Bitcoin Exchange Balances Plunge as Long-Term Holders Help Drive Price to $98,000

Bitcoin balances on crypto exchanges have reached historic lows, as on-chain data points to a rapid depletion of available inventory.

A recent note from 10X Research on Sunday highlighted the trend, underscored by a sharp drop in the amount of Bitcoin available to buy.

It contrasts sharply with trends observed in late summer when a sudden inflow temporarily replenished exchange reserves, according to the report.

This time, however, no such inventory boost has occurred, exacerbating the supply crunch.

Bitcoin and the broader crypto market have been bolstered by favorable catalysts that point to continual growth in the coming year, analysts say.

President-elect Donald Trump has vowed to establish a Bitcoin reserve in the U.S. while protecting crypto mining interests and crafting favorable industry policy.

That has helped drive Bitcoin’s price to record highs just below $100,000 and has revamped the asset’s image as a store of value in the eyes of investors.

On-chain analytics suggest that long-term holders—often viewed as a stabilizing force in the market—are firmly holding their positions, limiting the flow of Bitcoin into exchanges and reducing liquidity.

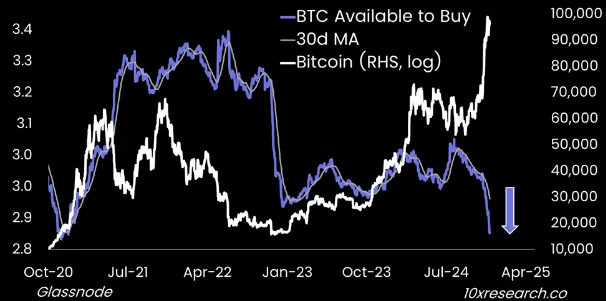

The attached chart from 10X Research, leveraging Glassnode data, reveals a clear divergence between Bitcoin’s available supply on exchanges and its price.

Shrinking Bitcoin Supple on Exchanges. Image: 10X Research

The blue line, representing the 30-day moving average of Bitcoin available to buy, has plummeted.

Meanwhile, Bitcoin’s price, plotted on a logarithmic scale, surged sharply in the latter half of 2024, recently nearing the $100,000 threshold.

Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—report sufficient Bitcoin reserves to meet buyer demand, 10X notes.

Smaller exchanges face increasing challenges in maintaining liquidity, which could lead to heightened price volatility.

A tightening supply coincides with broader macroeconomic trends, including institutional interest in Bitcoin-driven financial products such as spot ETFs.

Shrinking exchange inventory may further drive upward price pressure as demand from both retail and institutional players grows, Decrypt was previously told.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom