Bitcoin 2024: Ten Months in Review, Key Milestones, and Expert Predictions for Year-End

As of Nov. 11, 2024, bitcoin (BTC), the undisputed crypto heavyweight, has enjoyed a phenomenal year. Over the last ten months, it has been breaking records across the board. From hashrates to daily transaction peaks, price surges, and making an impact in non-fungible tokens (NFTs) and decentralized finance (defi), BTC has been on a non-stop streak. To commemorate these achievements, we present an extensively researched recap of bitcoin’s 2024 highlights, topped off with year-end price forecasts from Bitcoin.com experts.

Bitcoin’s Many Achievements Over the Last 312 Days

In the wake of the U.S. presidential election, where Donald Trump claimed the 47th presidency, bitcoin (BTC) soared to new USD heights. Over the past 312 days, BTC has climbed by 92% against the U.S. dollar, with Bitstamp recording an all-time high of $89,482 per coin on Nov. 11. But that’s just the start. This year has been a record-breaking journey for the crypto titan. Thanks to insights from the analysts at Bitcoin.com News, here’s a full rundown of BTC’s 2024 achievements.

After Bitcoin.com’s research report was completed, bitcoin (BTC) hit an all-time high of $93,483 on Nov. 12, 2024.

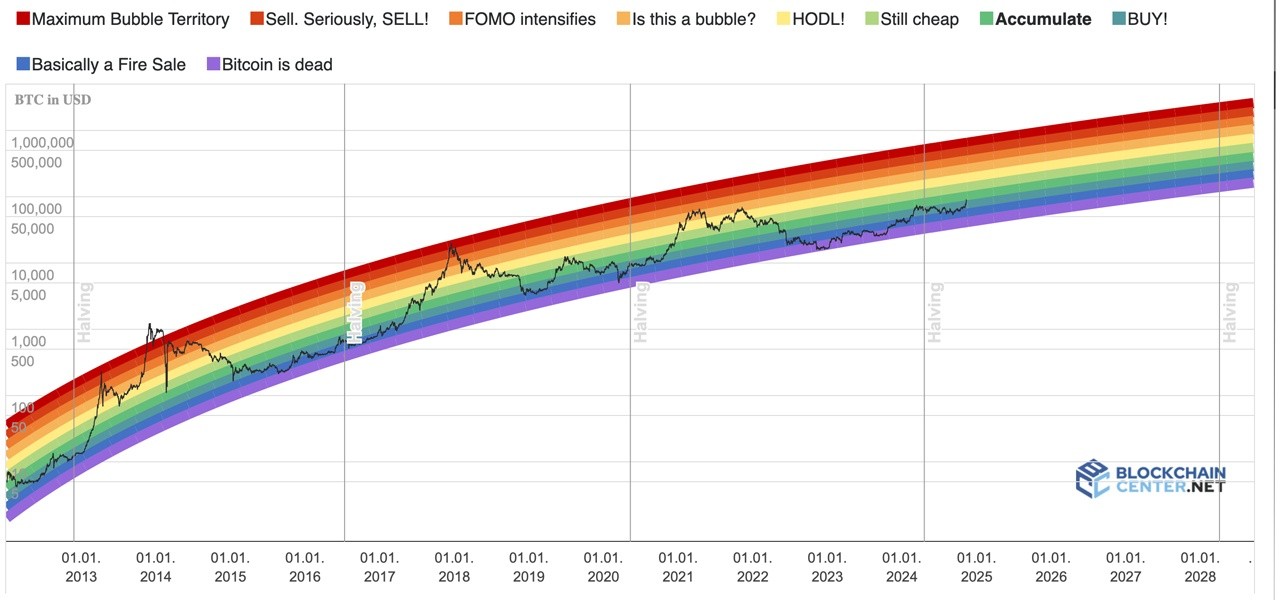

Bitcoin logarthimic rainbow chart. Source: blockchaincenter.net

Bitcoin Fees and Transfers

The Bitcoin network shattered records in 2024, hitting all-time highs in onchain fees and daily confirmed transactions. While its transfer rate doesn’t surpass all current blockchain networks, Blockchair.com stats show Bitcoin hit nearly a million transfers in a single day. On April 23, the network reached its peak with a staggering 927,010 transactions in just 24 hours. Another high point came on Sept. 8, with 910,083 transactions recorded. This surge in onchain activity was largely driven by everyday financial transactions, along with Ordinal inscriptions and Runes.

Bitcoin transactions confirmed per day. Source: blockchair.com

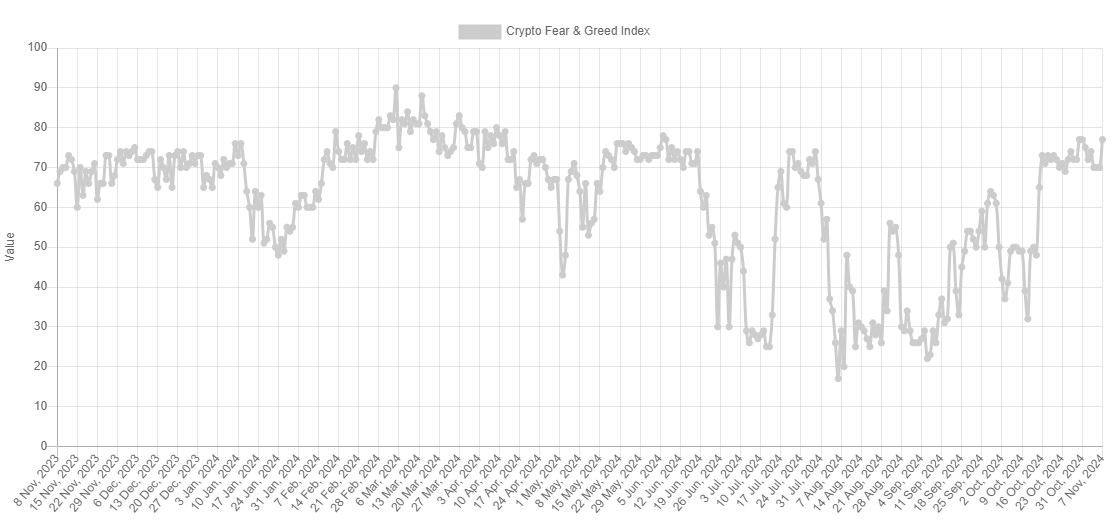

Following the fourth Bitcoin halving event, transfer fees soared to an all-time high of $240 per transaction on April 19, shortly after block height 840,000. The average fee paid during the 24-hour period post-halving was around $127 per transfer, with a median of $92. Since then, fees have generally dropped, with average onchain fees now ranging between $1.50 and $2.50 per transaction depending on the day. As of this analysis, the average transaction fee stood at 0.000016 BTC, or $1.22 per transfer, translating to 7.1 satoshis per virtual byte. Meanwhile, the median fee was 0.0000065 BTC, or $0.50.

Bitcoin average fee per transaction. Source: blockchair.com

While the highest average fee reached $127, the most economical average, clocking in around $0.38, was paid on Sept. 8. Across all daily average fees, the typical payout came to $5.51 per transaction.

Hashrate and Difficulty

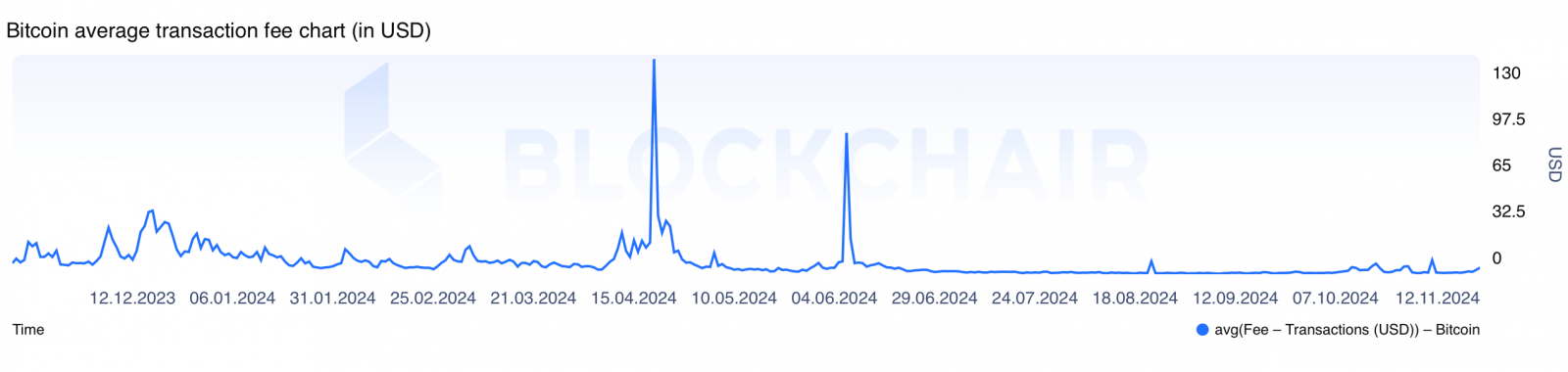

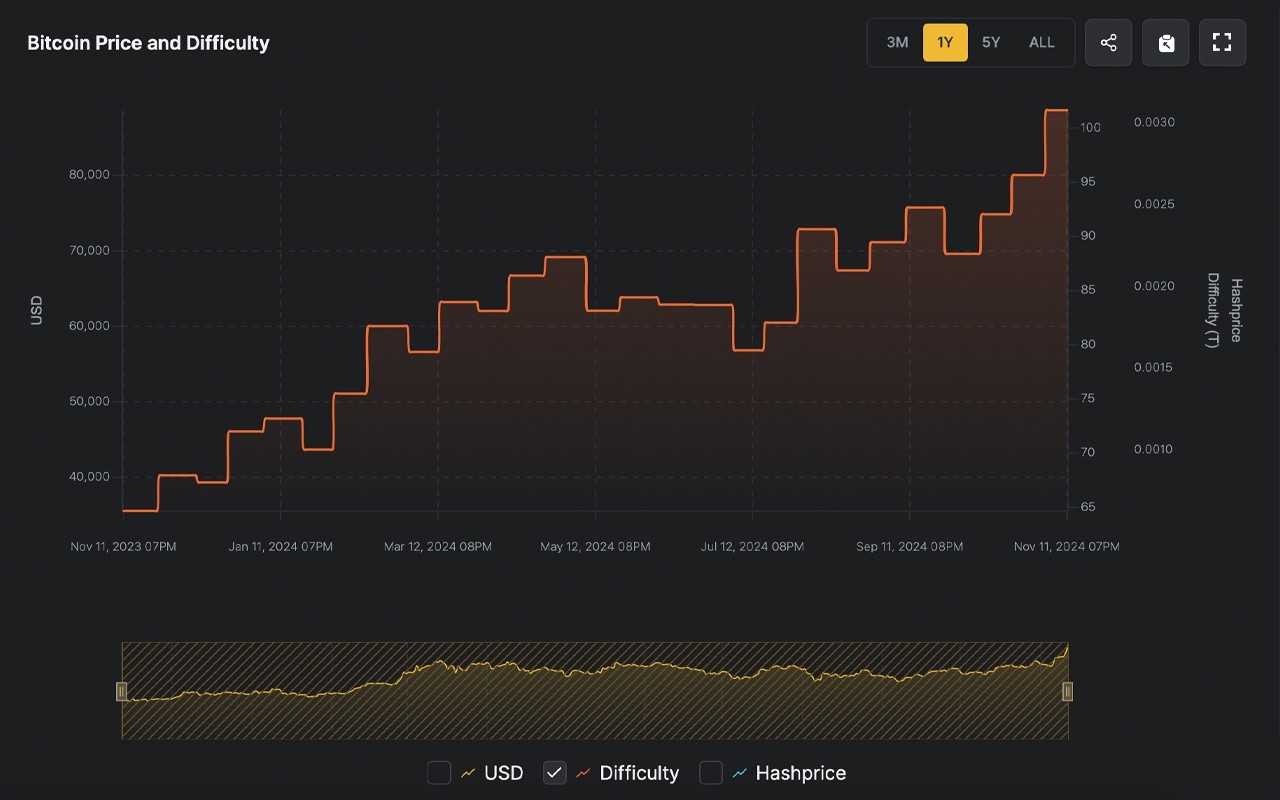

On Jan. 1, 2024, the Bitcoin blockchain’s total computing strength kicked off the year at roughly 512 exahash per second (EH/s). Fast forward to now, and the hashrate is cruising at 719 EH/s, meaning over 200 EH/s joined the network in the past ten months. The seven-day simple moving average (SMA), according to hashrateindex.com, hit its highest point of 766 EH/s on Nov. 1, 2024. This ramp-up in computational muscle also sent Bitcoin’s mining difficulty soaring to unprecedented levels, touching an impressive 100 trillion. On Nov. 4, the most recent difficulty adjustment nudged this figure up to 101.65 trillion, marking the toughest challenge miners have ever faced to unlock a block.

Bitcoin network hashrate (7-day SMA). Source: hashrateindex.com

This surge in hashrate is a testament to Bitcoin’s network resilience and security. Hashrate quantifies the computational power miners lend to the network, measured in hashes per second (H/s). A climbing hashrate reflects a more fortified network, as more miners are vying to validate transactions and uphold blockchain integrity. This enhancement also means increased resistance to potential threats, as any would-be attacker would need colossal resources to disrupt the system. Difficulty, which adjusts in response to hashrate changes, keeps block discovery close to a ten-minute pace, aligning supply with demand. Altogether, in 2024, these metrics spotlight Bitcoin’s core network robustness and dependability.

Bitcoin network difficulty. Source: hashrateindex.com

Spot Bitcoin Exchange-Traded Funds

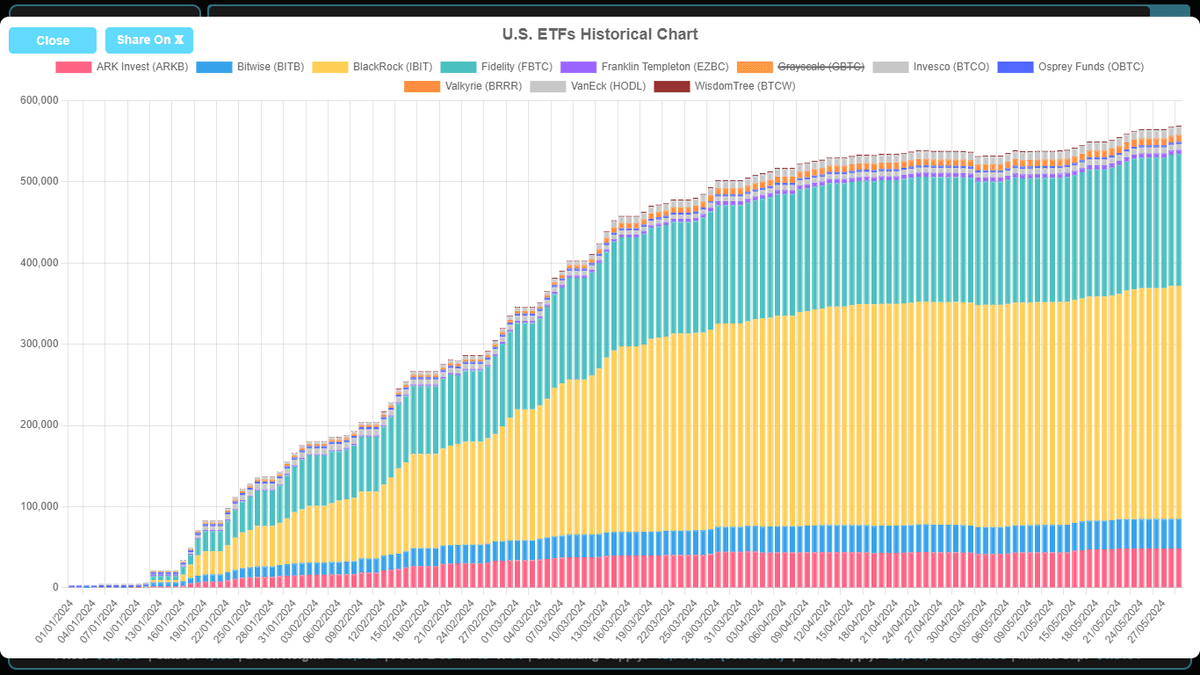

On Jan. 11, 2024, a milestone was reached as ten spot bitcoin exchange-traded funds (ETFs) began trading on the stock exchange. Now, the ETF count has climbed to 12, and since their market debut, sosovalue.com stats indicate that these funds have amassed $25.79 billion in positive inflows. According to data from timechainindex.com, the ETFs collectively hold over 1 million BTC, translating to a value of $78.9 billion. This reserve represents 5.21% of bitcoin’s total market cap.

U.S. spot bitcoin exchange-traded fund (ETF) reserves. Source: timechainindex.com

Among the ETFs, Blackrock’s IBIT leads, managing a substantial holding of more than 446,000 BTC. Grayscale’s GBTC follows with just over 217,000 BTC, and Fidelity’s FBTC secures more than 188,000 BTC. Ark Invest and 21shares’ ARKB holds over 48,000 BTC, while Bitwise’s BITB oversees more than 42,000 BTC. Grayscale’s Bitcoin Mini Trust rounds out the list, managing upwards of 34,000 BTC. The six ETFs mentioned above together manage a hefty 975,000 BTC, out of the grand total of 1.002 million BTC held across all 12 funds.

With over 5% of bitcoin’s market cap now controlled by ETFs, the rapid growth of these investment vehicles underscores their increasing role in mainstream financial markets. This substantial accumulation highlights a shift toward institutional adoption, reflecting a confidence in bitcoin’s long-term potential and a pivotal step in bridging the gap between traditional finance and digital assets.

NFTs

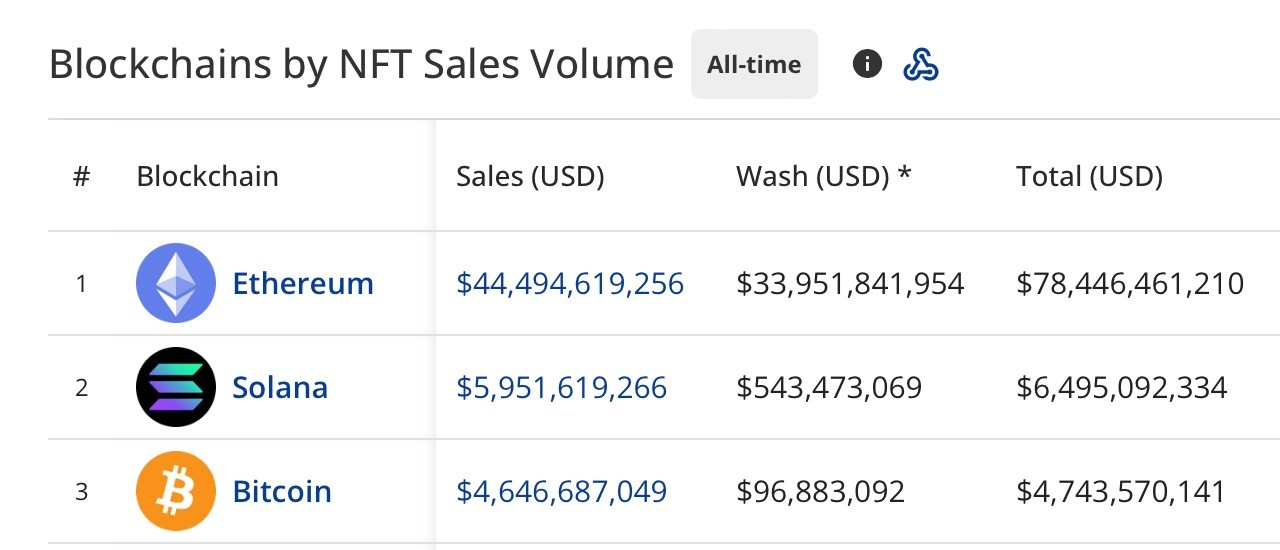

Since late 2023, bitcoin has been tapped to mint non-fungible tokens (NFTs) at a scale unlike anything seen before. This shift began with the debut of Ordinals Theory, a creative innovation by programmer Casey Rodarmor. Ordinals offer a unique method for embedding data on the Bitcoin blockchain, enabling the creation of NFTs and tokens like BRC20s. According to ordinals.com, around 77,282,122 Ordinal inscriptions have been recorded on the Bitcoin blockchain since the very first one.

All-time non-fungible token (NFT) sales. Source: cryptoslam.io

This surge of digital collectibles has ignited a thriving economy of tokens and NFTs, with bitcoin clocking $4.63 billion in NFT sales over more than four million transactions, according to cryptoslam.io metrics. This impressive volume has propelled Bitcoin to the third spot among blockchains in NFT sales. Although it trails Ethereum’s $44 billion, Bitcoin isn’t far off from Solana, the runner-up below Ethereum, with $5.94 billion in sales. April 2024 marked Bitcoin’s peak sales month, with $713.77 million settled during that time. Despite other layer one (L1) chains’ substantial head start in NFTs, Bitcoin’s rapid climb to the third position stands out as an achievement.

Decentralized Finance

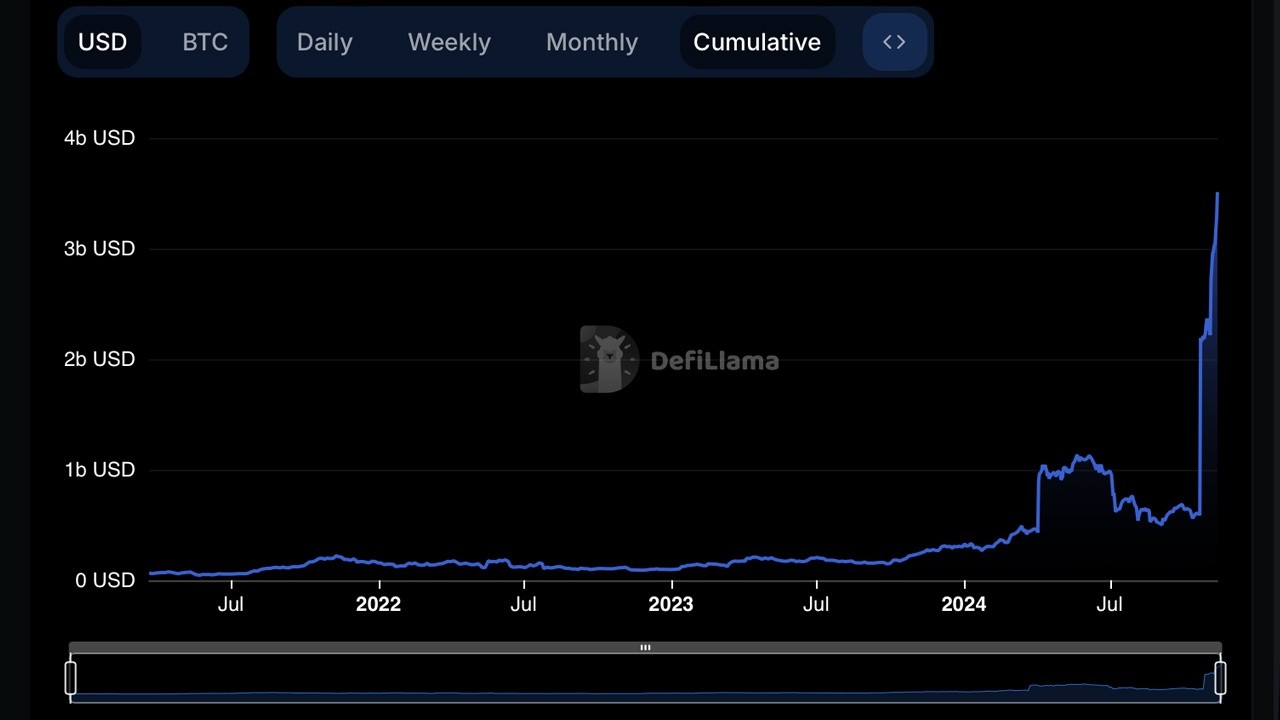

Just as non-fungible tokens (NFTs) have captivated attention, Bitcoin has made its mark in decentralized finance (defi) this year. In 2024, Bitcoin (BTC) holds a hefty $3.29 billion in value across 24 protocols. Leading the pack, Babylon claims the highest stake with $1.922 billion, while Lombard and Solvbtc follow closely, embracing the world of BTC staking. Through Babylon and its staking peers, bitcoin holders can put their BTC to work, earning a yield along the way.

Total value locked (TVL) in Bitcoin-centric decentralized finance (defi) protocols. Source: defillama.com

Ranking as the fifth largest blockchain in terms of defi value, bitcoin’s influence in 2024 is quite notable. Additionally, defillama.com stats show ten Bitcoin sidechains collectively manage $2.01 billion in assets. This group includes Core with $698.44 million, Bitlayer at $462.29 million, Bsquared at $226.83 million, Rootstock holding $194.93 million, and Merlin with $163.36 million. Rounding out the list, we see Stacks at $102.06 million, BOB with $79.4 million, Bouncebit at $51.12 million, Map Protocol with $17.5 million, and Rollux holding steady at $16.59 million.

Bitcoin’s deepening role in defi and the value flowing into its protocols reveal a strong demand for decentralized financial tools that go beyond typical layer one (L1) native proof-of-stake (PoS) currencies. With sidechains and staking options advancing, bitcoin’s influence continues to grow, connecting users to a wide range of defi possibilities and reshaping choices in this evolving ecosystem. The potential is immense.

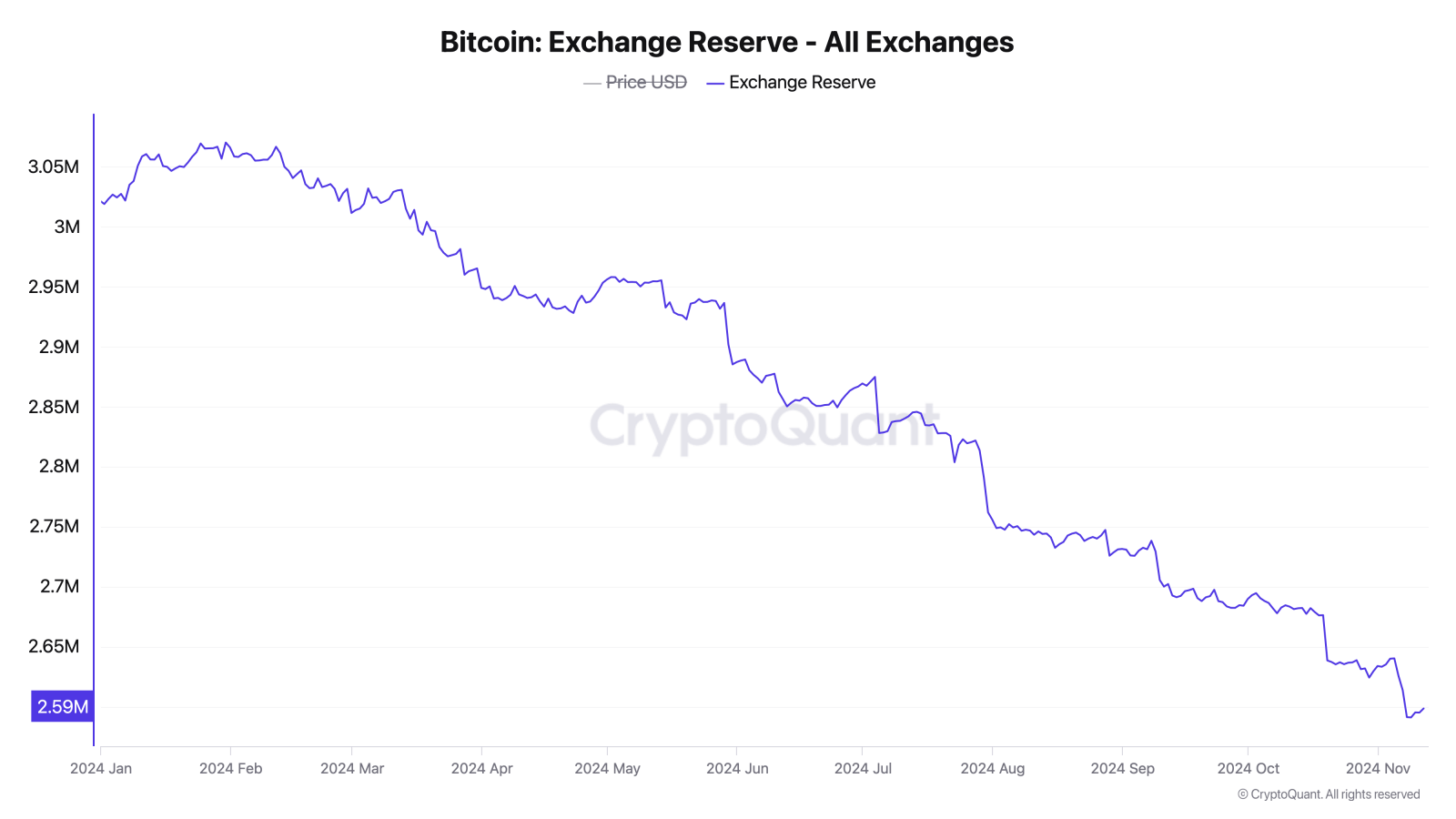

Exchange Reserves

Throughout 2024, bitcoin (BTC) held on exchanges has steadily declined over the last 10 months. In Jan., centralized exchanges held 3.02 million BTC, according to cryptoquant.com. As of Nov. 11, 2024, that figure has fallen to 2.59 million BTC, reflecting a withdrawal of 430,000 BTC this year—a level not seen since November 2018.

Bitcoin exchange reserves year-to-date. Source: cryptoquant.com

The ongoing decrease in bitcoin held on exchanges may signal a shift toward long-term holding, as more investors choose self-custody or alternative storage methods. This trend highlights a possible sentiment of reduced selling pressure, hinting that investors could be increasingly confident in bitcoin’s future prospects, holding BTC outside exchanges rather than readily available for trading.

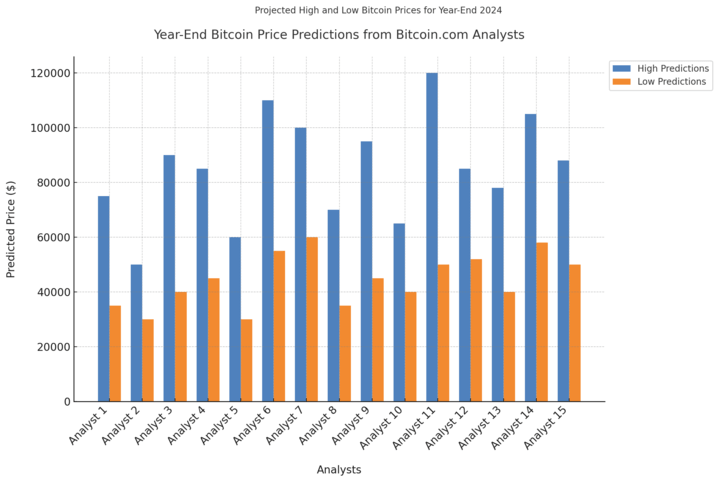

Year-End Price Predictions from Bitcoin.com Experts

In the aggregation of year-end price predictions from Bitcoin.com experts, we discerned a noteworthy range of foresight. The highest prediction stands at $120,000, highlighting a bullish outlook amidst prevailing market optimism. In contrast, the most conservative estimate is $25,000, illustrating cautious sentiments regarding potential market downturns. The average high across all predictions is approximately $89,100, while the average low is around $57,400, which signifies a generally positive but varied expectation for Bitcoin’s closing price for the year.

Bitcoin.com analyst price predictions collected between Oct. 27 to Nov. 5, 2024.

One Bitcoin.com expert humorously attributes their prediction to “For the memes,” underscoring a lighthearted approach to the volatile crypto market. Meanwhile, another specialist reflects on “short-term volatility following the election” and historical “halving cycles,” suggesting a nuanced analysis of political and cyclical impacts on Bitcoin. These diverse perspectives from Bitcoin.com experts underscore the complex interplay of humor, political events, and historical data in shaping their financial forecasts.

“Four years ago bitcoin ran from $15,000 at the election to $27,000 by the end of the year, so about a 2x,” one Bitcoin.com analyst remarked while sharing his prediction. “Acknowledging that more inflows are needed this cycle given the higher market cap, I’m expecting a similar but slightly muted move this time around.”

The Bitcoin.com analyst added:

In my view, the positive forces from last cycle (halving effect, zero interest rates, stimulus checks, cabin fever from lockdowns), roughly equate to the positive forces in this cycle, which are halving effect, ETF, pro-bitcoin president, coordinated global monetary easing regime, and less trust in tradfi and institutions

Another expert predicts a significant uptrend, expecting regulatory changes favorable to crypto, which they believe will establish the U.S. as the “Bitcoin capital of the world.” This optimism is echoed in another expert’s prediction, where they envision a rally to $75,000, influenced by political victory and monetary policy already priced into the market. Both contributors highlight the critical role of political developments and their direct implications on Bitcoin’s market dynamics.

These diverse predictions from Bitcoin.com experts, infused with personal insights and market analysis, illustrate a rich tapestry of expectations for Bitcoin’s year-end price. By reflecting a range of $25,000 to $120,000, they not only provide a broad spectrum of potential outcomes but also encapsulate the inherent uncertainties and excitement surrounding Bitcoin’s future. As we move closer to the end of the year, these forecasts will be pivotal in shaping investor sentiment and market strategies, offering a fascinating glimpse into the collective mindset of seasoned cryptocurrency analysts.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Stellar

Stellar  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Zcash

Zcash  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy