Bitcoin Bull Run To Resume Soon? Crypto Market Liquidity At Record Highs

According to the latest on-chain data, liquidity in the cryptocurrency markets has reached an all-time high. Here’s the implication of the rising liquidity on the price of Bitcoin and its future trajectory.

Stablecoin Market Cap Hits New Highs — Impact On Bitcoin Price

In its latest report, CryptoQuant revealed that liquidity in the crypto market hit a record high in late September, sparking conversations about the Bitcoin bull market resuming. According to the on-chain analytics firm, crypto market liquidity is measured by stablecoin value and market capitalization, which now stands at around $169 billion.

Data from CryptoQuant shows that the total market capitalization of major US dollar-backed stablecoin has increased significantly so far in 2024, rising by 31% (equivalent to $40 billion) year-to-date. Most of the growth, though, was triggered by the two largest stablecoins, Tether’s USDT and Circle’s USDC.

Source: CryptoQuant

Related Reading: Elon Musk Fuels Dogecoin Frenzy With Shiba Inu Mascot In New Cybercab

Unsurprisingly, USDT and USDC continue to dominate the stablecoin industry, with market shares of 71% and 21%, respectively. According to data from CryptoQuant, USDT’s market capitalization has grown by 30% in 2024 (about $28 billion) while USDC’s market cap is up by 44% (equivalent to $11 billion) year-to-date.

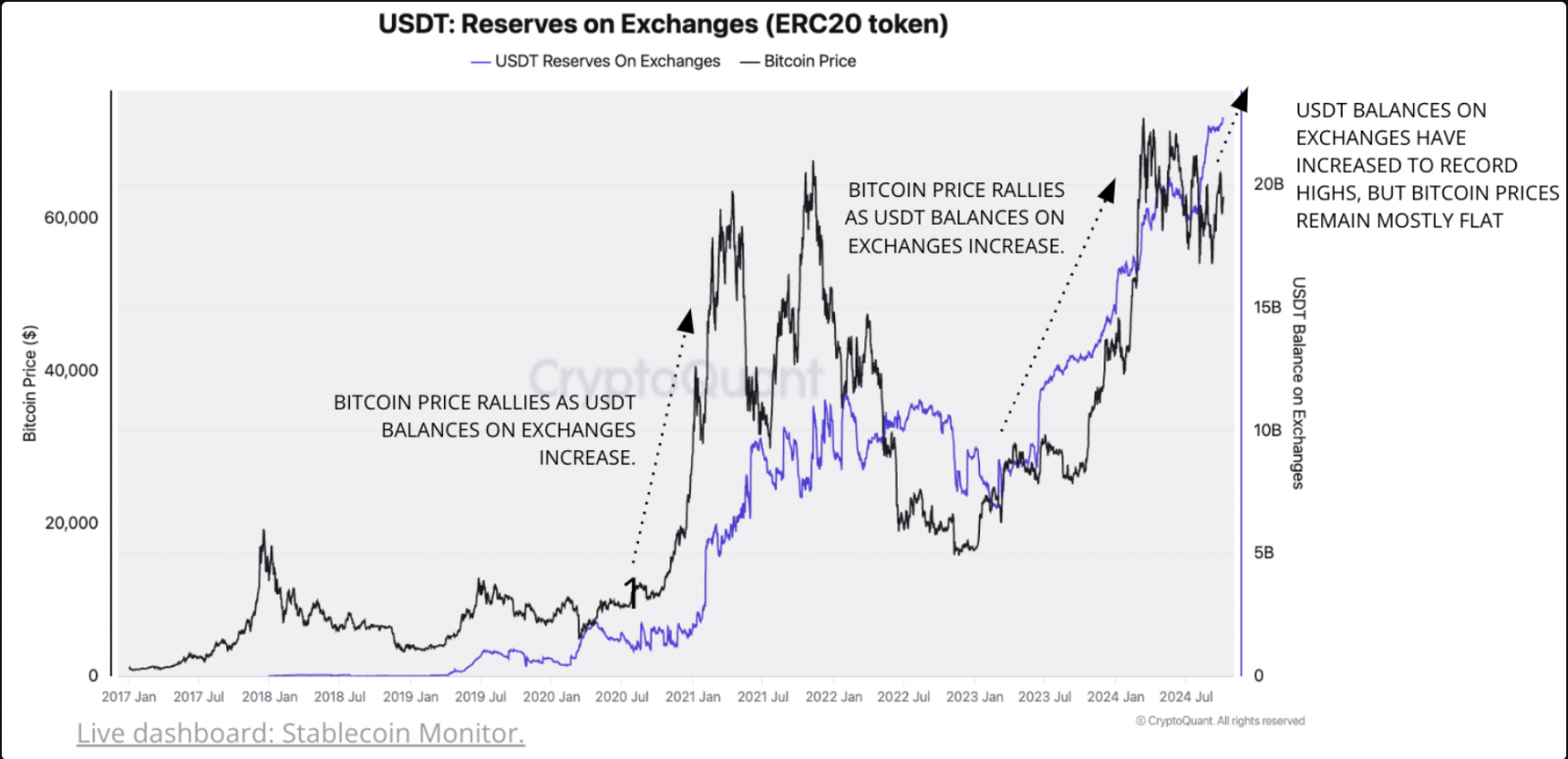

Another strong signal of growing market liquidity is the record-high stablecoin balances on centralized exchanges. Specifically, this growth is driven by USDT (ERC20 on the Ethereum), which has seen its balances on exchanges hit a record high of 22.7 billion in October. This reflects a 54% increase (about $8 billion) so far in 2024.

Historically, growing balances of stablecoins on exchanges are positively associated with higher crypto market prices, specifically the Bitcoin price. This is because the larger stores of stablecoins can signal more buying power for investors, as they can quickly trade stablecoins for other cryptocurrencies on exchanges (known to offer these trading services).

Larger stablecoin balances on exchanges can also signal the readiness of investors to accumulate crypto assets. Ultimately, this buying pressure tends to push asset prices to the upside, especially as investors often purchase expecting upward price movement.

With the growing liquidity in the market, investors have been led to wonder about the Bitcoin bull run resuming soon. It is worth noting that the total amount of USDT (ERC20) on exchanges has risen by 146% from $9.2 billion to $22.7 billion since January 2023, when the current cycle officially started.

However, investors might want to lower expectations, considering that these USDT balances have increased by 20% since August 2024 while Bitcoin’s price has remained relatively quiet.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at around $62,750, reflecting an almost 3% increase in the past day.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom