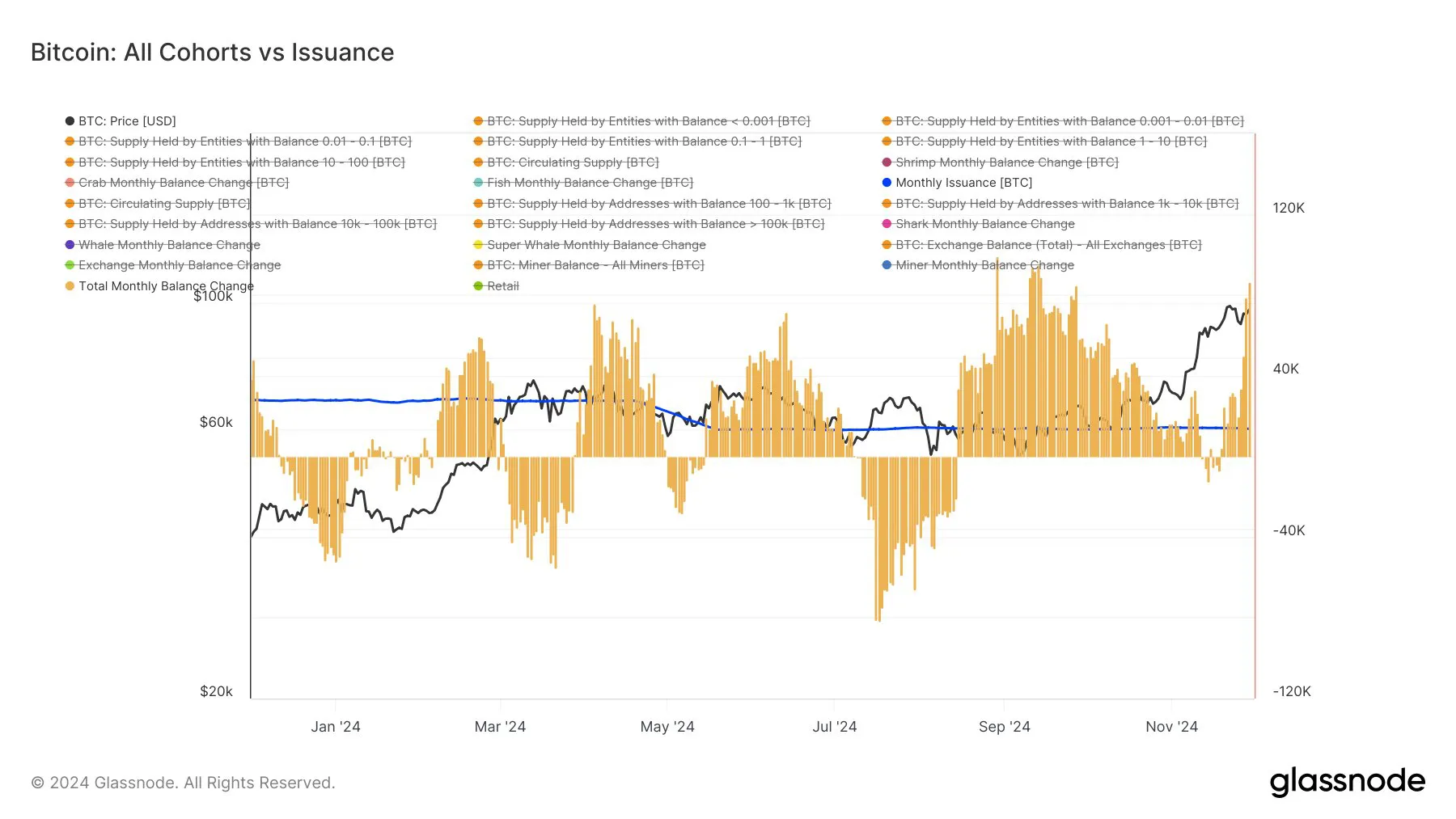

Crypto analyst James Van Straten believes that Bitcoin will cross $100,000 as long the demand for the flagship continues to outstrip supply. Van Straten shared this view in a post on X (formerly Twitter), noting a net accumulation of 87,000 BTC over the last 30 days.

According to the analyst, the return to accumulation is a great sign, showing that long-term holders (LTHs) selling off the flagship that has been taking profits have finally slowed down. Based on his analysis, this sell-off has been the reason behind Bitcoin’s struggle to reach $100,000.

Bitcoin saw 87k net accumulation in the last 30 days (Source: X/James Van Straten)

He said:

“Any LTH that wanted to take profit near 100k has pretty much done so. On top of all the STHs that capitulated on that 10% correction. If demand continues to outstrip supply, I don’t see what stops $BTC going through 100k.”

Van Straten’s view is shared by several market experts, including technical analyst Ali Martinez, who noted that the Bitcoin LTHs have booked profits on the flagship asset’s price increase. However, he observed that this is standard behavior in every bull market and warned against getting bearish or shorting Bitcoin based on that alone.

This cohort of holders’ selloff in November was the highest since April. According to CryptoQuant, LTHs offloaded 728,000 Bitcoin in November.

Whales back to accumulation mode

With the sell-offs now over, accumulation has returned, particularly among whales. Whales reportedly bought around $1.5 billion worth of Bitcoin during the last dip, taking advantage of the panic sell-offs by short-term holders (STHs) who sent almost $4 billion worth of BTC to exchanges, selling at losses.

STHs, who are likely resellers, have been selling off Bitcoin (BTC), possibly in anticipation of a price dip. However, several analysts, including Martinez, have observed that Bitcoin tends to move against market expectations.

Signs of a return to accumulation are evident in the outflows of BTC from exchanges, with Binance seeing historically low BTC inflows from other exchanges and Coinbase Prime recording the highest Bitcoin inflow since July 31.

CryptoQuant head of research Julio Moreno also observed that Bitcoin demand growth is accelerating again, noting that demand expansion will boost Bitcoin’s price.

Historical data shows Bitcoin will cross $100k before the year ends

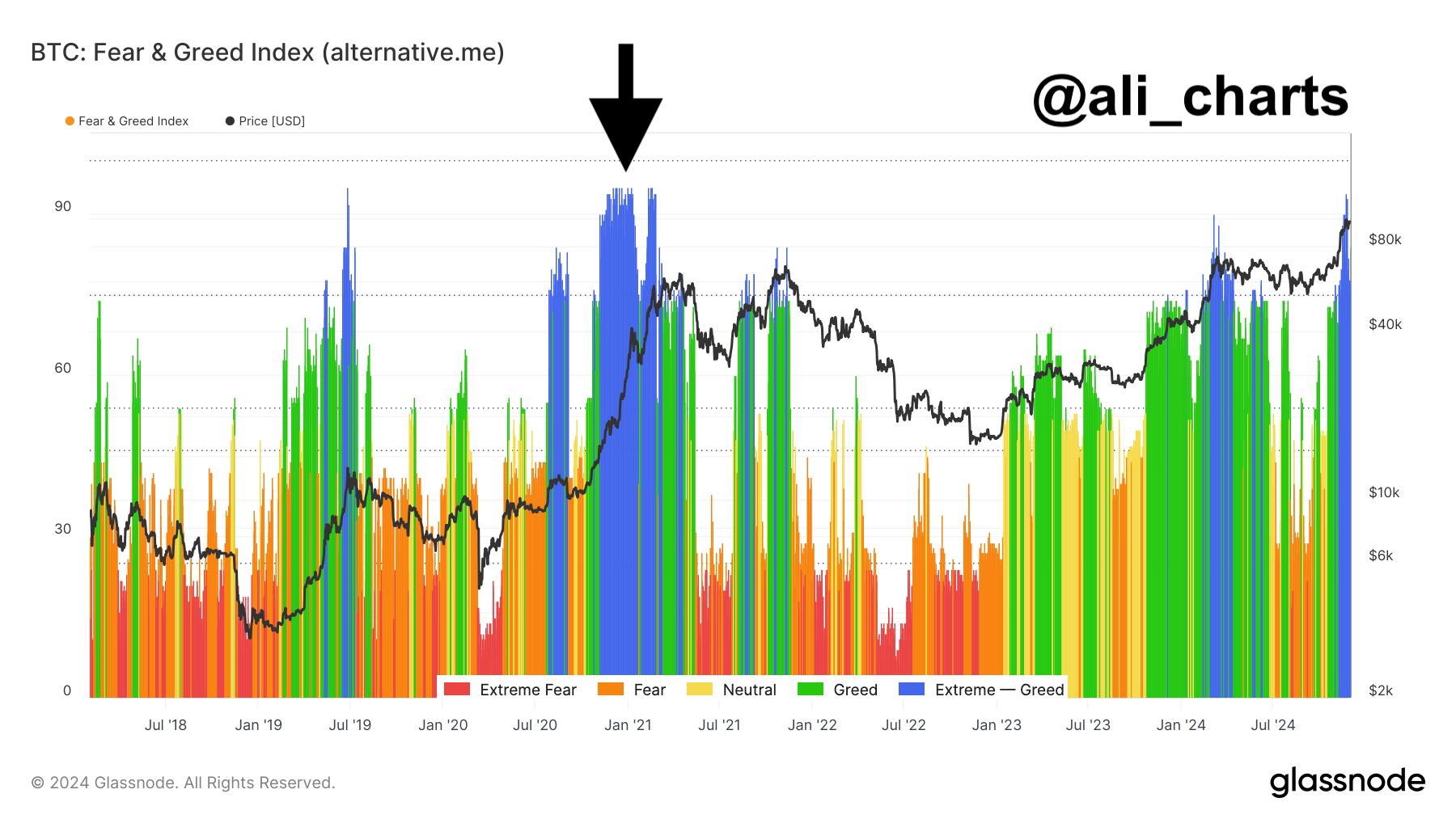

Meanwhile, current sentiments suggest market participants are very bullish on the asset. The Fear & Greed index is currently at Extreme Greed, the same sentiment as during the last bull market, where Bitcoin went from $15,000 to $57,000.

Bitcoin Fear & Greed Index is at Extreme Greed – Ali Martinez via glassnode

Additionally, Bitcoin’s historical performance in the last two Decembers after the US elections has been positive, gaining 30% and 46% in 2016 and 2020, respectively. If the same happens now, Bitcoin could finish 2024 trading between $125,000 and $140,000.

Despite the flagship asset gaining over 35% in November, on-chain data suggest it still has much room to run. Santiment data shows that Bitcoin’s Mean Dollar Invested Age has been dropping, with the average age of Bitcoin sitting in wallets now down to 466 days per coin. The Santiment analysts claim that continuous decline in this metric is evidence that we are still in the bull market.

Meanwhile, Cryptoquant analysts also believe the current bull market is nowhere near the top. They point to the Bitcoin value held by new investors, which is currently around 50%, far lower than the previous market, which tops at over 90% in 2017 and over 80% in 2021.

The analysts wrote:

“Bitcoin price tops typically occur when new investors enter the market to buy at extremely high prices, which causes them to hold a large proportion of the total value invested.”

Additionally, retail activity in this cycle has been relatively low. Retailers have actually reduced their holdings by 41,000 BTC since October, even as whales increased theirs by 130,000 BTC during the same period. This absence of high retail activity means there is no fear of missing out (FOMO), as the market top comes when retail starts buying aggressively.

Beyond that, the Bull-Bear Market Cycle indicator is currently in the bull phase and has not crossed to the overheated bull phase, which usually signifies a top. Nevertheless, the Bitcoin top price target based on realized price valuation is currently at $146,000. Historically, this metric has marked the top of the previous Bitcoin cycles.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Hive

Hive  Nano

Nano  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom