Aurum Launches $1B Tokenized Fund for Data Center Investments on XRP Ledger With Zoniqx

Private equity firm Aurum Equity Partners said Tuesday it is launching a $1 billion tokenized equity and debt fund on the XRP Ledger (XRP) network, an enterprise-focused blockchain closely associated with Ripple.

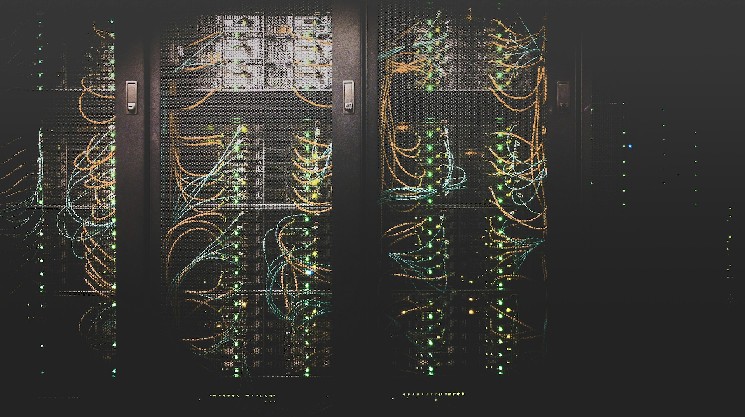

The fund focuses on investments in data centers across the U.S, United Arab Emirates, Saudi Arabia, India, and Europe, and it is claimed to be the “world’s first combined equity and debt tokenized fund,” according to the press release.

The fund leverages tech by San Francisco-based tokenization service provider Zoniqx to create security tokens of the underlying financial instruments.

The issuance marks a milestone for XRP Ledger and development firm Ripple Labs’ newfound ambition to claim a share of the booming real-world asset (RWA) tokenization space. Institutional investors are increasingly placing traditional financial products like bonds, credit and equity on blockchain rails in pursuit of operational efficiency gains and speedier around-the-clock settlements. The RWA market could grow to trillions of dollars over the next years, various reports from McKinsey, BCG, 21Shares and Bernstein estimated.

Ripple is also awaiting approval from New York state regulators to launch its U.S. dollar stablecoin, which would play a key role to improve liquidity and support institutions to tokenize and settle financial assets on the XRPL network, Ripple Labs President Monica Long said last week at the company’s annual Swell conference.

Read more: Ripple Names Exchange Partners for Stablecoin RLUSD, Awaits NYDFS Approval

“Tokenizing private equity is another emerging use case in RWA, tackling the challenges of illiquidity and limited access in these markets,” said David Schwartz, chief technology officer of Ripple and co-creator of the XRP Ledger. “By using XRPL’s ability to process transactions efficiently and securely, Aurum and Zoniqx are showing how real-world assets can be managed more effectively harnessing a decentralized blockchain.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom