Bitcoin (BTC) Pulls Back from Festive Highs, Risks Falling Below $90,000

Bitcoin, which saw a modest rally during the Christmas period, has recently witnessed a decline. The market participants appear to be booking profits, exerting downward pressure on the leading cryptocurrency’s price.

With weakening buying activity, BTC’s price may soon fall below the critical $90,000 mark. This analysis explores some of the reasons behind this projection.

Bitcoin Bears Apply More Pressure

BTC’s decline over the past few days has pushed its price below the Leading Span A (green line) of its Ichimoku Cloud indicator, where it currently trades. This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price falls below the Leading Span A of its Ichimoku Cloud, it indicates weakening momentum and a potential bearish shift. The Leading Span A represents a near-term support level, so breaking below suggests diminishing strength in the asset’s uptrend.

Bitcoin Ichimoku Cloud. Source: TradingView

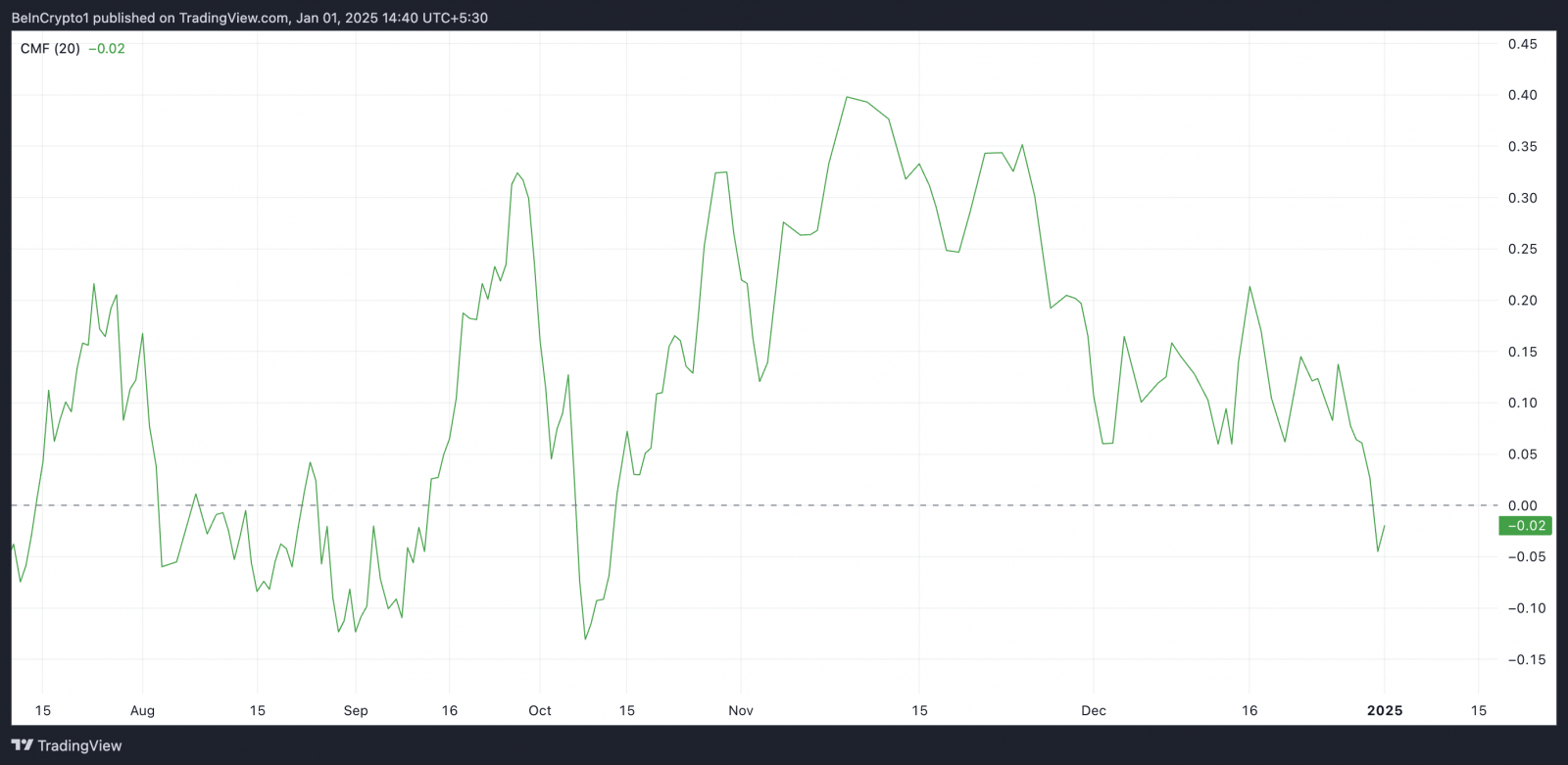

Further, the coin’s negative Chaikin Money Flow (CMF) confirms the waning demand for BTC. As of this writing, the indicator lies below the zero line at -0.02.

Based on price and volume, the CMF indicator measures the strength of money flow into or out of an asset over a specific period. As with BTC, when its value falls below zero, it indicates that selling pressure dominates, suggesting more outflow of money than inflow. This is a bearish signal that implies weakening demand and potential downward price momentum.

Bitcoin Chaikin Money Flow. Source: TradingView

BTC Price Prediction: Will $91,000 Support Hold?

Bitcoin’s next major support level, which lies at $91,488, may fail to hold if the demand weakens further. In that scenario, the coin’s price could fall below $90,000 for the first time since early November to trade at $86,697.

Bitcoin Price Analysis. Source: TradingView

However, if BTC experiences a resurgence in buying activity, this could propel its price above the dynamic resistance of $97,675 offered by the Leading Span A of its Ichimoku Cloud. A successful breach of this level could drive BTC’s price toward revisiting its all-time high of $108,230.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  DigiByte

DigiByte  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy