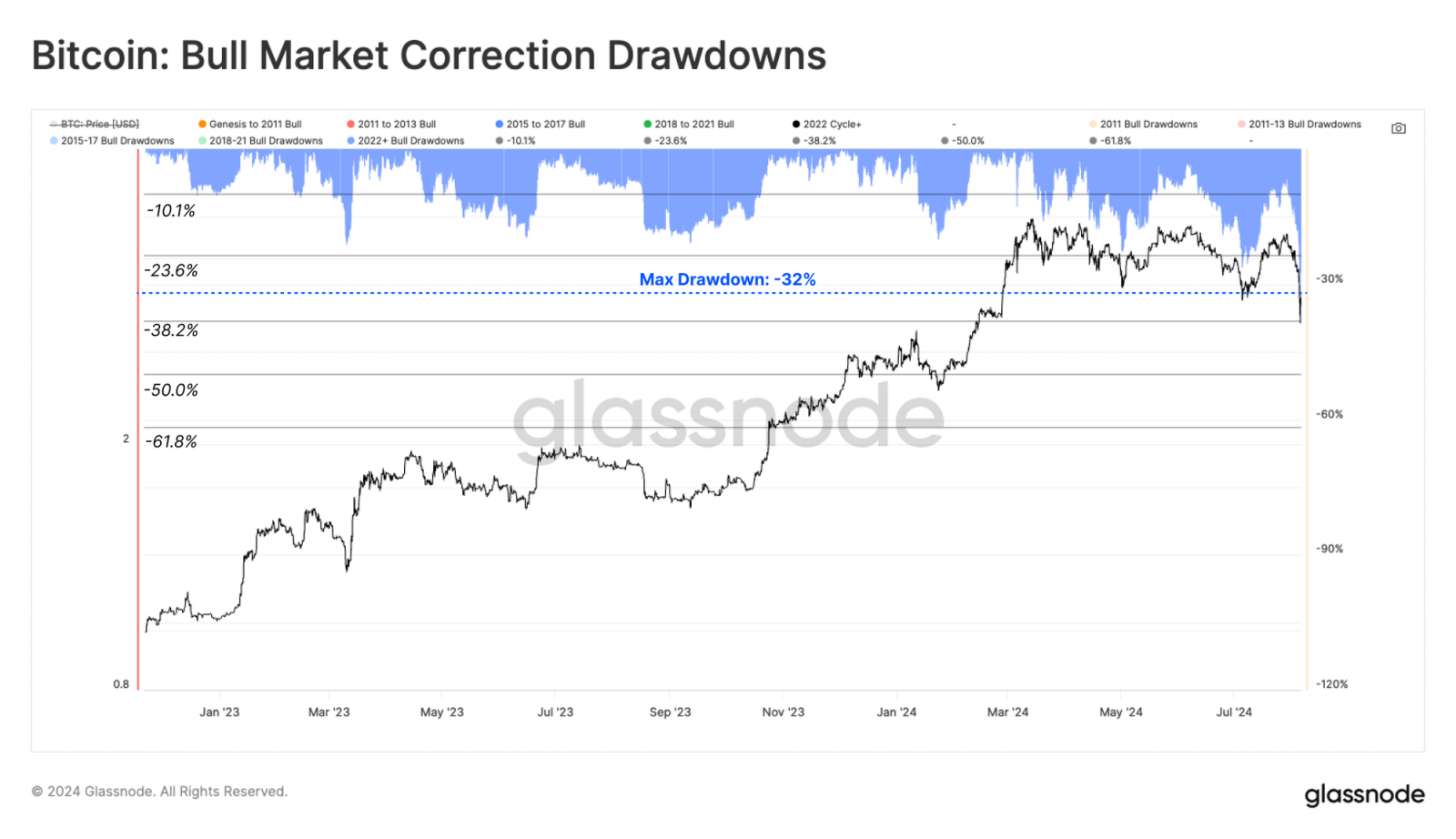

Bitcoin Faces ‘Mid-Cycle Wipeout’ as Markets Plunge: Glassnode Report

The latest report from onchain analysis firm Glassnode highlights a significant market downturn, marked by a 32% decline in bitcoin’s value, the largest drawdown of the current cycle. The study underscores the critical impact of this downturn on investor sentiment and the broader market dynamics.

Glassnode Report: Bitcoin’s 32% Plunge Signals Mid-Cycle Market Low

Glassnode‘s weekly onchain insights research emphasizes the severity of the recent market decline, linking it to a “correlation-1” event that caused major assets and equities, including bitcoin, to plummet. According to Glassnode, this event led to bitcoin’s spot price reaching $51,400, a crucial level for investor psychology, and triggered a sharp reduction in futures open interest by 11% in just one day.

“This likely increases the importance [of onchain] data moving [forward],” Glassnode’s report states.

Source: Glassnode’s Weekly Onchain Newsletter.

The report also details the pressure on short-term holders, who were disproportionately affected by the sell-off. Glassnode’s analysis reveals that only 7% of the short-term holder supply remains in profit, a figure that has not been seen since the FTX collapse in 2022. “This is also more than -1 standard deviation below the long-term average for this metric, and suggests a notable degree of financial stress amongst recent buyers,” Glassnode researchers explain.

Additionally, the Glassnode report points to a dramatic spike in realized losses, totaling approximately $1.38 billion. Notably, 97% of these losses were borne by short-term holders, underscoring their vulnerability during the downturn. The report notes that this level of realized loss is historically significant, ranking as the 13th largest on record in USD terms, and reflects a widespread sense of panic among investors.

Finally, the derivatives market experienced a substantial shakeout, with Glassnode reporting a total liquidation volume of $365 million, including both long and short positions. The forced closure of positions resulted in a significant reduction in futures open interest, indicating a potential reset of market conditions. Glassnode concludes that in the aftermath of this event, onchain and spot market data will be crucial for analyzing the recovery trajectory.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Maker

Maker  Gate

Gate  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  0x Protocol

0x Protocol  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD