Bitcoin call options clustering at $70k show bullish skew

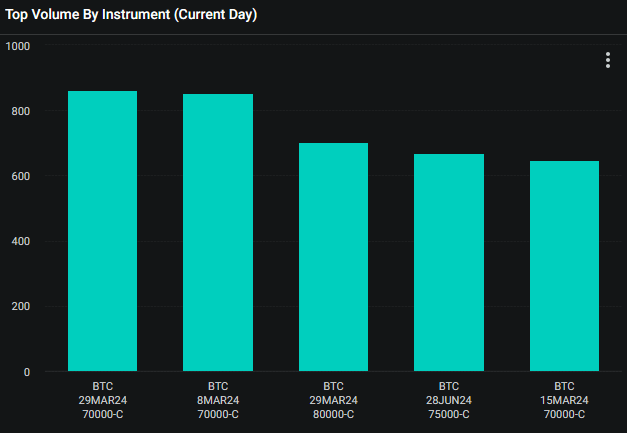

Analysts highlight the significant concentration of call options for Bitcoin, set to expire at the end of March, with a strike price of $70,000.

This information, provided by Bitfinex‘s Head of Derivatives Jag Kooner, suggests a growing optimism regarding Bitcoin’s (BTC) value.

Derebit’s Top Volume By Instrument Chart | Source: Derebit

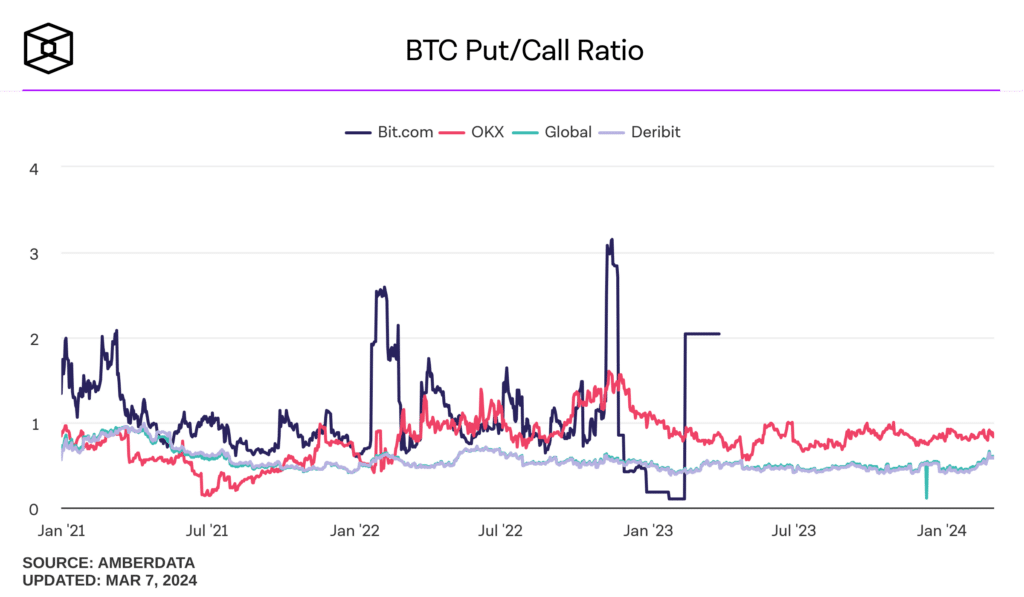

Kooner notes that the put-call ratio, a key indicator of market sentiment, has consistently remained below 0.6 for the first time in six months, indicating a bullish outlook among traders.

The global put-call ratio for Bitcoin options now stands at 0.6, according to The Block’s Data Dashboard. A ratio below 1 signals bullish sentiment, as it shows a preference for calls, which are bets on the asset’s price increase.

Conversely, a ratio above 1 would indicate bearish sentiment, highlighting a greater interest in puts, which are protective measures against a price decline.

You might also like: Elon Musk’s Tesla, SpaceX owns more than $1.3b in Bitcoin

Kooner pointed out that implied volatility in the options market has decreased noticeably. The decrease has reduced option premiums, making it more cost-effective for traders to enter positions.

Specifically, Deribit’s implied volatility index for Bitcoin fell from 77% to 72% over the past 24 hours. Lower volatility expectations suggest traders anticipate less price fluctuation shortly, affecting the pricing of options contracts.

Options are financial derivatives that allow traders the choice, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified date.

Call options grant the right to buy, whereas put options offer the right to sell. Purchasing put options generally reflects a bearish market view, while purchasing call options indicates a bullish stance.

Read more: Deribit sees significant interest in $50k Bitcoin call options

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom